Public investment stocks to make a comeback

The group of public investment stocks is forecasted by experts to be the highlight for the remaining months of 2024.

The year 2024 is projected to be a particularly fortunate year for the public investment sector, with industry participants predicting several positive outcomes. Companies tied to public investment are also predicted to increase, particularly in the later half of 2024.

LCG is about to invest in the Huu Nghi-Chi Lang border gate project.

Accordingly, the group of public investment equities represents a fruitful and attractive market for investors to explore in 2024. This group includes notable stocks such as VCG, LCG, HHV, and C47. BSC Securities analysts predict that LCG - Lizen Joint Stock Company will have strong growth in the last months of the year.

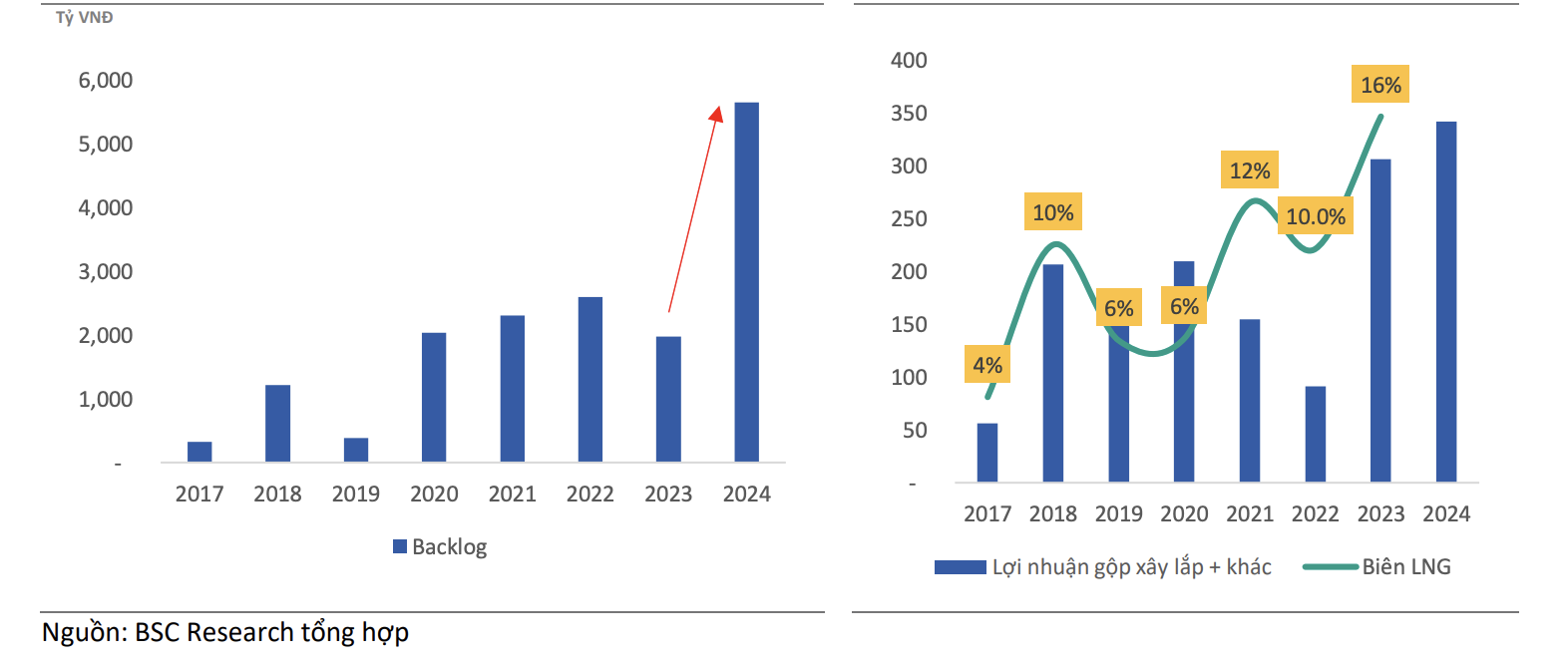

This is because, in addition to the over 6,000 billion VND backlog from projects such as Vung Ang-Bung, Nha Trang-Van Phong, and the Bien Hoa - Vung Tau expressway, LCG's consortium continues to win the Huu Nghi - Chi Lang Expressway bid, with a total length of over 59.8 km and a total investment of over 11,024 billion VND, nearly half of which is state budget capital in April 2024.

Additionally, LCG plans to buy back 45% of the charter capital of LCE Gia Lai Renewable Energy Investment Joint Stock Company with a total value of 75 billion VND while continuing to seek partners to sell 100% of this company's capital. According to the Board of Directors, the Van Phong-Nha Trang, Vung Ang-Bung, and Ring Road 4 projects will be the main contributors to the company's revenue and profit in 2024.

Based on the large backlog and solid financial potential, BSC Securities forecasts LCG's revenue and after-tax profit in 2024 to reach 2,827 billion VND (up 40.8%) and 201 billion VND (up 97.9%) respectively. Accordingly, the gross profit margin is expected to improve from 14.2% to 15.4%; the projected EPS is 989 VND/share, and the forecasted P/E is 11.4x, lower than the company's five-year average.

Therefore, with the ongoing development trend of public investment being further strengthened, LCG's large backlog is also expected to help maintain good revenue for the coming years.

LCG's stock is currently around its lowest price range since the beginning of the year and is showing good accumulation signals around the support threshold.

According to BSC, the Government plans to boost public investment disbursement even more in 2024-2025. Since the beginning of 2024, the distribution and payments progress for projects has been excellent. Some publicly traded construction businesses, such as C4G, LCG, and CC1, have significant cash reserves, mostly from project prepayments. LCG alone has 671 billion VND, which includes 428 billion VND from the Nha Trang-Van Phong project, 502 billion VND from Ring Road 4, and 115 billion VND from the Vung Ang-Bung project.

BSC anticipates that the public investment trend will continue to be strong, with funding for company initiatives being advanced during 2024. In LCG's example, it might potentially stay at 340 billion to 420 billion VND in 2024-2025, which is 30% to 35% higher than in 2017-2022.

The second notable stock in the public investment group is VCG - Vinaconex Import-Export and Construction Joint Stock Corporation. In 2024, VCG sets a challenging plan with consolidated revenue and after-tax profit targets of 15,000 billion VND and 950 billion VND, respectively, equivalent to 115% and 240% of 2023's results. However, after just the first quarter, VCG has already achieved nearly 50% of its after-tax profit target, recording 463 billion VND.

With significant potential from the construction segment and real estate business plans, investors expect VCG to complete its 2024 plan. With VCG's average P/E in 2023 at 14.8 times as a target, assuming VCG meets its 2024 profit plan, the EPS will reach 1,580 VND/share. Accordingly, VCG's target price is 23,300 VND/share.

Additionally, public investment stocks such as PLC, C4G, and HHV are also forecast to be undervalued and have many opportunities in the remaining months of 2024.

Overall, public investment stocks have many advantages to make a comeback, with expectations in Q3/2024 that the Prime Minister will allocate an additional 8,680 billion VND from the increase in central budget revenue in 2023. Of this, about 6,300 billion VND will be primarily allocated to the phase 2 North-South Expressway projects for continued implementation.

According to the Planning and Investment Department (Ministry of Transport), including the additional central budget revenue, the total capital plan assigned to the Ministry of Transport this year is 71,280 billion VND. Currently, the Ministry of Transport has been assigned 62,600 billion VND in central budget capital, of which about 45,000 billion VND is allocated to key projects.

As of July 15, 2024, the Ministry of Transport has disbursed about 27,500 billion VND, reaching 44% of the assigned plan. Specifically, key projects have disbursed 22,018 billion VND, achieving 49% of the annual plan. The phase 1 North-South Expressway alone disbursed nearly 2,700 billion VND, reaching 40% of the plan. The phase 2 North-South Expressway disbursed 16,765 billion VND, reaching 55% of the plan.

Currently, the disbursement pace aligns with the required progress of the projects. With the current disbursement pace, public investment stocks are also expected to surge in the remaining quarters of 2024.