PDR’s profit expected to recover from core business

MBS expects Phat Dat Real Estate Development Corp. (HSX: PDR)’s profit in the 2025–2026 period to increase by 341%/ 86% yoy, respectively, driven primarily by the Bac Ha Thanh and Thuan An 1 & 2 projects.

In 1Q25, PDR recorded a 170% YoY increase in revenue, primarily driven by the handover of products from the Bac Ha Thanh project. The gross profit margin of this project improved to 40%, up from 36.5% in 4Q24. However, net profit for 1Q25 slightly declined by 3.8% yoy due to the absence of significant financial income contributions, though it showed a strong recovery from last quarter’s low base. Account receivables from the Bac Ha Thanh project decreased by 12% qoq, equivalent to 38% of the project’s recognized revenue. In 2024, PDR's profit dropped sharply by 77% yoy, as the handover of Bac Ha Thanh project fell short of expectations and the company no longer benefited from large financial gains as in 2023.

During the 2022–2024 period, in the absence of favorable conditions for launching and handing over new projects, the company's profits were primarily supported by financial income through the continuous divestment of investment contributions—an unsustainable source of income.

“We believe that with legal progress at the Thuận An 1 & 2 projects (having received land use fee notifications and expected to fulfill financial obligations and commence sales in February 2025), along with more active sales efforts at the Bắc Hà Thanh project, PDR’s profit is projected to grow by 365% and 96% yoy in 2025 and 2026, respectively - recovering from the very low base in 2024”, said MBS.

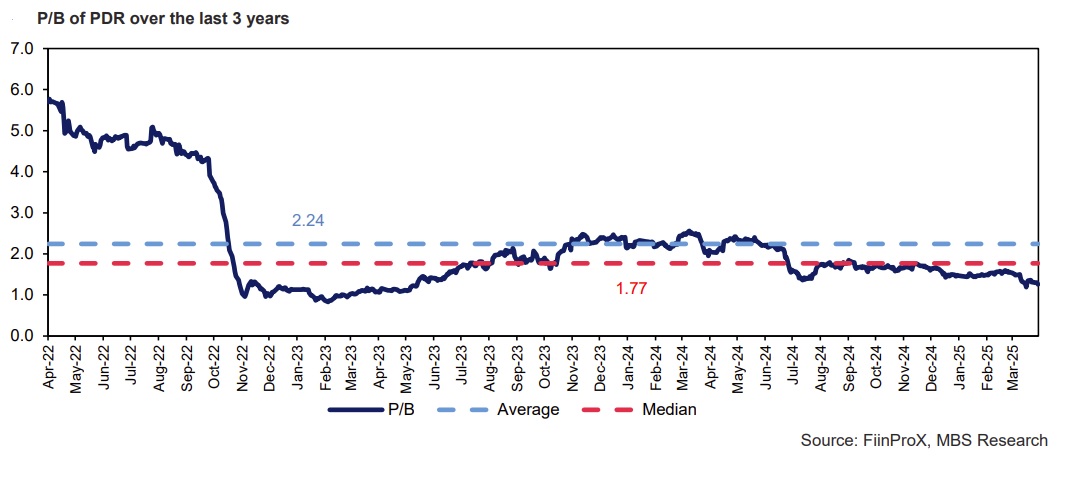

Currently, PDR share is trading at a trailing P/B ratio of 1.3x, which is below its 3-year average of 2.3x and 3-year median of 1.8x. In MBS’s view, this reflects concerns regarding: (1) dilution risks from additional share issuances for debt restructuring, and (2) audited 2024 earnings that were significantly lower than pre-audit figures. Given the expectation of profit recovery in 2025–2026 driven by improved core business operations, this stock company believes the stock has potential for revaluation, making this a reasonable time for accumulation.

In 2025, PDR is expected to recover its profitability from the low base of 2024, driven by core business operations. During the 2022–2024 period, amid unfavorable conditions for launching and handing over new projects, the company’s earnings were supported mainly by financial income from the continuous divestment of investment contributions—an unsustainable source of profit.

Many analysts believe that with legal progress at the Thuan An 1 & 2 projects and more active sales efforts at the Bac Ha Thanh project, PDR is projected to achieve profit growth of 365% and 96% year-over-year in 2025 and 2026, respectively.

The current price of PDR has adjusted to its lowest level in the past year, with a trailing P/B ratio of 1.3x, below the 3-year average of 2.3x and the 3-year median of 1.8x. In MBS’s view, this reflects concerns related to: (1) dilution risks from the issuance of an additional 34 million shares to exchange over VND 700 billion in debt with ACA Vietnam, and (2) audited 2024 earnings that were significantly lower than the pre-audit figures. However, it believes that once PDR records profit recovery in 2025, the PDR stock will be revalued at a higher multiple than its current level.