Insurance is no longer the "golden egg-laying goose" for banks

Amidst the crisis of confidence in the "marriage" between banks and insurance, the cross-selling revenue from insurance at banks significantly declined in the first half of the year compared to the same period last year.

|

|

Chart: H.D |

Some banks have experienced a reduction in insurance revenue of over 80%

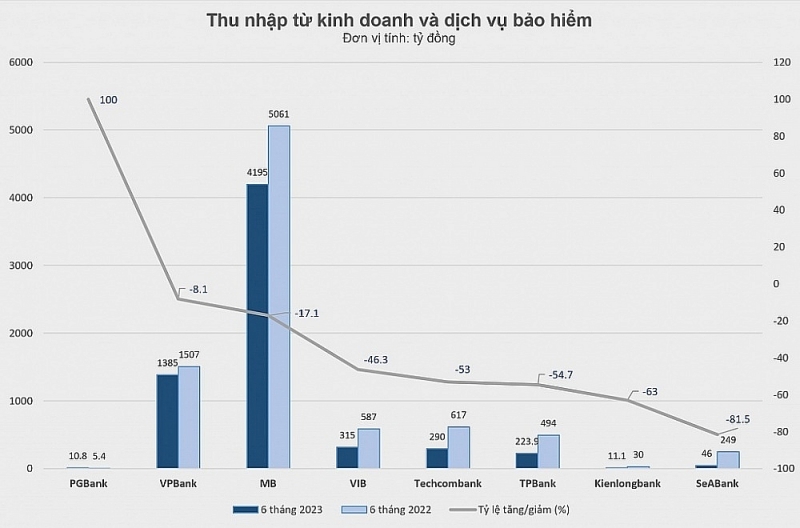

According to statistics from the financial reports for the second quarter and the first 6 months of 2023 from 28 banks, only 8 banks provided detailed breakdowns of their insurance activity revenue. Among these, 7 banks reported negative growth, while only 1 bank, PGBank, achieved positive growth with 10.8 billion VND in the first 6 months of this year, compared to the 5.4 billion VND from the same period last year.

In absolute terms, MB still leads in terms of income from its insurance business and services, even without an exclusive agreement. In the first 6 months of 2023, MB recorded a revenue of nearly 4,195 billion VND, a decrease of 17.1% compared to the approximately 5,061 billion VND in the same period in 2022. The bank's financial report stated that the operational costs for the insurance business in the first 6 months of the year were nearly 2,643 billion VND, indicating that MB earned more than 1,550 billion VND from insurance – still a significant portion of MB's net profit from its service activities.

Currently, for MB, owning two insurance companies directly – Military Insurance Corporation (MIC) with a 68.37% capital share and MB Ageas Life with a 61% capital share – has significantly contributed to the bank's annual profits in both life and non-life insurance segments. MB's insurance revenue experienced rapid growth from 2019 to 2022 and only slowed down in the first 6 months of this year. In 2022, the insurance segment accounted for over 71% of MB's total service activity income.

The most substantial decrease in revenue from insurance business and services is observed in SeABank, which dropped from 249 billion VND in the first 6 months of 2022 to just 46 billion VND in the first half of this year, marking an 81.5% reduction. Kienlongbank follows with a 63% decrease, falling from over 30 billion VND to just over 11 billion VND. TPBank and Techcombank also reported a twofold decrease compared to the same period last year. VIB's revenue also decreased by over 46%, reaching 315 billion VND in the first 6 months of 2023. Techcombank is collaborating with Manulife Insurance Company; TPBank is distributing insurance from Manulife and Sun Life; VIB has entered a long-term strategic partnership agreement with Prudential Vietnam.

Insurance is still facing difficulties

According to information from the Ministry of Finance, as of the end of July 2023, the total insurance premium revenue for the entire market is estimated to reach 130,138 billion VND, a 5.54% decrease compared to the same period last year. This indicates that the insurance industry is facing many challenges, thereby affecting the cross-selling insurance business through banks, which has long been considered a "golden egg-laying goose" for banks.

According to experts, the decrease in revenue is an inevitable trend due to the declining customer trust in the cross-selling of insurance through banks. According to a survey published in July 2023 by Vietnam Report, 81.8% of insurance companies believe that the appearance of negative information about life insurance is the biggest challenge that businesses will face in 2023.

Especially, based on inspection and examination conclusions regarding insurance sales through banks at four insurance companies: Prudential, MB Ageas Life, Sun Life, and BIDV Metlife by the Insurance Supervisory Authority (Ministry of Finance), in 2021, the cancellation and termination rate of insurance contracts after 1 year at BIDV Metlife was 39.4%; at Prudential (Vietnam), it was 41%; at Sun Life Vietnam, this rate was 73% through TPBank and 39% through ACB; at MB Ageas Life, it was nearly 6%. Although these figures are from 2021, they might still hold true to a significant extent to the present day.

Despite numerous directives from the Ministry of Finance and the State Bank of Vietnam regarding the review and strict handling of violations in the channel of insurance sales through banks, the reality shows that the situation of bank employees providing unclear advice persists. This has led customers to be "tricked" into transforming savings into purchases of life insurance or investment-linked insurance, causing much frustration among the public.

Because of this, enhancing the quality of the "marriage" between insurance and banking is crucial. The Vietnam Insurance Association has proposed that insurance companies, when signing cooperation contracts with banks, should use the second-year contract retention rate as an assessment basis for quality. Additionally, both banks and insurance companies need to establish measures to monitor and supervise the quality of insurance sales through banks.

On the part of insurance companies, corrective actions are being actively carried out. Mr. Phuong Tien Minh, CEO of Prudential Vietnam, stated that in the early months of 2023, Prudential had collaborated with partner banks to conduct 100% quality assurance calls to ensure that customers receive accurate and sufficient advice, and that they understand their rights when participating in insurance. Representatives from Sun Life Vietnam also mentioned continuous strong improvements, with a commitment to adhere to ethical business standards in all activities. They conduct regular internal audits, as well as independent and periodic audits as required by the Ministry of Finance.