How will Fed’s monetary policy outlook impact Vietnam?

Statistics about U.S inflation and the labor market are the two drivers for the Fed's actions in the coming time.

FED may start tapering at FOMC meeting on 3 November 2021

FED's message

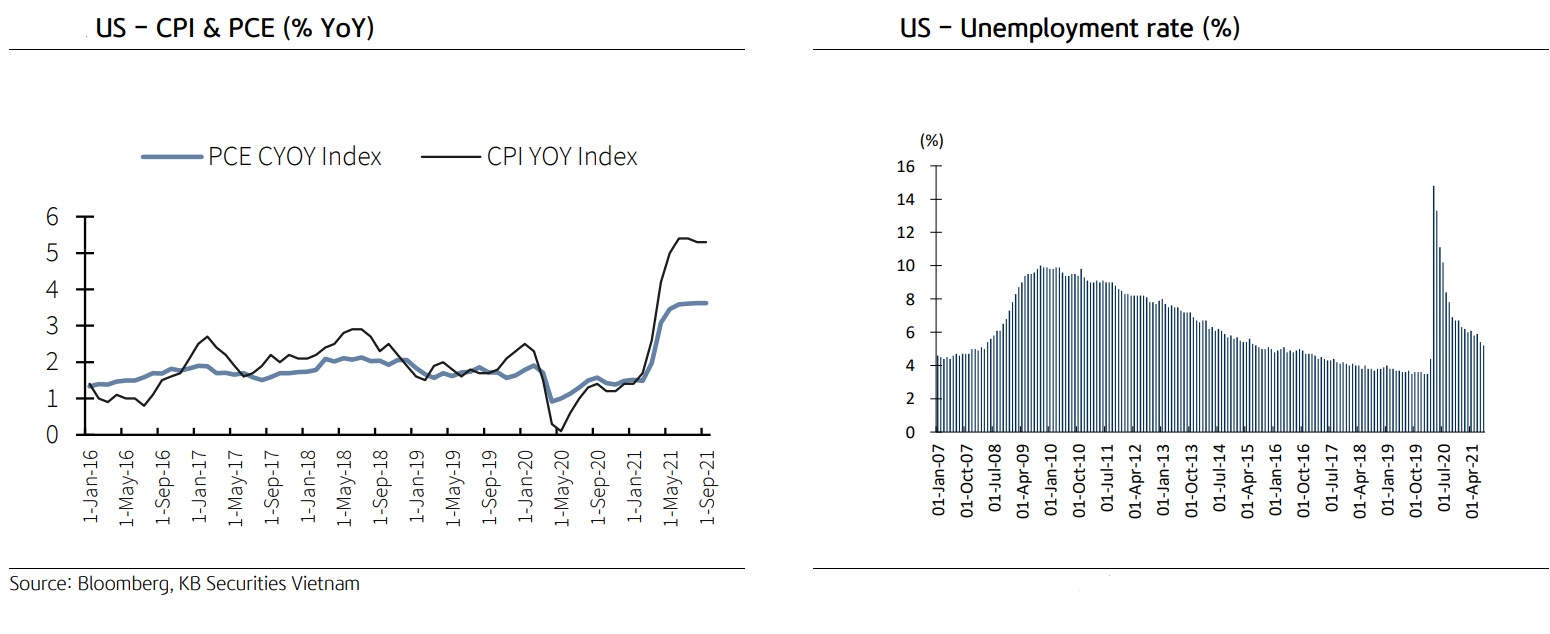

Inflation in the US has increased sharply since the beginning of the year. Petrol and rental prices and eating out costs are the only factors that maintain the upward momentum while the prices of airfares, hospitality services, car rental, and purchase prices all cooled down. This is reflected in headline price pressures as gauged by the personal consumption expenditures price index including food and energy increased 0.3% for the month, pushing the year-over-year gain to 4.4%. That’s the fastest pace since January 1991. The continued inflation jump came as personal income declined 1% in September, more than the expected 0.4% drop. Consumer spending increased 0.6%, in line with Wall Street estimates.

In particular, the headline inflation rate was pushed by a 24.9% increase in energy costs and a 4.1% gain in food. Services inflation rose 6.4% on the year while goods increased 5.9%.

KB Securities noted that the risk of inflation would continue increasing in the last months of the year still exists as the broken supply has not fully recovered, and the demand for consumption increases after the pandemic, causing prices of all kinds of goods to rise such as iron, steel, and oil. Therefore, inflation is still a factor that needs to be closely watched and updated in the near future.

Meanwhile, the number of employed people in 19 of the 50 states declined while the rest of the states such as California, Texas, and New York - states with large population rates - showed signs of recovery, although unemployment rates remained high. The unemployment rate in the group of people of color in some states reached 12-15% (twice the national average unemployment rate). Overall, the US unemployment rate fell 0.4 percentage points to 4.8% in September 2021. The number of new jobs created in September was 194,000. These figures show that the recovery of the labor market in the US is slower than expected due to the spread of the Delta variant and the speed of recovery across regions and ethnicities.

The message conveyed in the Fed’s September meeting was in favor of a hawkish policy with two main ideas. First, the Fed announced the time when the Central Bank of this country plans to implement the tightening of the asset-buying program (QE) between November 2021 and mid-2022, in which the first one would be done on 3 November meeting. This process is more urgent than in 2014 in terms of both starting time and implementation time (eight months in 2021- 2022 compared to 10 months in 2014). Second, the Fed fund rate continues to be maintained at 0-0.25%, but the Dot plots show that half of the Fed officials want to raise interest rates in 2022 (compared to the 7/19 ratio at the June meeting).

The global stock market in general and the US stock market in particular reacted positively after the meeting of the Fed despite the more-hawkish than-expected messages. The reason is that the market is satisfied with the way the Fed Chairman Mr. Powell gave the speech. He has done a great job in leading and preparing the market for a cautious monetary tightening cycle. Besides, investors were also reinforced with confidence that the inflation rate will soon decrease, and the Fed will only raise interest rates when the US economy is strong enough.

Two scenarios

KB Securities said there would be two scenarios for FED monetary policy in the coming time as well as its impact on related markets.

As for the positive scenario, the inflation and job market would develop as Fed's recently released projections, of which GDP growth, unemployment rates, and PCE index for 2021 are 5.9%, 4.8%, and 4.2% respectively (these figures for 2022 are 3.8%, 3.8%, and 2.2%). The Fed plans to reduce assets buying from November 2021 and lift interest rates at the end of next year. This scenario is quite similar to the last time the Fed raised its rates when the economy strongly bounced back during 2016-2018. Better corporate profit is an attractive factor to boost interest rates, thereby helping the US stock market to rebound.

In this case, KB Securities said the negative impact on the Vietnam stock market would be not profound. Although the indirect investment cash flows tend to return to the US and be net withdrawn in the emerging markets, including Vietnam, the strengthening dollar may lead to certain macro disturbances. As a major trading partner of Vietnam, the US economy's strong recovery with low inflation would play an important role in Vietnam's economic stability and recovery in the long run.

With the negative scenario, the inflation remains high and shows no sign of easing, while the economic growth and job market do not recover strongly enough. Specifically, the US economy gradually recovers and pushes the consumption demand up amid Coronavirus-triggered supply chain interruption, which causes prices to escalate. Therefore, KB Securities said the Fed would face pressure to speed up the tightening of monetary policy despite the unstable job market and economic growth. This is a negative scenario in the wake of the Fed's drastic interest rate hikes, causing the dollar to appreciate and force emerging countries with weak local currencies, including Vietnam, to raise interest rates to cushion their currencies and lower inflation rates despite economic stagnation and high inflation risks.