Key strategies to shape Viet Nam’s hospitality market in 2026

The Vietnam Hotel Investment Guide 2025 indicates that repositioning and operational standardisation are becoming core strategies for investors to maintain competitiveness and capture the tourism growth momentum.

Tourism demand continues to post impressive growth, while new hotel supply has slowed significantly compared with previous periods. Photo: FLC Thanh Hoa.

As competition intensifies amid shifting traveller behaviour, existing hospitality assets in Viet Nam are entering a pivotal transition. Tourism demand continues to post impressive growth, while new hotel supply has slowed significantly compared with previous periods. According to Savills Hotels Vietnam Hotel Investment Guide 2025, this shift creates a decisive turning point, where well-located existing projects with underutilised potential are likely to become investment hotspots in 2026.

Mauro Gasparotti, Senior Director, Savills Hotels Southeast Asia, notes that the greatest opportunities no longer lie in expanding room count, but in upgrading assets to enhance competitive advantages. “Viet Nam has a large number of hotels whose operational efficiency has not been maximised. As new supply slows, especially in HCMC and Ha Noi, and travellers increasingly prioritise quality, upgrading and repositioning will deliver the greatest long-term value for investors during 2026 to 2030”, said Mauro Gasparotti.

Savills Hotels data shows that over 68% of the current supply is self-operated by owners, and many properties have not applied international operating practices or invested adequately in customer experience. This creates a significant “value-repositioning pool” in which performance can be materially improved through asset refurbishment, operational benchmarking, or partnerships with international brands.

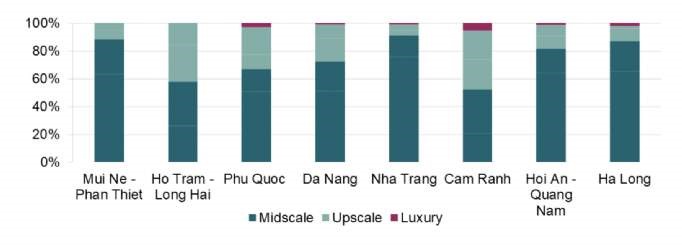

At destinations such as Ha Long, Nha Trang, and Mui Ne, most existingsupply is concentrated in the midscalesegment, where price competition is intense. At the same time, demand from European, Indian and North Asian markets, as well as Viet Nam’s expanding middle class, is shifting towards higher-end products with a stronger focus on experience, service and amenities. This mismatch suggests that assets with upgrade potential are likely to be the most attractive.

Amid regulatory hurdles and scarce development land, existing assets in HCMC and Hanoi offer substantial value uplift potential through redevelopment or repositioning. The trend becomes even more pronounced in the two gateway cities where future supply is reaching its limit. In Ha Noi, 4,000 new rooms are expected by 2028, largely in the upscale or luxury segments. HCMC faces even greater constraints, with fewer than 1,500 rooms currently in the pipeline. In addition, emerging destinations such as Quy Nhon, Phu Yen, Ho Tram and several northern satellite areas are benefiting from accelerated infrastructure progress, particularly the Long Thanh International Airport and key expressway corridors.

Supply by segment at selected coastal destinations. Source: Savills Hotels

However, to fully capture this growth, hospitality products in emerging destinations require stronger standardisation, enhanced guest experience, and alignment with evolving international demand; improvements that upgrading and repositioning can deliver more quickly than new development.

Gasparotti adds, “Viet Nam is facing a rare opportunity to uplift the overall hospitality landscape. Investors who proactively reinvest in existing assets (from design and landscaping to operations) will be the ones leading the next growth cycle.”

With a combination of strong demand, limited new supply, and rapidly maturing domestic investors, 2026 is projected to mark a period where asset quality optimisation is the dominant trend. Savills Hotels emphasises that this is an optimal time for owners to reassess operating strategies, evaluate brand repositioning potential, and capitalise on the shifting market landscape.