POW struggles to raise charter capital

PetroVietnam Power Corporation (PVPower, HoSE: POW) has steadily improved its commercial performance, although it continues to confront financial risks and pressure to seek funds to undertake projects.

Nhon Trach 4 project

POW plans to ask for approval from the General Meeting of Shareholders for the issuance of shares to increase charter capital from VND 23,418 billion to VND 30,678 billion.

Improved business performance

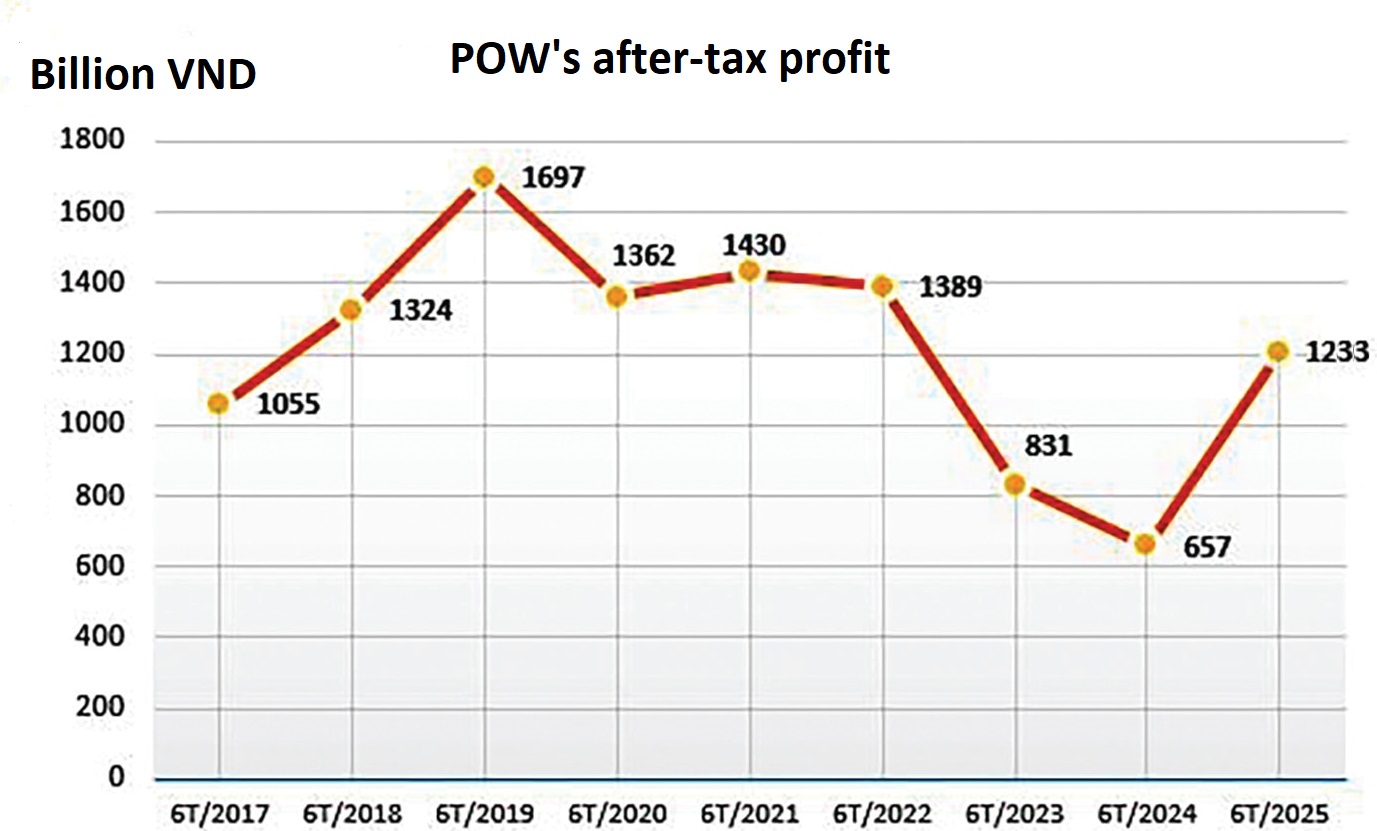

POW has officially released its consolidated financial statement for the second quarter of 2025, with net revenue of roughly VND 9,415 billion, virtually unchanged from the second quarter of 2024. However, after subtracting expenditures, POW's after-tax profit was over VND 733 billion, a 66% increase over the same time the previous year.

POW's total revenue for the first six months of 2025 was VND 17,549 billion, a 12.3% increase over the same period in 2024. Its after-tax profit was VND 1,233 billion, up 87% from the first half of 2024. This demonstrates how POW's company performance has gradually improved.

The Ministry of Industry and Trade has anticipated that power consumption growth will remain high at more than 10% from now until 2030, indicating the government's determination to enhance economic growth. In addition, POW benefits from the switch of gasoline cars to electric vehicles in major cities beginning in 2026. This company is now piloting charging stations and aims to add 1,000 more by 2035. One could view this move as a catalyst for its business activities.

Increased financial risks

As of June 30, 2025, POW's total assets were VND85,651 billion, up 7.1% from the start of the year. Its short-term receivables climbed by VND1,684 billion from the start of the year to VND13,557 billion, with the majority coming from the Electric Power Trading Company (EVNEPTC).

By the end of the second quarter of 2025, POW and its subsidiaries' total bad debts had climbed to VND665 billion, up VND102 billion from earlier in 2025, and they had to set aside roughly VND563 billion in provisions. The greatest bad debt remained that of EVNPTC, which totaled VND623 billion.

POW's liabilities at the end of the second quarter were VND50,075 billion, up 10.7%, with total short-term debt at VND30,918 billion. As a result, Pow's liabilities are 1.4 times its equity, indicating that current debt is weighing on this firm.

Notably, in the first six months of this year, POW's financial expenditures rose rapidly to more than VND574 billion, up 59% from the same period last year, with interest expenses totaling VND257 billion. Meanwhile, financial earnings for the period were just VND414 billion. POW's financial expenditures have risen dramatically as a result of increasing loans to finance the Nhon Trach (NT) 3 and 4 projects, as well as steep increases in exchange rate losses. DSC expects that the pressure on POW's financial costs will intensify in the fourth quarter of this year due to current monetary policy changes and the operational circumstances of the NT3 and NT4.

Promoting issuance for fundraising

Among the large power companies benefiting from the Government's long-term investment strategy, POW has a favorable opportunity to improve its position due to the investment plan for key national projects, including the NT 3 and NT 4 plants (1,600 MW in the 2025-2026 period) and LNG Quang Ninh (1,500 MW in the 2029-2030 period). Furthermore, this company is working on a number of further projects, including LNG Quynh Lap (1,500 MW in a joint venture with SK and NASU Korea), LNG Vung Ang III (1,500 MW in a joint venture with Bgrimm), and Ca Mau 1&2 MR (1,500 MW). These projects are in the process of creating feasibility study reports. These initiatives will increase POW's investment capital requirement significantly.

POW has now announced the documents for the 2025 Extraordinary General Meeting of Shareholders (GMS), which will be held on September 25 in Hanoi. The forthcoming GMS will approve the plan to offer and issue shares to enhance charter capital from VND 23,418 billion to VND 30,678 billion. The first option is to issue additional shares to current shareholders at a 12% rate, with a total of 281 million shares at an offering price of VND 10,000 per share. The second approach involves POW issuing shares to raise equity capital from equity (bonus shares) at a 15% rate. The third method is to issue shares to pay dividends at a rate of 4%. Source of shares issuance from undistributed profit after tax on the 2024 audited financial statements.

The POW's Board of Directors requested that the above three options be implemented concurrently once approved by the State Securities Commission. The proceeds from the offering of shares to current shareholders (about VND 2,810 billion) will be utilized to fund the NT 3 and NT 4 Projects. According to POW's first-half-of-2025 report, the EPC contractor expects to have the NT3 Plant operational by the end of 2025.

According to the design, these two facilities require a total investment capital of VND 32,486 billion (30% equity and 70% loans). This is Vietnam's first LNG-fueled thermal power plant. When operational, this project will provide about 9 billion kWh of electricity to the national power grid each year, contributing to the government's pledge to net zero emissions by 2050 at COP 26.