Interest rate outlook and banking variables in 2026

With capital costs rising due to higher interest rates, pressure on Net Interest Margins (NIM) could make NIM the most unpredictable variable for the banking industry in 2026.

Interest rate pressure turns NIM into a variable. (Illustration: ITN)

In recent days, interest rates have become a primary topic of concern for businesses and investors. As interbank rates remain persistently high, a significant capital gap has emerged. Despite positive growth in deposits flowing into the banking system, credit growth has outpaced it, making liquidity pressure on banks very apparent.

Signals of an Upward Adjustment in Deposit Rates?

Despite significant capital support through the State Bank of Vietnam’s (SBV) market regulation operations, the trend of adjusting deposit rates has begun to spread to state-owned banks.

According to SBV data, credit growth reached 16.56% as of November 27 (a multi-year high). Many banks have nearly reached their credit growth limits, with only a few retaining room for expansion. Based on these developments, Vietcap Securities does not expect the SBV to grant additional credit quotas at this stage.

Conversely, regarding system liquidity, pressure has been recorded increasing since early October 2025, reflected in overnight interbank rates rising from an average of approximately 4% to 6-7%. According to Vietcap, this stems from three main factors: (1) seasonal factors as credit demand typically surges toward year-end, (2) the large gap between credit growth and deposit growth, and (3) persistent exchange rate pressure.

The SBV has flexibly used the Open Market Operations (OMO) channel to support system liquidity and recently deployed 14-day foreign currency swaps (FX swaps) as a supplementary tool to reduce short-term pressure.

"In early December, the SBV raised the OMO lending rate from 4.0% to 4.5%, which we assess as a timely and appropriate move to regulate liquidity. In 2024, we witnessed a similar development when the SBV raised the OMO rate from 4.0% at the start of the year to 4.5% in May amid rising liquidity/exchange rate pressures, then reduced it back to 4.0% toward the end of the year as pressures cooled. This shows the SBV is willing to flexibly support short-term liquidity rather than tightening general interest rate levels. In our view, the SBV's recent OMO rate hike has signaled that commercial banks may adjust deposit rates upward," Vietcap noted.

Are Interest Rate Levels Still Supportive?

The recent round of interest rate hikes has been primarily led by private banks, especially small banks focusing on retail customers.

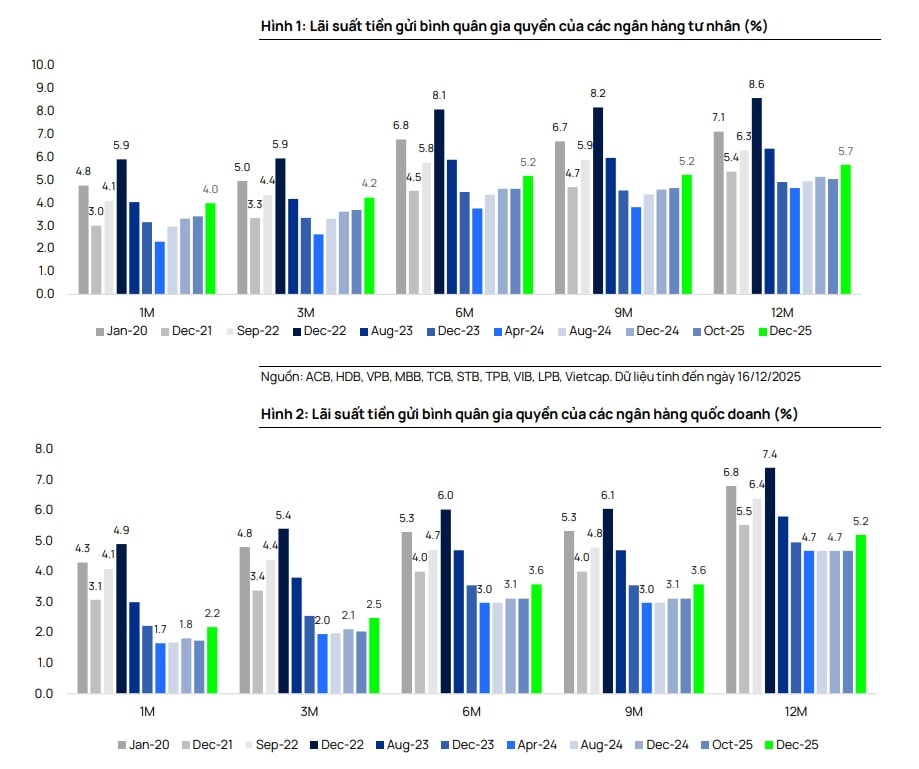

Weighted by deposit size, private banks have increased deposit rates by approximately 50-64 basis points across various terms over the past three months. Regarding the range of offered rates, private banks have raised listed rates by approximately 20-140 basis points across different terms since the beginning of the year (noting that deposit rates decreased slightly during March-May following government directives). Small private banks (such as KLB, GPBank, PVComBank, BVB, SGB, etc.) have recently offered deposit rates—including promotional programs—to selected customer groups at around 7.5%-8.1% for 6-12 month terms.

BID, CTG, VCB, Agribank, Vietcap. Data as of December 16, 2025.

State-owned commercial banks (SOCBs) have also officially adjusted their listed deposit rates upward by as much as 50 basis points across most terms, after remaining stable since mid-2023. Agribank adjusted its rate to 2.4%/year (a 0.3 percentage point increase), while Vietcombank, VietinBank, and BIDV all rose to 2.1%/year, with a sharper adjustment margin of 0.5 percentage points.

The rapid rise in very short-term interest rates indicates an immediate need for liquidity replenishment as banks face year-end payments and fierce competition to attract short-term deposits.

"From our perspective, this move is not surprising given that private banks increased rates previously and the SBV raised the OMO rate by 50 basis points. More importantly, with this adjustment, the listed 12-month deposit rates at VCB, BID, and CTG rose from 4.6-4.7% to 5.2%, which is still 30-40 basis points lower than the COVID-era trough of 2020-2021 and about 160 basis points lower than pre-COVID levels. This suggests that such absolute interest rate levels remain supportive of the economy," Vietcap experts commented.

To address capital needs, banks are forced to increasingly diversify their funding sources. In addition to deposits and SBV liquidity support, banks are diversifying their capital structure by: (1) issuing valuable papers (bank bonds, certificates of deposit), (2) mobilizing foreign capital (e.g., MBB recently raised a $500 million green syndicated loan, which was oversubscribed by international banks), and (3) private placements of shares (capital increase plans are being restarted).

"We maintain our view that current pressure to increase deposit rates remains under control and absolute interest rate levels are generally still supportive. We expect the SBV to maintain an accommodative monetary policy stance to support the Government's 10% GDP growth target for 2026. Short-term liquidity is being actively supported by the SBV, and according to historical trends, liquidity stress typically begins to ease in March after the Lunar New Year holiday," analysts expected.

In the medium term, system liquidity and funding sources are optimistically viewed as continuing to be supported by Fed rate cuts, accelerated public investment disbursement, further diversification of funding channels by banks, and the return of the household business/trading sector to depositing money into the banking system as they adapt to new tax and electronic invoice regulations.

However, Vietcap believes that pressure on NIM will persist in the short term (Q4/2025 and Q1/2026) as rising capital costs due to higher interbank/deposit rates continue to squeeze margins. NIM is forecasted to bottom out in 2025 and may stabilize or slightly increase in 2026. This improvement is supported by: steady credit demand amid more constrained supply, which makes the lending rate environment less competitive (e.g., many banks have stopped preferential interest rate loan programs in recent weeks); stronger retail lending growth; increased disbursement of medium-to-long-term loans (such as mortgages and infrastructure projects); and improved asset quality.

Nonetheless, Vietcap admits that NIM remains the industry's largest unpredictable variable in 2026, and downside risks persist if liquidity tension lasts longer than expected.

It is worth noting that market observations show that access to medium and long-term loans, such as mortgages, is slowing down as banks begin adjusting lending rates. Investors also hope this is merely a short-term adjustment as credit quotas near their limits—rather than a new baseline for lending rates. In 2026, many real estate experts comment that the market will face difficulties and the economy's momentum will slow if credit is truly "tightened" with lending rates maintained at the high levels adjusted at year-end. "When household disposable income has not improved or grown in tandem with the sudden interest rate hike, ensuring the ability to repay high-cost loans will cause real estate borrowing activities to stall," one expert emphasized.