Resolving the “risk” for the steel industry - Part 3: The need for tariffs and national technical barriers

After Decision No. 3098/QD-BCT regarding the reduction of anti-dumping tax on some H section steel products originating from China (Jinxi) from 22.09% to 13.38%, the difficulties of the Vietnamese H section steel market have become even more alarming.

The volume of imported H section steel from China at cheap prices immediately increased. Some domestic H section steel traders have now even switched to Chinese import to optimize profits from cheap imported goods. As a result, the domestic H section steel manufacturing and trading industry is facing huge risks with high inventories (domestic H section steel products) when domestic demand has been continuously gloomy in recent times. To minimize losses for distributors as well as protect domestic market prices, the representative of the domestic H section steel industry, Posco Yamato Vina Steel Joint Stock Company, has continuously announced price increases despite the context of declining demand. Experts believe that this is an important and necessary step to protect domestic market prices and prevent Chinese exporters (Jinxi) from achieving their goal of destroying the Vietnamese market as well as paralyzing the domestic steel industry.

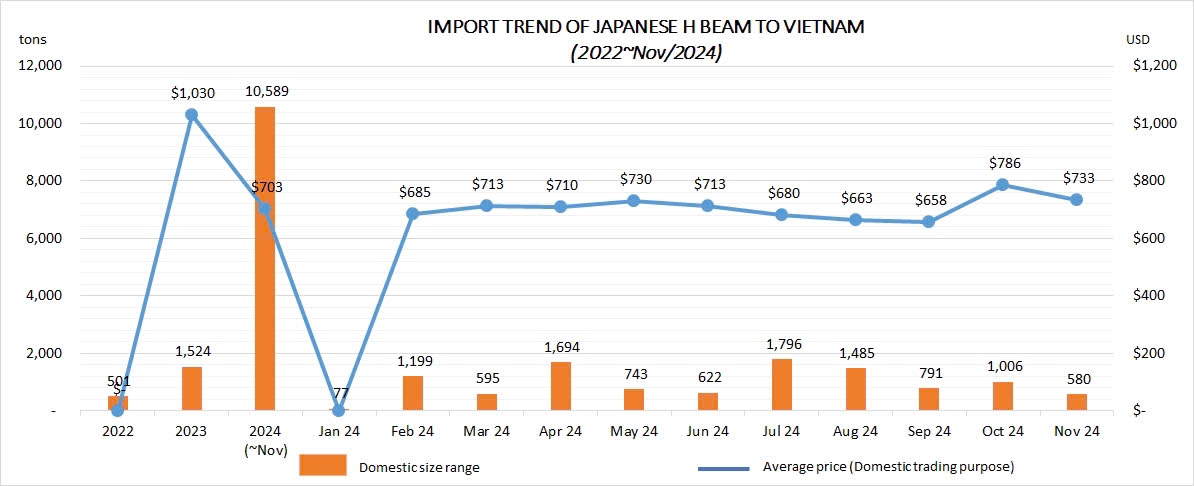

Not only having to deal with cheap imports from China of which the quality could be unclear, since the beginning of 2024, the increasing import trend of H section steel from Japan has been raising many concerns and challenges for the domestic steel market.

Data shows that Japan is increasingly boosting its exports of H section steel to Vietnam every year. In the first 11 months of 2024 alone, Vietnam recorded a sharp increase in imports from this country, up to nearly 12 thousand tons, an increase of 498% over the same period last year. Of which, about 90% are sizes that the domestic manufacturing industry can produce, a great increase of 705% over the same period last year. Import prices from Japan have also decreased significantly every year. Should Vietnam also consider appropriate trade defense measures for H section steel products from Japan?

Responding to the Business Forum Magazine, an expert said that “To ensure the security of strategic material sources and sustainable development, protecting domestic manufacturers is more important than ever when once again, the domestic manufacturing industry is facing high risks threatened by unfair competition from countries such as China and Japan. Only by creating and maintaining a fair competitive environment, the Vietnamese government will contribute to promoting the development of the domestic construction materials manufacturing industry as well as building a solid foundation for the independent and sustainable development of the Vietnamese construction industry. Promoting the lawsuit against the dumping of H section steel from JFE (Japan) is necessary to seek protection from Vietnamese authorities for domestic products.”

Faced with the increasingly urgent issues mentioned above, a representative of PYVina said “PYVina will not only request the State management authority (Trade Remedies Authority of Vietnam, Ministry of Industry and Trade) to review the AD03 case against Chinese H section products (especially from Jinxi manufacturer) but also propose to initiate a new anti-dumping case against Japanese products (from JFE manufacturer) with recently increased import volume”

Thanks to the anti-dumping measures of the Ministry of Industry and Trade, the domestic H section steel industry has contributed significantly to the supply of high-quality steel for key national projects. If we depend too much on imports, the disruptions in the international supply chain or low quality steel can affect the progress, construction costs of domestic projects as well as cause further potential risks

“Posco Yamato Vina Steel Joint Stock Company will request the investigating agency to carefully consider the information and data provided by PYVina soon, taking into account the complexity in the production and sales structure of importers (Jinxi. JFE etc) for reasonable calculations, reflecting the true nature of the production and export of investigated goods to Vietnam, and at the same time, consider the role of the domestic manufacturing industry in timely meeting the supply of high-quality products in the domestic market, especially for key national projects, ensuring energy security, sustainable development and the interests of the manufacturing industry and Vietnamese consumers”

In short, we can see that maintaining equality and healthy development of the steel market shall open up opportunities for domestic hot-rolled section steel manufacturers to boldly invest in developing other products, avoiding the dependence on foreign imports.