Inflation will remain under control

According to KB Securities, inflation in 2023F will be considerably below the government's objective ceiling.

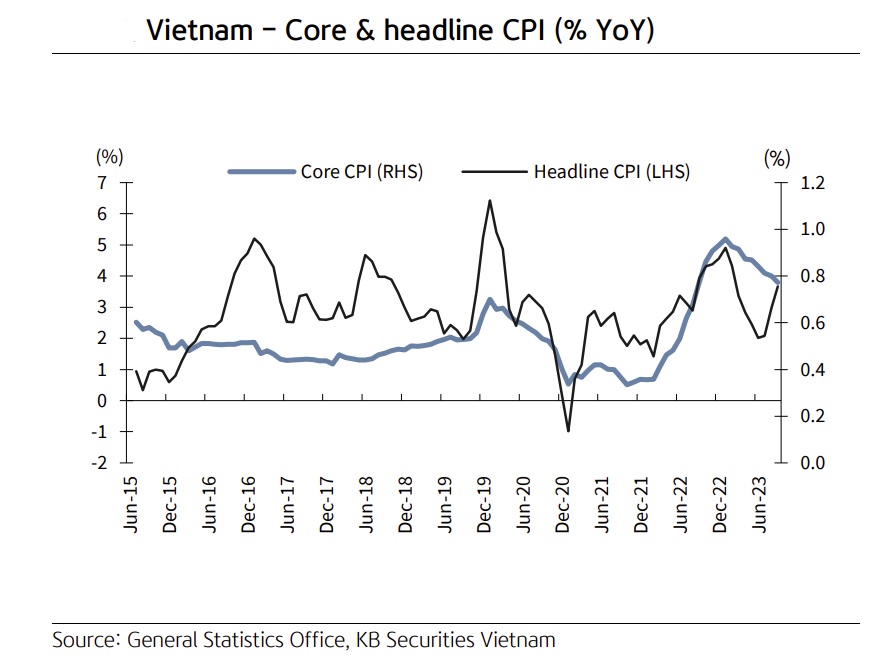

In 9M23, the average CPI increased by 3.16% year on year.

>> October CPI slightly increases

Inflationary pressure returns

In 9M23, the average CPI increased by 3.16% year on year. CPI is greatest in the initial months of the year and progressively falls, although it has gradually grown since July 2023 when compared to the same time. CPI climbed by 1.08% MoM or 3.66% YoY in September alone, owing to rising fuel prices affected by global oil prices and the roadmap to raise tuition rates. Since the beginning of the year, core CPI has been dropping; nonetheless, the average 9M23 core CPI has climbed by 4.49% year on year.

The following are the primary elements influencing the average CPI in the first nine months of the year:

First, housing and building material costs grew by 6.73% year on year, causing the headline CPI to rise 1.27ppts. The price of cement and sand increased in response to the price of raw and input materials, and dwelling rentals increased.

Second, education group prices increased 7.28% year on year due to certain areas hiking tuition for the 2023-2024 school year in accordance with Decree No. 81/2021/ND-CP's roadmap, lifting the headline CPI by 0.45ppts.

Third, food costs grew 4.85% year on year due to rising domestic rice prices (in line with export rice prices), and foodstuff prices rose 2.83% year on year as consumer demand surged throughout the holidays and Tet, leading the headline CPI to rise 0.6 percentage points.

Inflation is forecast to expand

Inflation may begin to rise in the fourth quarter of 2023. However, given the little increase in the first half (0.7% YTD, 0.1% MoM on average), KB Securities anticipates 2023F inflation to remain well below the Government's goal ceiling. In particular, it forecasts 3.6% YoY inflation in 2023F, which equates to a 0.77% MoM average monthly rise in 2H23. Factors driving inflation higher include: (1) high oil and gas prices; (2) a slight increase in building material prices due to the acceleration of public projects in the year-end period; (3) higher pig and rice prices due to supply-demand fluctuations; and (4) rising tuition fees under Decree 81.

On the plus side, some factors limit ing inflationary pressures include: low money supply growth, VAT reduction, steady import price index (MPI), and fuel and construction material costs that are lower YoY despite their downward trend.

Brent prices rose to about USD96/barrel at the end of September, the highest level in a year. Despite the fact that oil prices have calmed, we believe that fluctuating oil prices will continue to exert pressure on Vietnam's inflation. In 4Q23, Brent is expected to remain above USD85/barrel as (1) OPEC maintains its 4.96 million barrels/day production cut until the end of 2023, equivalent to nearly 5% of global demand; (2) US shale oil output falls due to reduced upstream investments; (3) global oil consumption is expected to grow further in 2H23 and 2024, driven by China's rising consumption for industrial production, tourism, and fertilizer production; and (4) the Gaza conflict may escalate into regional conflict.

>> Inflation tamed but risks remain: experts

The average live pig price declined to VND57,000/kg in September (-4.8% MoM and -12% YoY) due to rising supply and lackluster demand. Nonetheless, we anticipate that pig prices will rise slightly to VND62,000/kg by the end of the year, owing to increased demand from restaurants, cafés, and tourist places. Due to global supply and demand variations, domestic rice prices may follow the worldwide upswing. India has yet to relax the restriction on exporting broken rice or remove the 20% tax on white rice exports, the Philippines dropped the rice price ceiling order, Indonesia filed a bid for 300,000 tons of rice, Vietnam's primary crop has yet to arrive,... Vietnam's export price for 5% broken rice reached approximately USD595/ton at the end of September, an 11-year high.

The acceleration of public projects in the last quarter of the year will increase domestic building material demand. However, price rises in building materials will be minor because to (1) cooling input costs for steel and cement production (Figure 38) and (2) low residential sales, which will slow the development of new projects. As a result, Mr. Tran Duc Anh, Head of Macro and Strategy at KB Securities, predicts that building material costs will either remain flat or slightly rise by the end of 2023. Gas prices will trend sideways as global energy costs are expected to remain constant through the end of the year. After recent price rises, domestic electricity and water prices climbed little compared to previous year.

“We are not concerned about inflationary pressures caused by monetary pressure. By the end of September, M2 growth was predicted to be 7.75% YTD, which is quite low when compared to 2022, and the economy's capacity to absorb capital is weaker while the real estate market is still experiencing significant challenges, leading credit growth to be lower YoY despite rising over the previous two months”, said Mr. Tran Duc Anh.

The import price index (MPI) of important commodities such as farm produce, food and food stuffs, fuel, and raw materials has peaked since 3Q22 and is on the decline due to falling global commodity prices. The rate of decline, however, has slowed. Mr. Tran Duc Anh anticipates imported raw material costs would go sideways in the short term due to rising demand in the last months of the year.