More headwinds for STK

In the second quarter of 2012, Century Synthetic Fiber Corporation (STK) reported sales of VND530 billion (up 3.9% annually) and net income of VND76.3 billion (down 0.0% annually). This business still has additional challenges to overcome.

In the second quarter of 2012, STK reported net income of VND76.3 billion, down 0.0% YoY.

Contraction in global demand

After a pandemic lockdown, the US has demonstrated a significant pent-up demand. Due to Americans going back to work, demand for office supplies like shirts and vests is increasing. As a result, the value of US textile and apparel imports in 5M22 increased 31.5% year over year to reach US$ 51.6 billion.

Although the CPI in July declined to 8.5% from 9.1% in June, a pace not seen in more than four decades, Mr. Nguyen Duc Hao, analyst at VNDirect, predicted that the demand for textiles and clothing in the US will slow down in 2H22F due to high inflation. "We believe that rising inflation will have an impact on the demand for upscale clothing, such as vests, shirts, and T-shirts manufactured from recycled yarn”, Mr. Nguyen Duc Hao stated.

In Mr. Nguyen Duc Hao’s view, recycled yarn demand could decline in 2H22 and progressively pick up in 2Q23F. As a result, he reduces his prior prediction for recycled yarn sales for FY22/23F by 15.9%/8.2% because of 1) weaker-than-anticipated 2Q22 performance, 2) slower US market demand, and 3) a Unitex mill that began operations commercially later than projected.

The cost of raw materials remains high

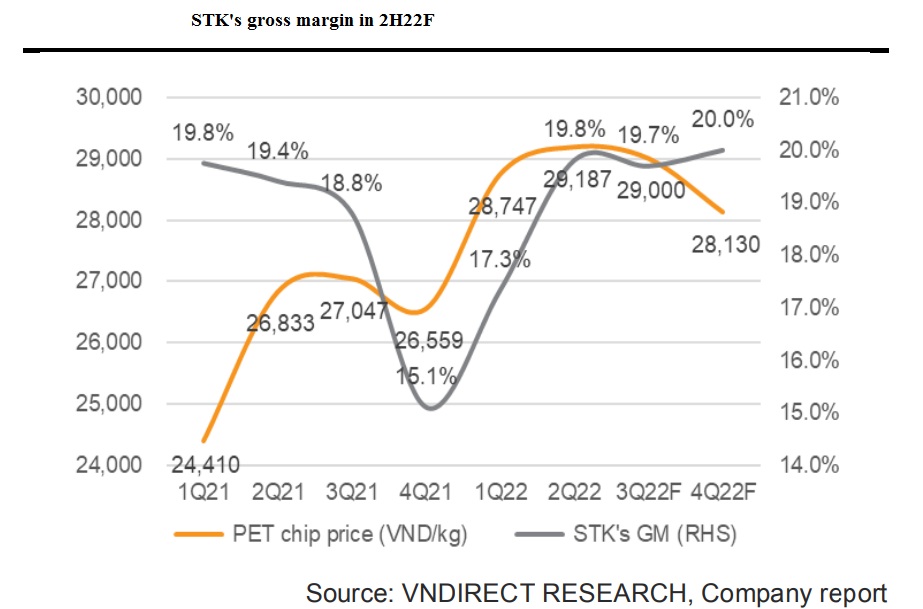

Due to growing gasoline use and rising international travel as more nations reopen their borders, the demand for oil is rising globally. As a result, the price of Brent oil increased 22% ytd and averaged US$111.7/barrel in 2Q22 (58% yoy). As a result, the price of PE chips—the STK's primary input and the source of 60% of COGS—rose 9% year over year to VND29,187/kg in 2Q22.

Fundamentally, Mr. Nguyen Duc Hao is of the opinion that the price of Brent oil will remain high for a few more months before gradually declining toward the end of 2022 as potential increases in supply from the US, OPEC, and Iran may be able to partially meet the rising demand, resulting in an average Brent oil price of US$100/bbl in 2022F.

He said that PE chip prices would continue high in 3Q22 before declining in 4Q22 because they are frequently 1 to 2 months behind oil prices. In light of this, we anticipate STK's GM to be 19.7% (-0.2% pts from 2Q22) and 20.0% (0.3% pts from 2Q22) in 3Q22F and 4Q22F, respectively.

Outlook ahead

Social distance caused a delay in 2021, but STK's Unitex facility is anticipated to resume operations in 2022. STK is in the process of obtaining a building permit and finishing the required formalities with the authorities. Phase 1 of the Unitex factory will start producing commercially at the end of 3Q23, which is two months later than VNDirect had anticipated.

According to Mr. Nguyen Duc Hao, Phase 1 of the Unitex factory will begin commercial operation in 2023F at 30% capacity, with a production volume of 10,800 tonnes. This would cause sales to rise by 20% yoy in FY23F.

VNDirect, however, revised its commercial projections for STK. Due to 1) worse-than-anticipated 2Q22 results, 2) weaker US market demand, and 3) a Unitex factory starting two months later than anticipated, it therefore decreased FY22/23F recycled yarn revenue by 15.9%/8.2% compared to the prior prediction.

In addition, it upped its prediction for virgin revenue for FY22/23F by 3.7% to 4.2% as a result of increasing domestic market demand. Additionally, it decreased FY22/23F selling expenditures by 18.6%/17.4% because he expects STK to leverage the anti-dumping tariff to promote virgin yarn in the domestic market. In instance, the shift in product mix sales impacted GM in FY22/23F by 1.7%pts/1.1%pts. It consequently decreased the net profit expectations for FY22 and 23F by 14.7% and 14.5%, respectively.