Resolving the “risk” for the steel industry - Part 1: The “invasion” of cheap imported goods

In the context of domestic steel demand remaining low, the continuous influx of imported goods has caused many difficulties for the domestic steel production and business.

According to the report of the Vietnam Steel Association (VSA), the total production capacity of domestic steel enterprises currently reaches about 23 million tons of crude steel (square billets, flat billets). The production capacity of finished steel products, including construction steel, hot-rolled steel coils, cold-rolled steel, galvanized steel, and steel pipes, reaches about 38.6 million tons/year. With the current recovery momentum, it is forecasted that finished steel production this year could reach 30 million tons, an increase of 7% compared to 2023. However, this recovery is uncertain, and steel enterprises still face many risks, including the "invasion" of cheap imports from China and some other countries in recent times.

Facing potential risks such as disruption of market order and safety for users, the Vietnamese government has imposed anti-dumping taxes on low-priced imported H-shaped steel products from China to protect the market and prevent unfair price competition; however, the flow of low-priced H-shaped steel products from China continues to increase.

In fact, from more than 37,000 tons in 2022 to more than 55,000 tons in 2023, only in the first 9 months of 2024 alone, the import level of this type of steel reached 72,000 tons. The flow of cheap imported goods from China not only disrupts the market order in Vietnam but also negatively affects the production and business activities of domestic steel enterprises. And the sales output of H-shaped steel (domestic production) of Posco Yamato Vina Steel Joint Stock Company (PYVina) is considered a typical example when it continuously decreased to 208,000 tons in 2022, 195,000 tons in 2023, and 39,000 tons in the first quarter of 2024.

It is worth noting that this decline has not shown any signs of stopping, as statistics from this enterprise show that the business situation in Q3/2024 has decreased by 19% compared to Q2/2024 and Q4 is expected to be even more difficult if the demand for H-shaped steel does not improve, as well as imported goods continue to flood in.

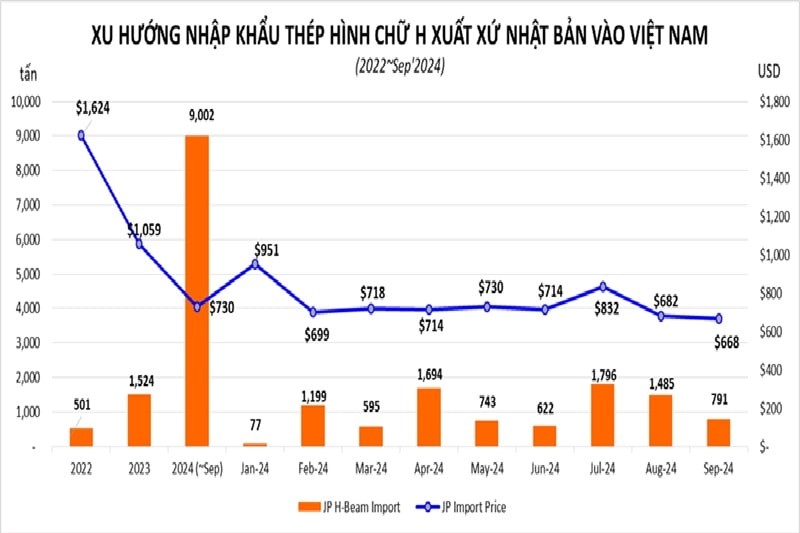

Not only having to deal with cheap imports with unverified quality from China, since the beginning of 2024, the increasing import trend of H-shaped steel from Japan has been raising many concerns and challenges for the domestic steel market. Data shows that Japan is increasingly promoting the export of H-shaped steel to Vietnam every year. Only in the first 9 months of 2024, Vietnam recorded a strong increase in imports from this country, up to more than 10,000 tons, an increase of 811% over the same period last year. Of which, more than 90% are sizes that the domestic manufacturing industry can meet, a skyrocketing increase of 1,184% over the same period last year. Import prices from Japan have also decreased significantly over the years.

In addition to China and Japan, H-shaped steel output from Korea also increased sharply, reaching nearly 13,000 tons in the first 9 months of 2024, an increase of 267% over the same period in 2022. Particularly for the sizes that the domestic production industry can meet, the number is also alarming with a total volume of more than 11,000 tons, an increase of 390% over the same period in 2022. In particular, H-shaped steel from Korea is switched to Boron-added alloy steel to avoid the 10% tax rate.

| Recently, on November 20, 2024, the representative of the domestic steel industry (PYVina) sent an Official Letter to the Vietnam Steel Association, presenting such challening situation of the domestic industry as well as the heavy losses that the industry is suffering. Currently, this difficult situation is even more alarming after Decision No. 3098/QD-BCT dated November 25, 2024 of the Department of Trade Defense - Ministry of Industry and Trade, when the anti-dumping tax on H-shaped steel originating from China (Jinxi group of companies) was sharply reduced from 22.09% to 13.38%, after finalise the second review requested by the Jinxi group of companies. Therefore, the manufacturing industry as well as domestic steel enterprises are in dire need of appropriate and timely support measures to protect the healthy competitive environment, so that they continue to be given fair conditions to maintain the existence of the domestic H-shaped steel industry, as well as have the motivation to continue developing one of the important and key industries in key state projects, towards the strong and longevity of the nation. |