Proposed amendments to Circular 06/2023/TT-NHNN

The government urged the State Bank of Vietnam (SBV) to research and use a proactive approach, listen to ideas, and seek feedback from enterprises and individuals in order to quickly and efficiently design solutions that boost credit growth.

At a recent meeting on August 17, 2023, the Government highlighted the need for the State Bank of Vietnam (SBV) to study and leverage a proactive attitude, listen to opinions, and gather feedback from businesses and citizens in order to promptly and effectively formulate solutions to strengthen the credit access of businesses and individuals.

This announcement is in line with the spirit of the Prime Minister's urgent guidance in official dispatch number 746/TTg-KTTH dated August 16, 2023, in which the Prime Minister assigned Deputy Prime Minister Le Minh Khai to lead a meeting with the SBV and relevant agencies to study the revision of Circular 06/2023/TT-NHNN, with the goal of improving businesses' credit access capabilities.

Regarding the Circular amendments (Circular 06 and Circular 03), it is expected that these adjustments would remove hurdles to credit availability for firms, particularly real estate enterprises.

Expected amendments for Circular 06

Concerning Circular 06, various companies have made comprehensive amendment proposals and attended meetings presided over by Deputy Prime Minister Le Minh Khai. For example, the Chairman of the Ho Chi Minh City Real Estate Association (HoREA), Le Hoang Chau, recently presented proposals for the modifications' direction.

As a result, HoREA considers that in order to maintain the coherence and compatibility of Circular 06 with legal rules, as well as to satisfy the investment needs envisaged for obtaining credit for "legitimate capital use purposes," the SBV should examine the following:

First, reconsider removing "Article 8, Clause 8" because there are signs that it may be in conflict with Article 2, Clause 51 of the 2013 Constitution and other provisions of the Law.

Second, suggest a change to "Article 8, Clause 9." HoREA specifically recommends that the SBV consider allowing credit institutions to provide credit for businesses, investors, and homebuyers seeking credit for "capital contribution contracts, cooperation investment contracts, or business cooperation contracts to carry out investment projects" where the investment projects have "received authorization from competent state agencies to be implemented." Borrowers must demonstrate financial competence, interest and principal repayment capabilities, or offer collateral as required by credit rules.

Furthermore, HoREA recommends revising "Article 8, Clause 10," which governs "costs related to project implementation and business activities arising within 24 (or 36) months from the time the credit institution decides to grant the loan," in order to align with the practical situation of the real estate market, where "legal obstacles" account for approximately 70% of the difficulties causing project implementation to be delayed, awaiting decisions from authorized agencies rather than the courts.

HoREA also recommends that the SBV reconsider Circular 03/2023/TT-NHNN by removing point a, Clause 8, Article 4 of Circular 16/2021/TT-NHNN. The substance of this point a, Clause 8, Article 4 rules that credit institutions are not permitted to acquire corporate bonds in the following circumstances: a) Corporate bonds are issued with the intention of restructuring the issuing corporation's obligations.

Thus, if altered in this way, it would effectively erase a critical "red line" that is now impeding the debt restructuring process in the capital market - a situation in which many real estate firms are struggling without an exit strategy.

Expected Direction for Circular 06 Revisions

This suggested Circular 06 modification direction is expected to transform the landscape and health of the real estate sector. MSVN securities firms believe that a better understanding of the issue is required, beginning with defining what defines a "qualified business project."

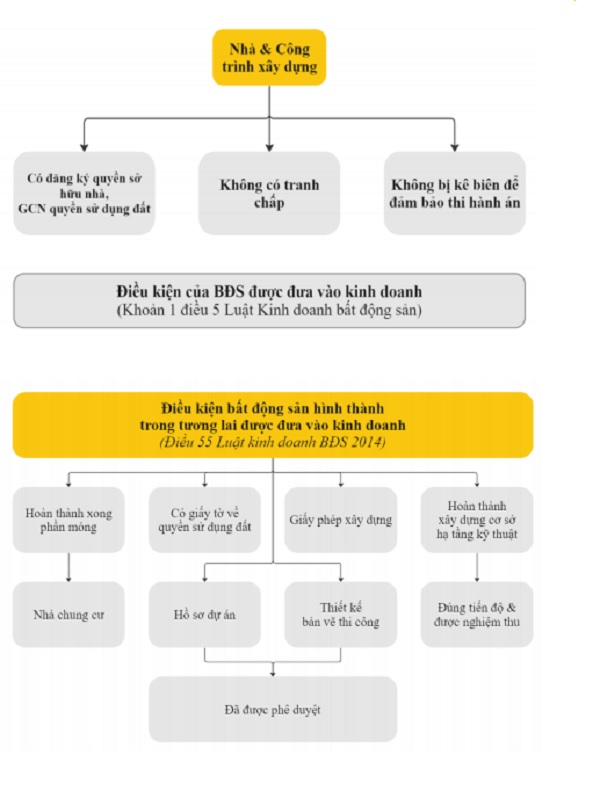

MSVN's analytical team believes that qualifying business initiatives that may be put into basic operation must have completed the following legal procedures: (1) Obtaining investment permission; (2) permission of comprehensive planning; and (3) Fulfilling financial commitments relating to land.

Numerous projects have not finished these procedures, or their execution is experiencing problems, preventing them from entering the operational phase. Most real estate assets that do not fulfill the requirements for commercial operation become collateral in the banking system. In circumstances when clients lack payment capability and banks proceed with the foreclosure of these assets, but the projects do not fulfill the standards for commercial operation, the success of the foreclosure is improbable. This condition jeopardizes the stability of the financial system. As a result, the new legislation in Circular 06/2023/TT-NHNN, point 9, Clause 8, tries to limit these risks. This is also the SBV's point of view when justifying the rule in Circular 06, after multiple warnings about hazards across the system.)

"In our view, land use fees and infrastructure costs often account for 50 - 60% of the total investment of a project. Thus, providing credit from the initial phase of the project is extremely necessary for real estate companies. When the project meets the requirements for business operation, the investor is not necessarily required to borrow from banks at high interest rates, because at that point, the investor can engage in buying and selling future real estate properties, mobilizing capital from customers. This is the cheapest and most effective source of funding, as it avoids the pressure of repaying interest and principal, focusing only on completing the project early to hand over houses to customers. Therefore, the regulation prohibiting credit for "projects not meeting the requirements for business operation" can be interpreted in two ways: one is "projects lacking legal prerequisites," and the other is "projects lacking prerequisites for sales." Hence, this may limit businesses' access to capital...", MSVN concludes.

The expert panel also considers that the anticipated amendments to Circular 06/2023/TT-NHNN would assist the real estate sector, notably in terms of better access to financing from credit institutions, especially in the current environment of capital-strapped real estate firms.