Is the outstanding bank loans quality a cause for concern?

At the end of the third quarter, Vietnamese commercial banks kept their levels of risk provisions at a respectable level despite pressure on the bad debt narrative.

Up to the end of 2002, financial experts observed, Vietnamese banks had a generally favorable risk provision story. Because of this protective shield, banks have bravely employed profit adjustments over the last three quarters to sustain growth, if it hasn't been very strong.

Mr. Quan Trong Thanh, Expert from MSVN, highlights the significance of evaluating profitability on equity. For the banking industry, this is an important metric. Banks have kept this ratio between 18% and 26% (for listed banks) as of the end of September, and it is favorable. But as equity declines, some banks are beginning to feel the heat.

Additionally, Mr. Thanh offers statistics on bad debts, contrasting Vietnam with other nations in the region like Thailand, where bad debt ratio is typically 3–3.6%, and Indonesia, where it ranges from 3 to 4% (Vietnam’s is less than 3%). In his opinion, the total ratio of 4.5% is not yet at a risky level if bad debts rise and, based on NHNN statistics, include NPLs at VAMC and those of weak institutions.

"Banks have generally been tight by the end of September as a result of the decrease in provisions and allocations to sustain growth. Bad debts are continuously accruing in the interim. Banks will have difficulties in the fourth quarter of 2023 and the upcoming year. They will face tremendous pressure if the economy does not rebound and credit growth is not noteworthy in the final quarter of this year. Relying solely on regulatory provisions will only provide temporary relief to banks", said Mr. Thanh.

It is noteworthy that while NHNN Deputy Governor Dao Minh Tu issued a warning in August 2022 that risk debt and hidden bad loans ratio may reach 7.8 to 8%, the real number is 6.1-6.12%, which is less than forecasted.

"Banks are currently having trouble maintaining their desire to expand credit growth while maintaining their standards—in fact, they are only beginning to loosen up. It's evident that banks were extremely hesitant to grant real estate loans before to September, but it's also clear that real estate loans are rising dramatically. The Prime Minister's recent direction to increase real estate financing by the end of October is a sign", said Mr. Thanh.

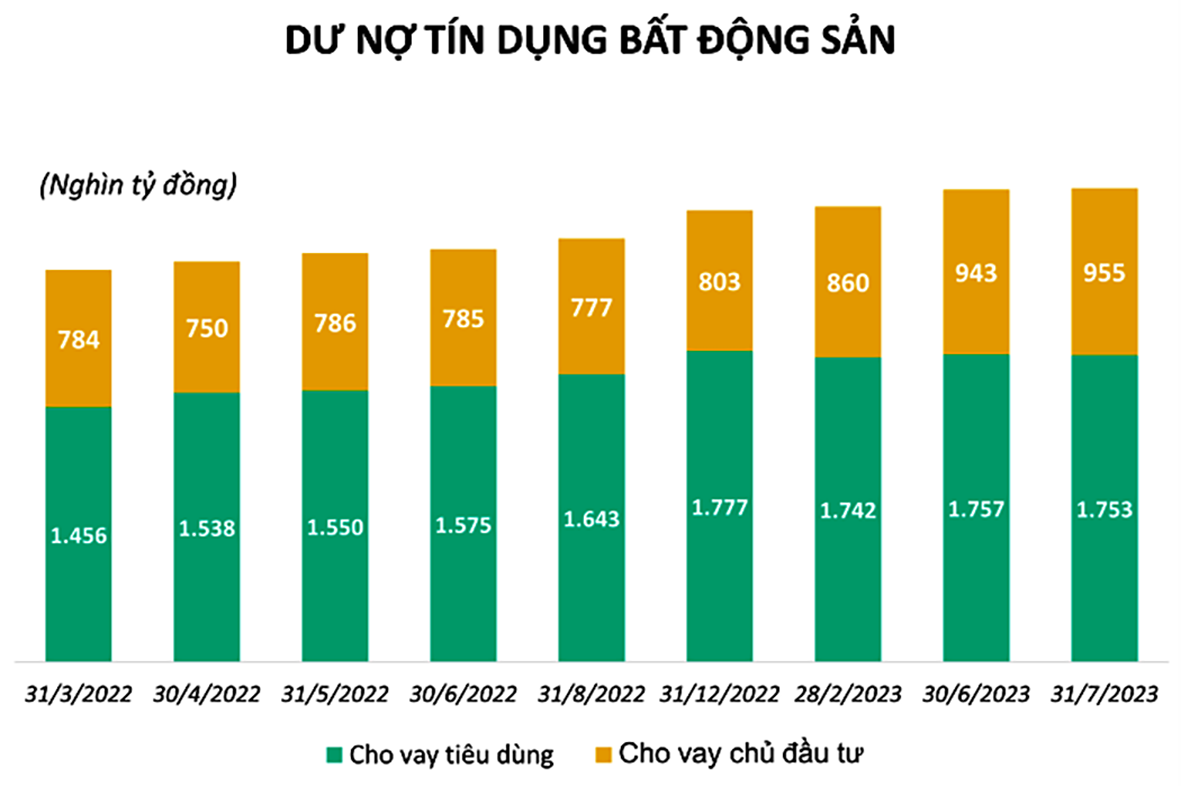

According to recent data from the State Bank of Vietnam, the growth rate for commercial real estate loans during the first eight months of 2022 has significantly surpassed the 10.73% growth rate for the full year. The total amount of outstanding real estate loans as of the end of August was 986,477 billion, up 22% from the start of the year (more than 803,000 billion). Over 186,000 billion dong of bank loans were extended to the real estate industry in the first eight months, making up more than 28% of the entire credit growth in the economy.

Some banks, like Techcombank and VPBank, have seen a dramatic increase in loans for commercial real estate compared to the beginning of the year, according to the Q3 financial statements. These banks do, however, continue to express optimism about the caliber of outstanding loans and maintain that the real estate value chain's efficiency still holds the key to maximum profitability.