Investment strategy in the Trump 2.0 era

Economies around the world remain at a crossroads at the start of a period of uncertainty, influenced by the tariff policies of President Trump’s second term (Trump 2.0).

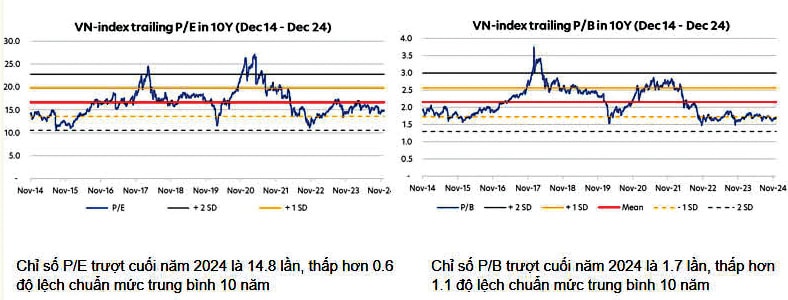

Market valuations at attractive levels. Source: UOBAM Vietnam

By identifying the context and filtering objective information—rather than wishing for a “crystal ball”—investors can plan to expand their multi-asset portfolios appropriately.

Positive Outlook for Many Sectors

Global economic growth for 2025 is expected to slow but remain in an expansion phase. According to Mr. Abel Lim, Head of Wealth Advisory and Strategy at UOB (Singapore), the outlook for the global economy will depend heavily on President Trump’s policies. Although the current situation and outlook are unclear, growth divergence could emerge.

Investor confidence has weakened amid trade tensions, impacting global stock markets. However, this has also prompted capital flows to shift toward other markets, including ASEAN, given that the U.S. stock market is perceived as overvalued.

Experts note that inflation risks could rise in the 2025 economic landscape. Should the Fed raise interest rates to curb inflation, that move could also dampen economic growth. Globally, monetary policy will be influenced by the economic and inflationary effects of President Trump’s policies. UOB forecasts that the Fed will cut interest rates by only 25 basis points in the second quarter of 2025, whereas the market previously expected four rate cuts and now anticipates only two, according to the Dot Plot released after the Fed’s most recent meeting on March 19, 2025.

Against this backdrop, Vietnam’s economy is projected to continue strong growth in 2025, supported by stimulus via public investment and credit growth, as well as expectations for a rebound in domestic consumption and the real estate sector, according to Mr. Lê Thành Hưng, Chief Investment Officer at UOB Asset Management Vietnam. Beyond key infrastructure projects, the high-tech sector will be a new driver of Vietnam’s economic growth from 2025 to 2050, with a positive outlook for semiconductors as many major global semiconductor firms look to invest in Vietnam.

Opportunities Across Asset Classes

“The outlook for global stock markets remains positive, although heightened volatility may arise due to uncertainties in U.S. policy,” says Mr. Abel Lim. Returns in individual markets may vary, since U.S. trade policy affects each country differently. Investors might consider a dollar-cost averaging approach to mitigate market volatility risks.

Mr. Abel Lim recommends investors build a diversified portfolio by allocating capital to a variety of assets, regions, and industries, while maintaining flexibility to seize tactical opportunities. For those seeking a “safe” investment with a 5% return, mutual funds and ETFs are options. Bonds can potentially offer higher yields, especially higher-quality debt instruments. Regarding the U.S. dollar, the expert forecasts a weakening trend in the second half of 2025, but notes potential upside risks stemming from inflation pressures tied to the Trump administration’s tariff policies.

Mr. Abel Lim also highlights gold as a means of diversifying portfolios and hedging against slower economic growth and market uncertainties. “Overall, long-term demand for gold as a safe haven asset is expected to remain strong, with prices possibly reaching USD 3,200 per ounce in the first quarter of 2026. However, gold’s upside potential is limited; it is highly volatile and carries a considerable risk of downward reversal, so short-term investors should be cautious,” he emphasizes.

As for Vietnam, Mr. Lê Thành Hưng expects the stock market in 2025 to remain upbeat, supported by factors such as domestic consumption and expanded public investment, rapid growth in high-tech and digital transformation, and stronger corporate earnings (EPS growth). Valuation discounts (P/E and P/B) further bolster the market outlook. Additional support comes from the new KRX trading system, slated to go live in May 2025, and the potential upgrade of Vietnam’s stock market to emerging market status in 2025.

Regarding 2025 investment strategies, representatives of UOBAM (Vietnam) are optimistic about the prospects for financials and industrial real estate. Banking, which has the largest weight in the VN-Index, will continue to drive the index, propelled by robust credit growth. Meanwhile, the technology sector is given a neutral rating.

“Consumers believe the Vietnamese market has strong growth prospects and offers attractive returns. While businesses may have concerns about the impact of tariffs, investors generally remain confident, allocating capital across various asset classes, steering and waiting,” explains Mr. Paul Kim, Head of Personal Financial Services at UOB Vietnam.