Representative of domestic manufacturing industry – Posco Yamato Vina: Actions to survive

Posco Yamato Vina already submitted a dossier to Trade Remedies Authority of Vietnam - TRAV requesting the investigation on the application of anti-dumping duty on sheetpile products imported from China.

Request ad investigation and application on sheetpile imported from china

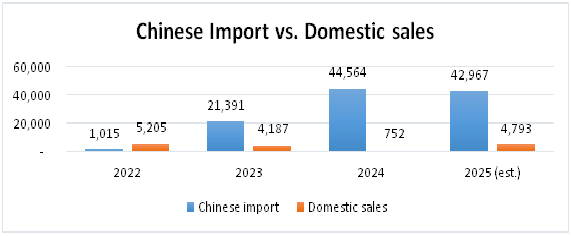

Data shows that domestic sales volume in 2022 is significant as compared to imports from China. However, when domestic demand increases rapidly from 2023, this increase is entirely offset by the amount of dumped imports from China, with more than 21 thousand tons (21 times higher than in 2022). Not stopping there, 2024 recorded a significant increase, even doubling that of 2023 and 44 times that of 2022. Although the import is expected to decrease slightly to more than 42 thousand tons in 2025, it is still at an extremely high level and is dominating the sheetpile steel market in Vietnam.

In contrast, domestic sales have continuously decreased from more than 5 thousand tons to only 700mt in 2024. Although it is expected to show signs of recovery to 4,743 tons in 2025, this quantity is still very limited as compared to the import level from China.

Although the domestic industry has sufficient or even excess capacity, the domestic sheetpile market is still dominated by low price imports, accounting for about 90% of the market in 2025, 3 times its market share in 2022. In other words, the domestic industry is gradually losing market share to imports with dumped price. It is expected that in 2025, the import price of Chinese sheetpiles will be only about USD553.4/mt, while the import price from other countries is USD1,087/mt, almost double. This price difference is extremely high, clearly showing that the price of Chinese sheetpiles does not reflect the actual market situation. Insteads, there are dangers to the financial stability and position of domestic manufacturers. In general, imports from China have quickly dominated the Vietnamese market, directly affecting domestic sales. This shows that the domestic industry has been severely damaged by import price and quantity pressure from Chinese products.

Some other practical actions of the domestic manufacturing industry

Regarding the import situation of H-shaped steel from Japan, the domestic manufacturing industry is still closely monitoring the import situation of H-shaped steel from Japan as well as carefully considering the submission of a request to initiate an investigation to apply anti-dumping duty on this product. If the import volume continues to increase with a price reduction suspected of dumping the market, the domestic manufacturing industry will take drastic actions to protect the domestic market, ensuring a healthy and fair competitive environment for businesses.

Regarding the mid-term review of anti-dumping duty on H-shaped steel products imported from China, after the decision to reduce anti-dumping duty on H-shaped steel products originating from Jinxi factory (Decision No. 3098/QD-BCT dated November 25, 2024), China, the domestic steel market was greatly affected, consumer behavior has changed, leading to a decline in sales revenue of domestic steel manufacturing and trading enterprises. Therefore, the domestic manufacturing industry will continue to fight to prevent the market from being destroyed by cheap imports with unverified quality.

Regarding the final review of anti-dumping tax on H-shaped steel products originating from Malaysia, after the decision to impose anti-dumping duty on H-shaped steel products imported from Malaysia (Decision No. 1975/QD-BCT dated August 18, 2021), up to now, Vietnam has not recorded any import data of H-shaped steel from this country. Therefore, the domestic manufacturing industry decided not to submit a request for a final review. However, the domestic manufacturing industry will keep close eye on this country to promptly prevent future dumping (if any).