Is MWG well positioned to IPO its two retail chains?

The IPO of Dien May Xanh (DMX) by Mobile World Investment Corporation (HOSE: MWG) is expected to be more straightforward than that of Bach Hoa Xanh (BHX).

As of the end of the third quarter of 2025, the BHX chain still recorded accumulated losses of nearly VND 7 trillion, mainly incurred during its aggressive chain expansion phase from 2020 to 2023.

Return to positive growth

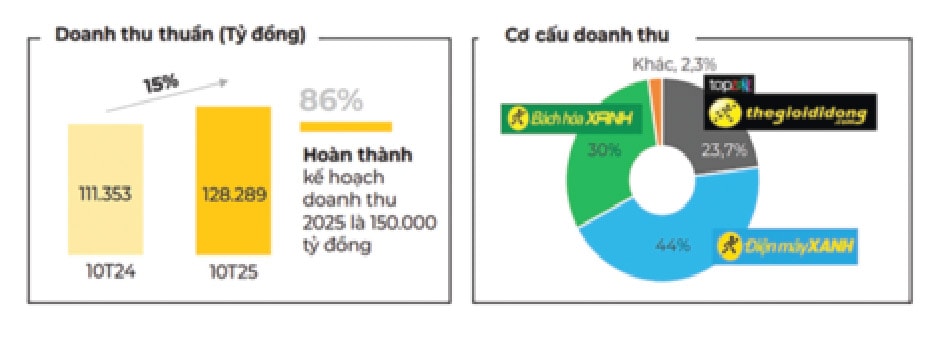

MWG recently released its third-quarter 2025 financial statements, reporting revenue of VND 39,853 billion—up nearly 17% year on year and the highest level since the company’s establishment. Net profit after tax for the quarter reached a record VND 1,784 billion, up 121% from the same period last year. This marked the third consecutive quarter in which MWG posted profit growth compared with the previous quarter.

For the first nine months of 2025, MWG recorded revenue of VND 113,607 billion and net profit after tax of VND 4,989 billion, representing increases of 14% and 73%, respectively, from the same period in 2024. With these results, MWG has achieved 76% of its full-year revenue target and exceeded its full-year profit target by 3%.

During the first nine months of the year, the The Gioi Di Dong (TGDĐ) and Dien May Xanh (DMX) chains delivered positive business performance, supported by a “quality-driven” growth strategy focusing on superior customer service, lifetime customer value, and comprehensive financial solutions.

Plans to IPO two chains

Assessing the outlook for MWG’s retail chains in 2026, analysts believe that the mandatory implementation of electronic invoices for household businesses (Decree No. 123/2020/ND-CP) and Resolution No. 68-NQ/TW—which aims to eliminate the lump-sum tax regime, encourage the conversion of household businesses into formal enterprises, and crack down on counterfeit and substandard goods—will create competitive advantages for modern retail chains and help MWG expand its market share. With established chains such as DMX and BHX, MWG has a basis to target double-digit growth.

Against this backdrop, MWG’s Board of Directors recently announced plans to IPO BHX in 2026 and DMX in 2028, with the goal of listing these businesses on the stock market. According to MWG’s management, the IPOs of BHX and DMX are intended to more accurately reflect the value and market position of the parent company, MWG.

Separating and listing these two subsidiaries could help re-rate MWG’s ownership value and brand equity. Valuing each chain independently may lift the group’s overall valuation compared with the current consolidated valuation model. As of the trading session on December 17, 2025, MWG shares closed at VND 81,900 per share.

IPO challenges

Despite the clarity of MWG’s plan to list its core retail chains, the company faces a major obstacle—particularly with BHX. As of the end of the third quarter of 2025, BHX continued to record accumulated losses of VND 6,918 billion, largely stemming from rapid expansion between 2020 and 2023.

Under Decree No. 155/2020/ND-CP governing listings on the Ho Chi Minh City Stock Exchange (HOSE), one of the mandatory requirements is that a company must not have accumulated losses at the time of registering for a public share offering and listing. In addition, the company must have been profitable for two consecutive years prior to listing. Accordingly, for BHX to successfully list on HOSE, it would need to generate sufficient profits to fully eliminate its accumulated losses of nearly VND 7 trillion. This poses significant challenges for MWG as the parent company, as well as for its subsidiary chains.

According to Mirae Asset, the IPO of BHX should be closely monitored. While BHX’s store operations have improved, the chain’s profitability remains very thin and highly dependent on whether expansion can be executed efficiently. Moreover, plans to continue opening additional BHX stores further increase risks to profitability. Mirae Asset estimates that even under a positive scenario, BHX’s net profit margin would remain very low and highly vulnerable to the costs associated with new store expansion.