Real estate outlook in 2024: Credit conditions are expected to be relaxed

According to Mr. Le Hoang Chau, Chairman of HoREA, in order to continue increasing credit supply in the real estate industry, legislative bottlenecks must be removed at the same time.

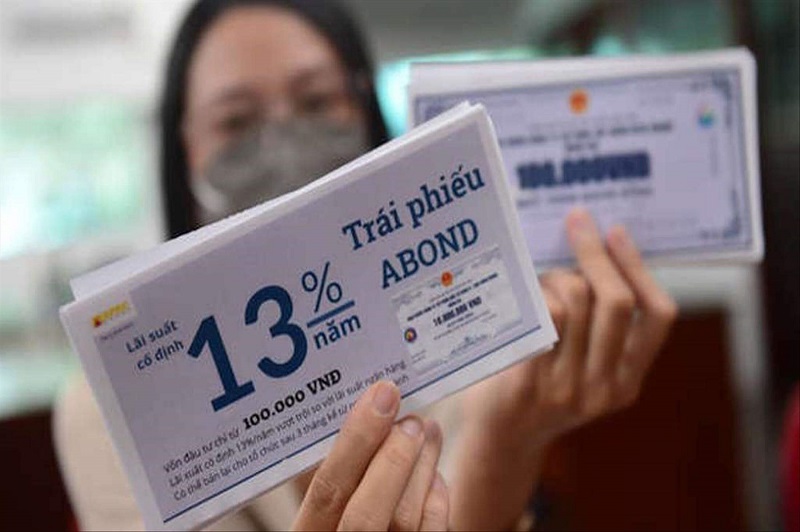

The real estate industry continues to confront issues as we approach 2024. Resolving issues with credit sources, bonds, investment funds, and so on is critical for stimulating capital flow into the real estate market and contributing to greater liquidity.

According to HoREA, the first answer is non-credit-related in order for commercial banks to continue promoting credit lending in the real estate industry. It is dependent on the rapid settlement of legal hurdles to real estate initiatives by authorized bodies at all levels, from central to local. This is necessary for projects to fulfill credit criteria (real estate projects with appropriate legal reasons to serve as collateral for financing) and to make it easier for developers to carry out their projects.

To implement the non-credit solution and resolve legal obstacles for real estate projects, the role and responsibilities of the head of the Prime Minister's working group at the Ministry of Construction must be emphasized further, in accordance with the Prime Minister's directives in Official Dispatch 993/C-TTg. Furthermore, the government's working group must play a role in this respect.

Simultaneously, HoREA recommends to the State Bank many credit-related options.

First, the group advises that the State Bank alter and update Article 7 of Circular 39/2016/TT-NHNN in order to modestly reduce lending criteria. Instead than requiring consumers to complete all standards, just specified conditions should be required. Furthermore, it proposes supplementing a customer-agreed method with an independent consulting firm to assess the feasibility and cash flow of the investment project; the cost of the assessment should be borne by the customer, assisting commercial banks in project feasibility evaluation and making credit more accessible to customers.

Second, the organization suggests that the State Bank direct commercial banks to continue implementing Circular 02/2023/TT-NHNN on loan repayment terms restructuring, as well as maintaining debt groups to help clients in difficulty, until the economy returns to normal growth levels. This attempts to improve business resilience and offer them with additional options to receive fresh finance.

Third, it recommends that the State Bank reconsider amending and supplementing point d, Clause 5 of Article 16 of Circular 22/2019/TT-NHNN, extending the effective implementation period by 12 months until October 31, 2024, in order to increase the money supply for credit institutions while ensuring the credit system's safety.

Fourth, it suggests that the State Bank evaluate and revise Circular 03/2023/TT-NHNN by eliminating point a, Clause 8 of Article 4 of Circular 16/2021/TT-NHNN, which allows credit institutions to acquire corporate bonds issued to restructure issuing firms' obligations.

Fifth, it proposes removing sub-point (iii) of Clause 2 of Article 22 and Clause 5 of Article 26 of Circular 39/2016/TT-NHNN to provide compliance with the 2015 Civil Code regulations on means to insure the execution of obligations, such as deposits, mortgages, and guarantees. Deposits made by real estate project investors and commercial housing are included.

Sixth, it suggests reconsidering the elimination of points 8, 9, and 10 of Article 8 of Circular 39/2016/TT-NHNN to assist credit institutions and clients in the loan and credit approval procedure.

Seventh, the association recommends that the State Bank broaden the scope of beneficiaries for the 120 trillion VND credit package to include developers and homebuyers in commercial housing projects with selling prices not exceeding 3 billion VND/unit, with first-time homebuyers given priority.

This Association recommends that the Ministry of Construction continue to collaborate with the State Bank, the Ministry of Planning and Investment, and the Ministry of Finance to restructure the 110 trillion VND social housing credit package in accordance with the Housing Law, which is expected to be passed by the National Assembly in its sixth session, and to implement the program to develop at least 1 million social housing units between 2021 and 2030.

Eighth, it recommends that the State Bank review and amend Article 4 of the draft Law on Credit Institutions (amended), supplementing the customer-agreed method with an independent consulting firm to assess the feasibility and cash flow of the investment project, with the customer bearing the assessment cost. This intends to help commercial banks evaluate project viability and make loans more accessible to clients.

Finally, it recommends changing and augmenting the Credit Institutions Law by include rules on project transfers when a portion of the real estate project is collateral for that loan, in line with real estate business standards. This guarantees the legal system's uniformity and coherence.

It permits developers, in particular, to transfer incomplete financial responsibilities relating to the project's land to the transferee, who must meet the whole financial obligation that the transferor has not fulfilled. The transferred part of the project has been determined by the competent state authority based on the financial obligations related to the project's land, and the transferee has deposited at the State Treasury or been guaranteed by a bank to ensure the completion of this entire financial obligation. The transfer contract includes these documents.