How stock investors ought to divide up their holdings

Proactivity, flexibility, and discipline in the allocation of equity portfolios will be crucial in reducing risks in a turbulent investment environment.

More than 85% of market capitalization, or more than 160 listed businesses on the HoSE, had released their 2025 business plans as of May 5, 2025. As a result, despite the challenges posed by President Trump's tariffs, the majority of businesses continue to aim for revenue and profit growth, particularly large-cap firms with expectations for positive profit growth. Companies specifically aim for after-tax earnings to rise by roughly 10.6% over 2024, which is a solid growth rate but less than analysts had predicted at the start of the year.

Aggressive business plan

Twenty percent of the Vietnam stock market's projected 2025 profit will come from industries directly impacted by US tariffs, nearly seventy percent from industries indirectly impacted and with average sensitivity to the impact of US tariffs, and the remaining more than ten percent will come from industries that are barely impacted by US tariffs.

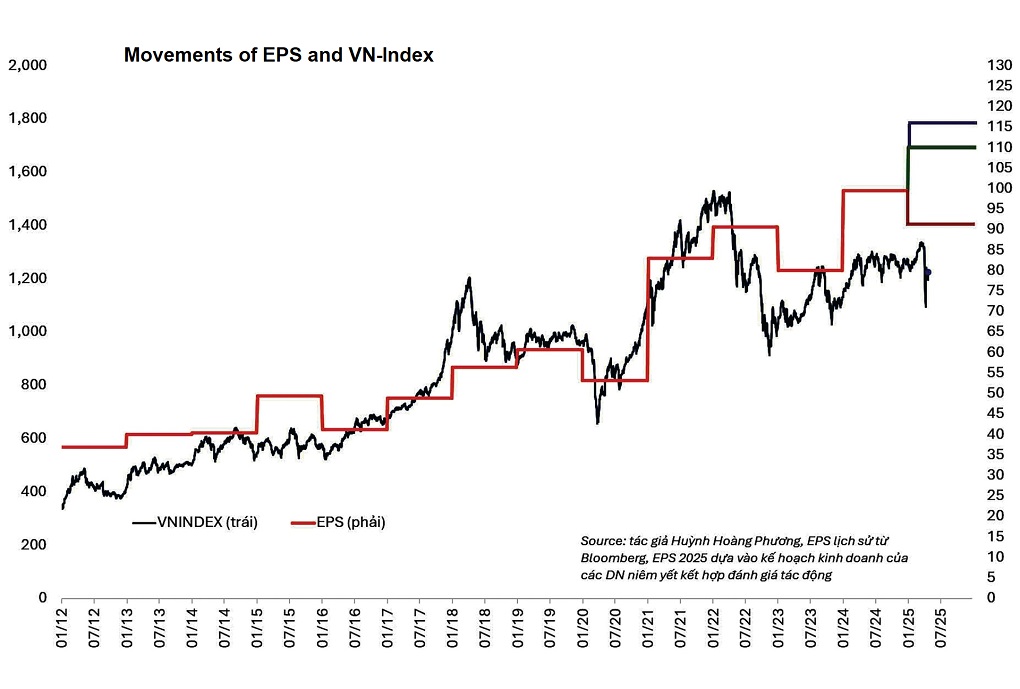

Following that, Huynh Hoang Phuong, Head of Research and Analysis, stated that the Vietnam stock market's EPS growth rate will reach 10.5% in the base scenario established by businesses and may go to 16.5% in the positive scenario when large-sized enterprises surpass their expected profit. In the worst-case scenario, when tariff discussions are unfavorable, the overall stock market's EPS may drop by 9.62% in 2025 and is probably going to have an ongoing impact in 2026.

“The forward P/E valuation of the Vietnam stock market will reach 10.7 times by the end of May 5, 2025, with the above-estimated EPS. This is the lowest value in the VN-Index's 15-year history, with a discount of around 25% from the average. In the worst situation, the forward P/E by the end of 2025 will be 13.1 times, which is a 9% discount to the average over the previous 15 years," added Phuong.

According to the base case scenario, the Vietnam stock market is now undervalued; even in the worst case scenario, there is not a significant danger associated with the market valuation at the end of 2025.

Investment strategy

Despite numerous risks from the outside, the Vietnamese stock market is still a reasonably appealing asset channel from an internal perspective, according to the 2025 business plan projection. FiinGroup reported that the 1Q25 business results, which accounted for over 96% of market capitalization, revealed that profit increased by 11.8% year over year. This was a good start that laid the groundwork for the completion of the 2025 business plan.

Phuong claimed that the government's domestic support programs would have a significant enough effect on the earnings of indirectly impacted industries in the midst of the US tariffs to serve as a risk neutralizer for the majority of market profits (almost 70% of market profits fall into this category). Therefore, the government's support policies will help limit the likelihood of EPS entering a negative scenario and restrict the risk spreading to 2026 if they are successfully implemented when external variables are unfavorable. Furthermore, in 2H25, cash inflows into the Vietnamese stock market are encouraged by the expectation of a market upgrade.

A sensible weight allocation strategy—not "all in" or "standing aside"—combined with adaptable weight allocation will provide investors with several benefits both now and in the future in a turbulent climate. "According to the baseline scenario, a reasonable weight allocation will help investors avoid missing opportunities and making the mistake of FOMO in an uptrend, as the story of EPS growth and market upgrade is a key foundation of the market in 2025. Furthermore, a required cash ratio and/or the avoidance of margin will enable investors to rapidly and flexibly adjust their portfolio in response to domestic and US policy developments”, said Phuong.

In a volatile investment environment, proactive, adaptable, and disciplined portfolio allocation will be viewed as essential to assisting investors in effectively defending their positions and being prepared to take advantage of favorable market shifts.