Pressure on alcoholic beverages sector stocks

Following the simultaneous challenges of the COVID-19 epidemic and Decree 100/2019/ND-CP, enterprises in the alcoholic beverages sector sector are now at danger of confronting another

The Ministry of Finance (MoF) has suggested raising the special consumption tax (SCT) on alcohol and beer. If this proposal is accepted, it might put a lot of pressure on beer and alcohol businesses' stock prices.

Shocking Proposal for the Alcohol Industry

Recently, the Ministry of Finance released a draft revision to the SCT Law. This plan proposes an 80% special consumption tax on alcoholic drinks having an alcohol level of 20 degrees or more, as well as beer, starting in 2026 and progressively climbing to 100% by 2030. The Ministry recommends a 50% tax on alcoholic beverages below 20 degrees beginning in 2026 and escalating to a maximum of 70% by 2030.

According to Mr. Nguyen Van Viet, Chairman of the Vietnam Beer - Alcohol - Beverage Association (VBA), the proposed SCT increase on alcohol and beer in the draft amendment is the most significant "shock" in the history of SCT rises. "The Association and companies are particularly astonished by this idea, given the continued problems they are already facing," Mr. Viet stated.

Furthermore, Mr. Viet noted that the impact assessment study is based on old data that does not fully reflect the current business reality, failing to address the sector's current difficulties. The statistical data and analysis are based on the pre-COVID-19 period of 2019, when the beverage sector did not endure continual reductions as it has lately.

Furthermore, the material supporting the SCT increase plan and its effect assessment focuses solely on one goal: boosting alcohol and beer prices by 10% or 20%, with further increases in coming years. There is no full study of other factors, such as whether higher taxes diminish consumption. What are the specific aims for preserving public health? How will the budget be impacted? How will the firms that are directly touched be affected? What are the customer reactions and the indirect socio-economic consequences?

Following the Ministry of Finance's plan, stock investors have reacted strongly against alcoholic beverage stocks. According to estimations, beer and alcohol stock values fell 20% in June 2024, owing to the unfavorable influence on some firms such as SAB and BHN.

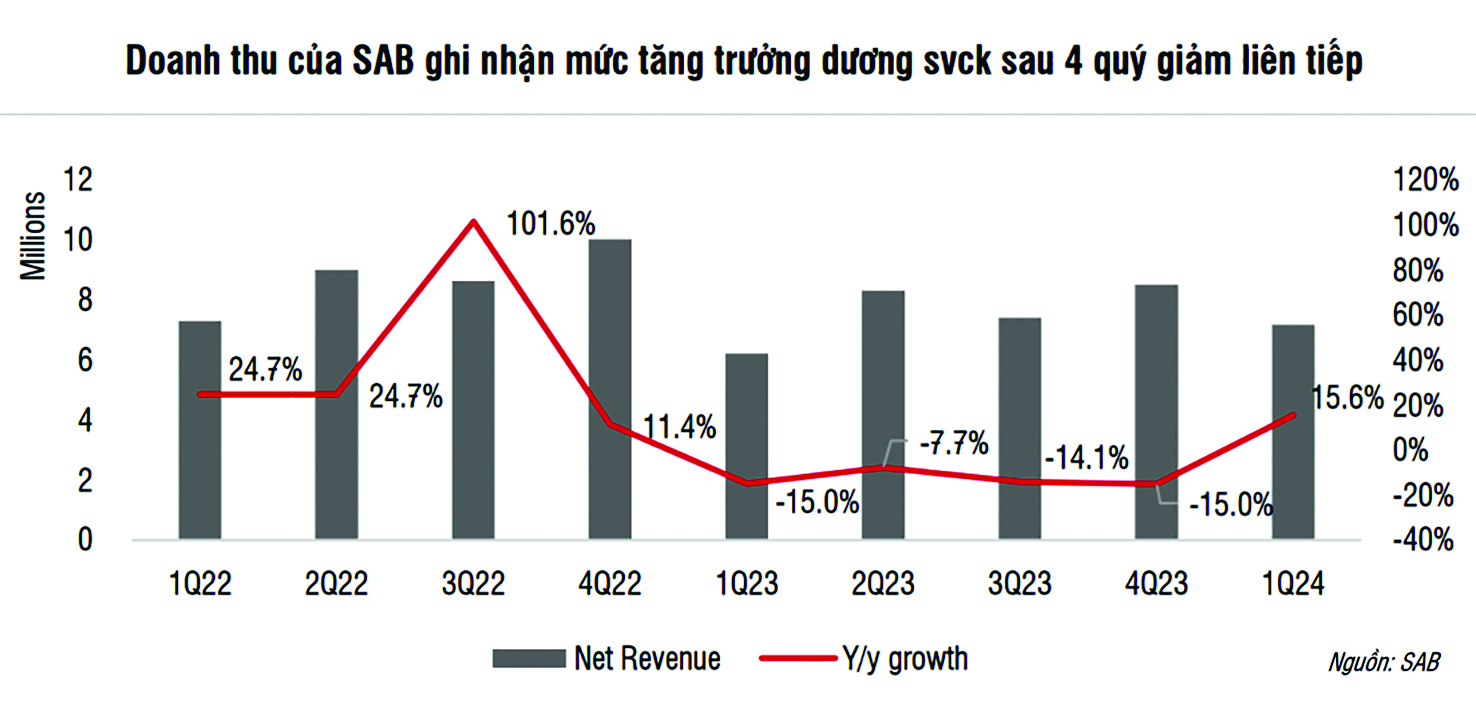

SAB's revenue has returned to positive growth

Considering Investment Opportunities

Despite the challenges on beer and alcohol firms, experts believe investors may still find value in these stocks. Investors should look at the following stocks:

First, SAB (Saigon Beer, Alcohol, and Beverage Corporation): With a pessimistic prognosis for 2024, analysts believe that SAB will continue to be impacted by tougher rules on alcohol use while driving and shifting consumer behaviors as spending tightens. As a result, SAB's growth rate is likely to decelerate.

However, Phu Hung Securities SJC (PHS) has revised its 2024 forecasts for SAB's net revenue and post-tax profit to VND 32.2 trillion (up 5.8%) and VND 4.6 trillion (up 9%), respectively, due to better-than-expected Q1 2024 business results and a slight increase in average selling prices in the first half of the year. SAB's net revenue for 2025 is expected to be VND 33 trillion, up 3%, with a net profit of VND 4.97 trillion, up 7%.

In the immediate term, many analysts predict SAB to post double-digit profit growth in Q2 2024, aided by UEFA Euro 2024 and the 2024 Summer Olympics, as well as a low comparative base in Q2 2023.

SAB shares are trading at a 2024E P/E of 17x, lower than the 5-year average of 22x. PHS recommends a neutral stance on SAB shares but raises the 1-year target price to VND 65,400 per share.

Second, BHN (Hanoi Beer-Alcohol-Beverage Corporation): According to Q1 2024 financial results, BHN generated net revenue of VND 1.308 trillion, up 12% year on year. However, after deducting expenditures and taxes, BHN reported a net loss of roughly VND 21 billion, compared to a loss of VND 3.7 billion during the same time previous year. The management ascribed the negative profit to a 16% reduction in financial income owing to reduced deposit interest rates, which totaled almost VND 38 billion. Additionally, greater market investment had an influence on expenditures.

According to BHN's financial documents, selling expenditures increased by 13% to more than VND 230 billion in the first quarter, with advertising, promotions, and support rising by 42% to VND 105 billion.

By the end of March, BHN's consolidated total assets had fallen by almost VND 600 billion to over VND 6.552 trillion. Notably, cash and equivalents declined by roughly 54% to VND 540 billion, while inventories fell by 10% to VND 646 billion. Liabilities were decreased by VND 575 billion, reaching VND 1.267 trillion. Given this circumstances, BHN expects sales of around VND 6.543 trillion and a post-tax profit of VND 202 billion this year, both lower than 2023 levels.

On July 8, BHN shares closed at VND 39,000 per share. Given the company's issues and projected SCT hikes, investors should only consider BHN as a long-term investment.