How Financial Safety Ratio Reforms Support Risk Discipline and Prudence in Business Growth

The Ministry of Finance (MOF) released revisions to the financial safety ratio (FSR) requirements for securities firms.

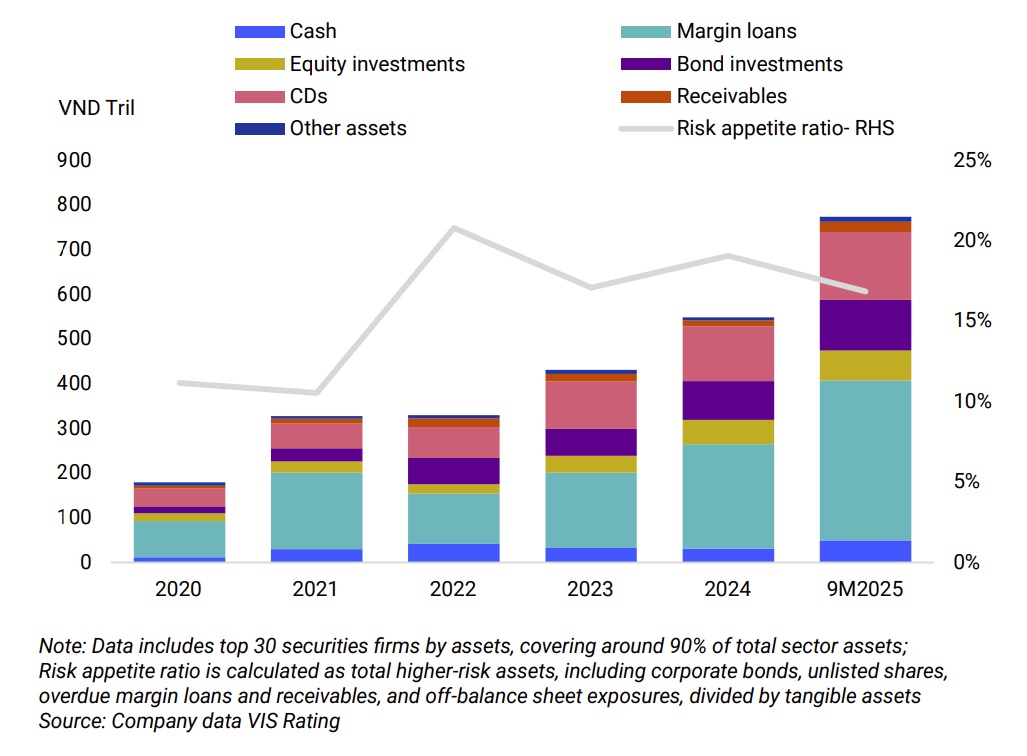

Rapid expansion in core margin lending and bond investments in Vietnam securities sector.

While the minimum FSR (i.e., capital-to-risk-weighted-assets ratio) of 180% remains unchanged, the updated framework introduces significantly higher risk weights across key asset classes—including corporate bonds, receivables, and equity investments. Additionally, firms must now fully deduct capital for defaulted investments. These changes are viewed as credit positive for the sector.

The revised rules are designed to steer business growth toward lower-risk activities, curb excessive risk-taking, and mitigate concentration risks. They serve as a timely reminder of the importance of prudent business growth and robust risk governance, especially amid buoyant investor sentiment and rapid expansion.

Risk weights have increased notably for higher-risk asset classes. These include: Corporate bonds: maximum risk weights raised to 45% (from 40%); now tiered by credit rating; Large customer advances: raised to 50% (from 8%); Business cooperation contracts (BCCs): maximum of 150% (from 100%); Equity investments in limited liability companies now count towards the single entity exposure limit; if the limit is breached, exposures will incur an additional 30% risk weight.

From 2020 to 9M2025, total assets of the top 30 securities firms by assets grew at a compound annual growth rate (CAGR) of 34%. Many firms—often affiliated with private banks—have actively financed large corporates, particularly in real estate and renewable energy, through corporate loans, bond investments, and margin lending. However, recent legal challenges and bond defaults among some large corporates have heightened credit risk exposure.

Banks’ increasing reliance on securities subsidiaries to expand profits amplified spillover risks. Their expansion into securities services has led to greater credit concentration in large corporates, raising operational vulnerabilities and susceptibility to single-name credit events. Over the past three years, private bank-affiliated securities firms have gained significant market share by assets , supported by substantial capital injections.

Despite the regulatory tightening, the near-term impact on business growth is expected to be limited. Most securities firms maintain FSRs well above the 180% threshold, including the six publicly rated by VIS Rating: MB Securities Joint Stock Company (MBS, A Stable), Sai Gon - Ha Noi Securities Joint Stock Company (SHS, A Stable), VNDIRECT Securities Corporation (VND, A- Stable), AIS Securities Joint Stock Company (AIS, A- Stable), Tien Phong Securities Corporation (TPS, BBB Stable), UP Securities Joint Stock Company (UPS, BBB- Stable).

Firms focused on margin lending (e.g., MBS) and proprietary trading in liquid equities (e.g., SHS) remain well-positioned, with ratios ranging from 550% to 650% in 1H2025. Meanwhile, firms with greater exposure to corporate bonds (e.g., VND, TPS) are actively raising capital to strengthen loss-absorption capacity and support continued growth.

Vis Rating expects the revised regulation will guide firms toward core activities, such as margin lending and fixed-income operations, while curbing non-core exposures, such as BCC receivables. Its analysis indicates that several firms hold significant BCC receivables, often linked to lending to corporates with weak cash flows, high leverage, and histories of bond defaults—posing elevated credit loss risks.

Importantly, the regulation now incorporates credit ratings—whether from international or domestic credit rating agencies—as a basis for determining risk weights on corporate bond investments. This aligns with the 2024 Securities Law, which mandates credit ratings for bond issuance and enables greater transparency for risk differentiation, particularly for firms specializing in bond investment and distribution.