Pressure to increase the exchange rate, will the State Bank take action?

Pham Chi Quang, Deputy Director General in charge of the Monetary Policy Department, State Bank of Vietnam (SBV), said that the agency will increase the frequency of selling foreign currency interventions.

|

|

According to SSI, the downward pressure of VND is still relatively clear in the context of USD appreciation. Photo: Internet |

Pressure from strong USD

In recent days, the US Federal Reserve (Fed) announced the adjustment of the basic interest rate to cope with record-high inflation, and also many other countries around the world are also facing record-high inflation, so they should proceed to increase operating interest rates. According to experts, this development will have a significant impact on the domestic exchange rate.

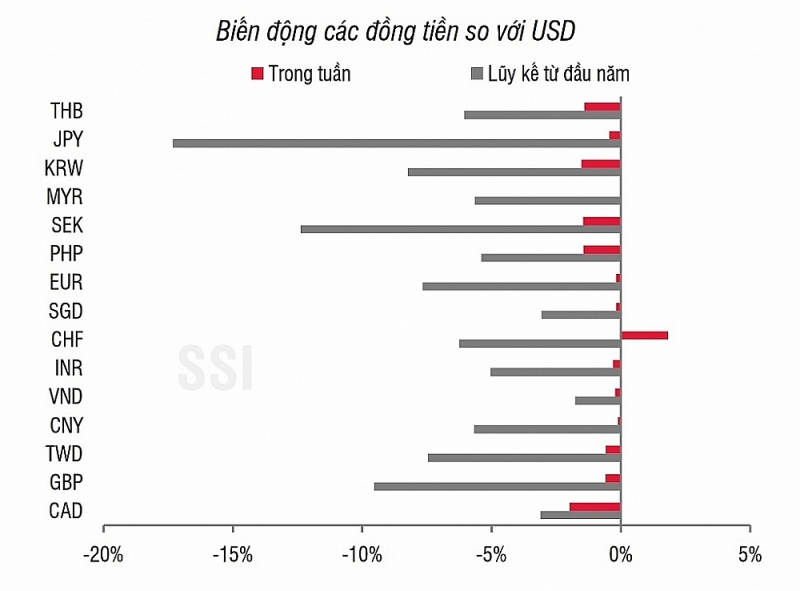

Currently, the USD index (DXY) on the international market has risen to around 104-105 points, up nearly 10% compared to the end of 2021. The greenback's strong appreciation caused regional currencies to have similar developments. For example, the yuan depreciated 5.3%; the Korean Won depreciated by 4.7%, the Taiwan Dollar by 6%, the Thai Baht by 3.4%, and the Japanese Yen by nearly 16%.

|

| Source: SSI |

However, according to calculations, since the beginning of the year, VND has only slightly depreciated by about 1.9%. Mr. Pham Chi Quang said that developments in the international market adversely affected the balance of supply and demand of foreign currency and the psychology of the domestic market, putting pressure on the stability of the exchange rate and the foreign currency market.

However, the domestic foreign currency market still operates stably, the market liquidity is smooth, and the legal foreign currency needs of the economy are fully and promptly met, especially the foreign currency demand to import essential commodities for production and business in the context of a sharp increase in energy prices and basic commodity prices.

Under such stability, in addition to the SBV's flexible exchange rate management, and implementing measures to sell foreign currencies to intervene with appropriate forms to supplement the foreign currency supply to the market from the beginning of 2022, According to experts, the exchange rate market is also supported by macroeconomic impacts.

Accordingly, Vietnam's foreign exchange reserves reach a record high of about US$110 billion. VND is also supported by foreign currency supply such as remittances, FDI disbursement is forecast to grow steadily, the trade balance in the first five months of the year has a surplus of US$2.53 billion and the whole year is expected to remain in surplus (estimated at about US$4-8 billion).

The report of VnDirect Securities Company also stated that the strong USD put pressure on the exchange rate of Vietnam. However, VND remains one of the most stable currencies in the region thanks to an improving trade surplus and high foreign exchange reserves. The analysis team forecasts that the trade surplus will increase to US$7.2 billion in 2022 from US$3.3 billion in 2021. VnDirect shares the same expectation that Vietnam's foreign exchange reserves will reach US$122.5 billion by the end of 2022 (equivalent to 3.9 months of imports).

Therefore, the USD/VND exchange rate will increase by no more than 2% in the whole of 2022.

In addition, according to some forecasts, VND may depreciate by more than 2% in 2022. According to economist Dr. Can Van Luc, the exchange rate in 2022 will increase by about 2-2.3%. Similarly, the report of Vietcombank Securities Company (VCBS) forecast that VND could depreciate by 2% against the USD this year.

SBV will increase the frequency of selling foreign currency interventions

A representative of the State Bank said that the USD/VND exchange rate increasing by about 2% compared to the end of 2021 is suitable for domestic and foreign market conditions and developments, and consistent with the goal of monetary policy management is to contribute to stabilizing the money market, the macro-economy, and controlling inflation.

Also on this issue, Mr. Ngo Dang Khoa, national director of foreign exchange, capital markets and securities services of HSBC Vietnam, assessed that the SBV's exchange rate policy continues to be flexible, adapting to new variables in the market, making the medium and long-term trend of the exchange rate more stable.

However, with many pressures from the economy remaining, especially in the context of rapid global inflation, the Deputy Director in charge of the Monetary Policy Department said that the SBV will coordinate and synchronously manage VND liquidity to support the stability of exchange rates, foreign currency markets and interest rates.

He also said that in recent years, when market conditions were favorable, the State Bank had purchased a large amount of foreign currency to increase foreign exchange reserves. In the context of unfavorable market movements and many pressures like now, with such a scale of foreign exchange reserves, the State Bank has continued to sell foreign currencies to stabilize the market.

“The SBV will increase the frequency of foreign currency interventions to be ready to supplement the foreign currency supply to the market more often, thereby creating conditions for the credit institution system to fully and promptly meet the needs of the legal foreign currency of organizations and individuals, including the demand for foreign currency to import essential goods for domestic production and business and export, thereby contributing to stabilizing the market and supporting economic recovery," said Mr. Pham Chi Quang.