Seek for appropriate investment direction amid market fluctuations

Many indicators show that financial investment activities might suffer from many variables in the second half of 2024. However, due to the current economy vitality, investors should pay attention to consider and choose appropriate investment channels, closely monitor and evaluate new developments.

|

|

Investors in the financial market need to review their investment portfolios carefully. Photo: ST |

Cash flow still goes into the bank

In the domestic market, from the beginning of May 2024 until now, more than 20 joint stock commercial banks have increased deposit interest rates, some banks even increased interest rates 4 times. Currently, many banks list deposit interest rates of over 5%/year for terms of 12-36 months. Along with that, banks also sell deposit documents with interest rates up to 8%/year.

According to experts, bank interest rates have been raised along with the warmth of the gold market and hot exchange rates, so it is necessary to increase the attractiveness of the deposit investment channel. But in reality, savings investment channels at banks are still safe and attractive, especially in the context that other investment channels are still unstable. The financial report for the first quarter of 2024 shows that customer deposits at 18 banks on the stock exchange still grew positively, although some banks still recorded a decrease in deposit balances.

However, the increase in deposit interest rates raises concerns about the possibility of changing monetary policy and affecting the economy, but economist Dr. Le Xuan Nghia commented that the growth rate of deposit interest rates is still at a moderate level, while keeping interest rates low and stable to recover the economy is still an important issue.

Previously, at the end of May, the State Bank continued to require banks to maintain a stable and reasonable deposit interest rate, strive to reduce lending interest rates by 1-2%/year, especially for traditional growth incentives, emerging industries, green transformation, circular economy, social housing... to support businesses and people to develop production and business, increase access to credit capital.

Discussing more about the interest rate situation, experts from Rong Viet Securities Company (VDSC) commented that the State Bank still has room to anchor interest rates within a reasonable range through open market operations (OMO) such as issuing bills, pledging valuable papers and selling USD for immediate delivery with the purpose of maintaining a reasonable amount of liquidity instead of the surplus as before, while narrowing the difference between USD and VND interest rates to cool down the pressure of USD net withdrawal before the US Federal Reserve (FED) cuts interest rates for the first time.

Similarly, according to experts from VNDirect Securities Company, the State Bank still carries out flexible pumping through the OMO channel, showing that the State Bank is trying to balance the goal of stabilizing the exchange rate and keeping interest rates from increasing sharply to support economic recovery aid. Therefore, VNDirect expects the average 12-month deposit interest rate to increase by about 50 basis points by the end of the year compared to the current level.

|

|

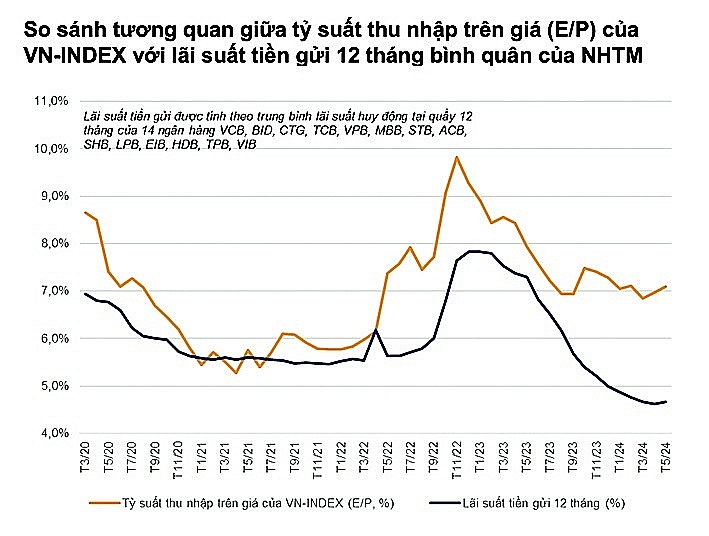

The high difference between E/P of VN-Index and deposit interest rates shows that the stock investment channel is still very attractive. Source: VNDirect |

Review investment portfolio and be careful with gold

Speaking at the regular Government meeting on June 1, Minister of Planning and Investment Nguyen Chi Dung stated clearly that inflation is a major concern that needs special attention and close monitoring to give out solutions to manage prices closely, carefully, promptly and effectively. The report on price management by the Ministry of Finance also mentioned many factors that put pressure on the price level, including inflation expectations when implementing wage reform and increasing regional minimum wages. Moreover, rising exchange rate between VND and USD prices also pushes the cost of importing raw materials up, putting pressure on domestic commodity prices, risks of natural disasters and adverse weather...

However, according to the Ministry of Finance, many factors may lift pressure on the price level such as global inflation that may cool down in 2024, helping Vietnam remove pressure from the "inflation import" channel; Some tax support policies in 2024 will continue to be applied similar to 2023 such as reducing environmental protection tax on gasoline and oil, reducing value added tax... Along with that is the policy of macroeconomic stabilization, inflation control by the Government helps strengthen the confidence of businesses and people in a stable macroeconomic environment, thereby stabilizing inflation expectations

Dr. Truong Van Phuoc, former acting chairman of the National Financial Supervisory Commission, warned that people need to thoroughly consider because of just one move by the Central Bank of China to stop buying gold reserves, as well as many economic variables in the US and Europe, the price of gold per night may drop from 80 to 100 USD. Meanwhile, the State Bank has sent a message saying that it has enough resources and determination to stabilize the gold market, so there is a phenomenon of hiring people to line up to buy gold with the goal of pushing up the price, enjoying the difference, and causing market instability.

In addition, according to Mr. Nguyen Minh Tuan, CEO of AFA Capital, co-founder of the Vietnam Financial Advisors Community (VWA), from the beginning of 2023 until now, gold and stocks are the two assets with the best performance. In particular, gold plays a defensive role, while stocks play an offensive role. However, investors should make adjustments based on the prospects of asset classes in the second half of 2024. Mr. Tuan recommended that investors should increase the proportion of deposits because savings interest rates have passed the bottom and are likely to reveal signs of a slight increase, while the risk of the bond market is still due to maturity pressure, but banks' bond groups can be considered. Given gold, this expert believes that we must be careful due to current and upcoming fluctuations

In addition, economic expert Dr. Le Xuan Nghia said that investors in the financial market need to review their investment portfolios amid the recovery of the economy, the bounce back of the stock market and real estate market, and the downtrend of gold market price. Furthermore, despite current pressure, inflation in Vietnam is quite low, the currency is quite stable and investment opportunities in some asset markets are also recovering quite strongly, such as the stock market, real estate, especially when the Housing Law, Real Estate Business Law, and Land Law have been approved to take effect 5 months earlier, expected from August 2024.