Deposit rates may ease to 4.7% by year-end

The average 12-month deposit rates of large commercial banks will have room to decrease slightly by 2 bps, easing to 4.7% by the end of 2025.

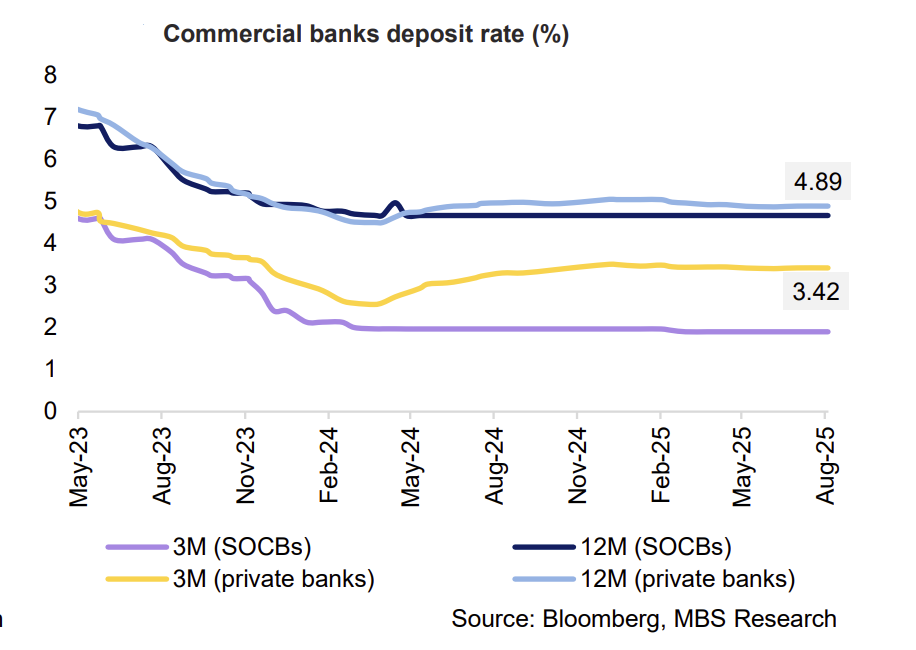

By the end of August, the average 12-month deposit rate at commercial banks remained at 4.89% per year

After the State Bank of Vietnam (SBV) began resuming net liquidity withdrawal in late July, interbank interest rates showed a strong upward surge in early August, with the overnight rate even hitting a 5-week high of 6.4% on August 7. However, subsequently, interbank interest rates maintained a relatively steady decline despite the SBV's continued net liquidity withdrawal. During the month, the SBV injected nearly VND 361 trillion through the open market operation (OMO) channel at a 4% interest rate for tenors ranging from 7 to 91 days. The total matured OMO capital was approximately VND 386.1 trillion. Cumulatively, the SBV conducted a net withdrawal of over VND 25.2 trillion.

Despite this, the overnight interbank rate still hit a 2-month low of 1.6% on August 28, indicating that system liquidity remained abundant. By the end of the month, the overnight rate rose to 3.8% as increased spending demand for the National Day holiday temporarily exerted pressure on system liquidity. Meanwhile, rates for tenors ranging from one week to one month fluctuated between 4.2% and 5.2%. Deposit rates remained stable in August

At many banks, no new adjustments to deposit rates were recorded. Accordingly, by the end of August, the average 12-month deposit rate at commercial banks remained at 4.89% per year (down 16 basis points from the beginning of 2025), while the rate for state-owned banks held steady at 4.7% per year. This occurred despite strong credit growth (as of August 29, credit growth has increased by 11.8% compared to the end of 2024 and by 20.6% yoy).

The stability of deposit rates despite sustained credit growth is attributed to the abundant system liquidity, following a significant net injection of over VND 156.9 trillion in June and July. Hence, this has supported banks in maintaining low interest rates to promote economic growth as directed by the government. According to the SBV, the average lending rate as of August 31 had decreased by 0.56% compared to the end of 2024, reaching 6.38%.

Toward year-end, deposit rates may face pressure from credit growth, particularly following the SBV’s announcement of increased credit growth quotas for banks to meet the economy’s capital needs. However, the SBV also requested credit institutions to implement comprehensive measures to stabilize and strive to reduce deposit interest rates, contributing to stabilizing the money market and creating room to lower lending interest rates.

This, combined with expectations of the Federal Reserve cutting interest rates by an additional 50 bps in Q4/25, bringing the total reduction this year to 75 bps, will help narrow the VND-USD interest rate gap while also creating conditions for the SBV to maintain a low interest rate environment. Based on these factors, MBS anticipates that the average 12-month deposit rates of large commercial banks will have room to decrease slightly by 2 bps, easing to 4.7% per year by the end of 2025.