SBV needs to grant additional credit quotas to banks sooner

If the State Bank of Vietnam (SBV) waits until the fourth quarter of 2022 to provide additional credit quotas to banks, it will be too late in comparison to the current capital requirement of the economy. The SBV should think about issuing additional credit quotas to banks sooner rather than later.

Credit growth was 9.42% in the year's first seven months.

>> Vietnam parliament calls for removing credit quota policy

In order to maintain the current recovery momentum, the economy in general and businesses in particular urgently require more bank loans.

Inflation is not a big concern

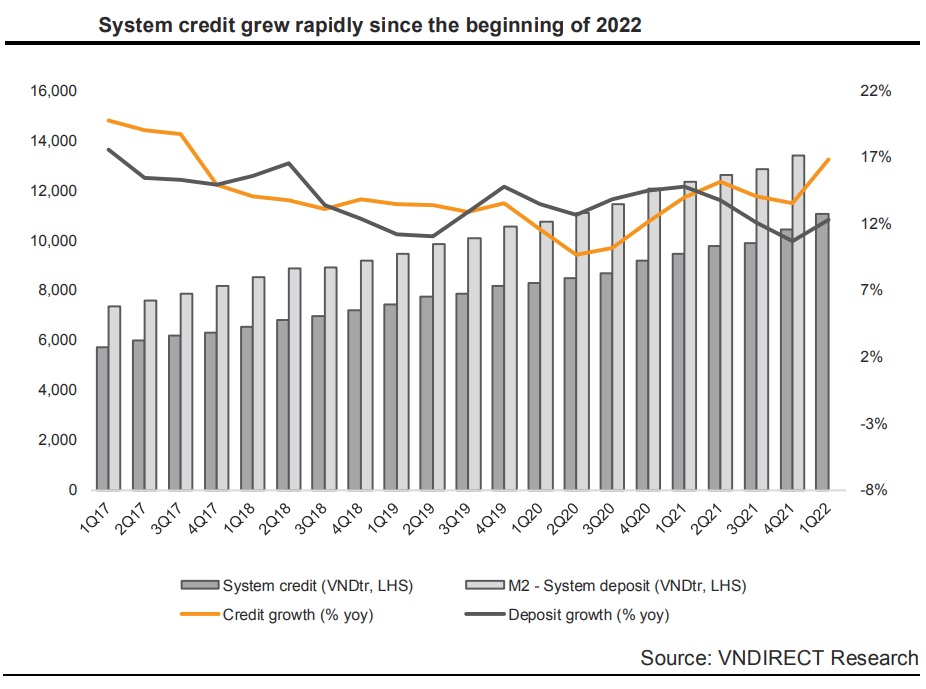

Credit growth was 9.42% in the year's first seven months. The Vietnamese economy's loan outstanding could rise by approximately 4.6% in the final five months of this year, or around VND 478,000 billion, with a growth target of 14% in 2022. However, the SBV continues to be concerned about two issues: inflation and banking system liquidity.

Despite a 9.42% credit growth, bank deposit mobilization only rose by over 5%, supporting the SBV's earlier worry. Vietnam's inflation pressure, however, is primarily caused by a cost push, while demand pull is not as significant as in past years. For example, the money supply in Vietnam continues to be moderately restricted.

>> Credit should be controlled by market mechanism

For example, whereas the core inflation caused by monetary variables only grew by 1.44% by the end of the first seven months of this year, the money supply had expanded by 3.6-3.7%. The said core inflation is predicted to be only between 2.5% and 2.5% for the entire year, which is a manageable level.

Diversify sources of capital

In the aforementioned situation, the SBV can estimate and forecast the money supply from the remaining sources, including foreign direct investment (FDI) and public investment, while also evaluating the actual situation to consider granting additional credit quotas to banks earlier in order to support the recovery of the economy and businesses. As it will probably take longer than the existing borrowing requirements of the Vietnamese economy, this needs to be completed sooner rather than later in the fourth quarter.

>> Credit quota must be eliminated as soon as possible

The mobilization of bank deposits is now growing much more slowly than credit growth. Commercial banks will take note of this problem and speed up deposit mobilization in the remaining months of this year so that additional loans can be added when the remaining credit quotas are released.

Commercial banks must make a careful choice and calculate the increased credit quotas in order to offer loans in the environment of limit ed capital.

In light of the fact that financial support is constrained, it is also essential to diversify additional funding sources for businesses, such as bond issuance, stock market fundraising, luring overseas investment, etc.