Monetary policy will lever in accommodative gear

VNDirect believes the State Bank of Vietnam (SBV) will maintain its pro-growth bias in 2H21.

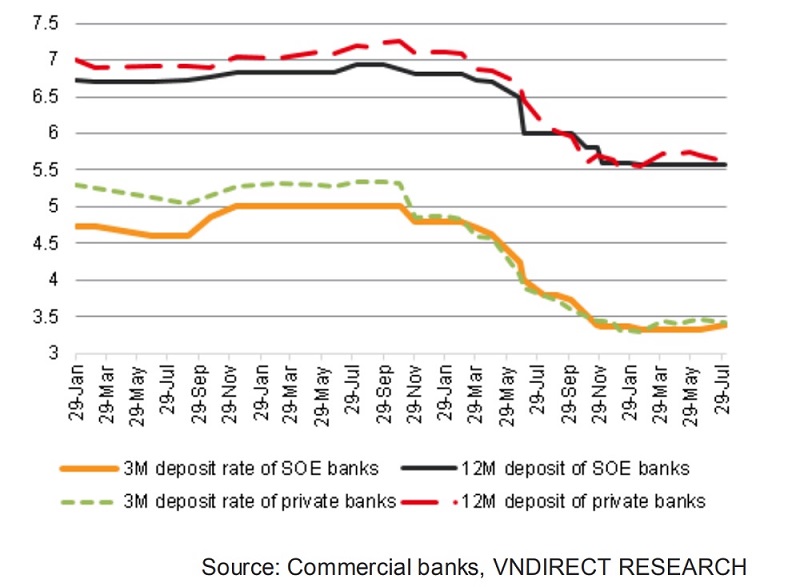

Deposit rate of commercial banks remained flat in Jul (%)

Vietnam’s headline inflation climbed to 2.6% YoY in Jul 2021 (vs. 2.4% in the previous month). On a month-on-month basis, headline CPI inched up 0.6% vs. Jun level, mostly driven by the 2.4% mom increase in the transportation price index, the 0.9% month-on-month increase in accommodation and construction materials index, and the 0.7% month-on-month increase in food and foodstuff price index.

However, the headline CPI in April-July period was lower than VNDirect’s previous expectation due to a lower than expected food and foodstuff index amid the strong decline in pork prices in the last four months and lower consumer demand after the 4th wave of COVID-19 broke out. Besides, the Government has announced to reduce prices and fees of essential services such as electricity, water supply, and telecommunication for customers affected by the COVID-19 pandemic. These policies also help curb inflation for the rest of 2021. As a result, VNDirect lowered its forecast for 2021F average CPI to 2.4% (/- 0.2 percentage points) from a previous forecast of 2.9%.

Lower inflation pressure could open up more room for monetary policy. On Jul 19, Vietnam reached an agreement with the US regarding its currency practices, in which Vietnam pledged not to deliberately engage in any competitive devaluation of the Vietnamese dong, as well as be more transparent about its monetary policy and exchange rates. Subsequently, the US Trade Representative (USTR) decided not to take any trade-restrictive measures against Vietnam, such as imposing punitive duties on Vietnam’s exports. The removal of the U.S tariff threat and a more flexible exchange rate would allow SBV to focus on supportive policies to help businesses overcome difficulties caused by the COVID-19 fourth outbreak. And finally, as the economic growth momentum will be hit hard by the current Covid 19-wave, both fiscal and monetary policies are likely to do more of the growth lifting in 2H21 and even 1H22.

VNDirect expects the SBV to be more open to raising the credit growth ceiling for commercial banks. It maintains its credit growth forecast for 2021F at 13%. Also, it expects the credit interest rate to ease further to support growth, especially for industries and customers heavily impacted by the COVID-19 pandemic. In July, SBV had required commercial banks to reduce lending interest rates to support businesses recovery. Following this, several banks have lowered lending rates.

Specifically, four SOE banks, including Agribank, BIDV, Vietcombank, Vietinbank, have announced cutting lending rates by 0.5-1% for existing loans of businesses and individuals affected by the pandemic, such as those operating in tourism, transportation, education, accommodation, and catering services. Meanwhile, private commercial banks such as ACB, MBB, VIB, VPB… also committed to cut lending rates by 0.8-2.0% for outstanding loans of pandemic-hit clients.

Regarding deposit interest rate, VNDirect lowered its forecast for an increase in deposit rates for the remainder of the year to 10-15 basis points, from its previous estimates of 25-30 basis points.