Smart supply chains: The role of IoT

In the aftermath of the pandemic, Internet of Things (IoT) technologies would assist businesses in building more resilient, efficient, and transparent supply chains...

The world’s leading logistics providers are implementing next-generation IoT technology

From disruption to digitisation

The COVID-19 pandemic has highlighted just how interconnected global supply chains are. As HSBC has written extensively, disruption in one part of the value chain can very quickly upend production and trade. For instance, over the past 20 months, exporters and importers have grappled with shortages of key inputs such as semiconductors and plastic materials, low inventories, port congestion, issues around the availability of truck drivers, surging freight rates, and difficulties in securing containers to ship their goods.

Ongoing logistics issues, coupled with strong demand for certain components (e.g., semiconductors), have significantly affected just-in-time manufacturing. As we set out previously, just-in-time (or JIT) production – whereby producers hold only the number of parts they need to minimise costs and improve efficiency – has transformed how supply chains operate over the last 60 years. Today, JIT production is used in a number of industries, including autos and electronics. But such lean production processes rely on the seamless movement of inputs between suppliers and buyers around the world, something that has been disrupted by the spread of COVID-19.

As parts of the world start to emerge from the pandemic, many businesses and economies are looking for ways to make their supply chains more resilient in order to better mitigate the next trade shock. One way in which businesses could do this is by embracing digital technologies such as IoT.

IoT refers to the use of internet enabled devices that communicate with each other via private or public networks. It can help manufacturers know, for example, when more components are needed, when an assembly line is about to go down, and the condition of their cargo at any given time by collecting, analysing, and transmitting data in real-time about the status of production and logistics.

"We look at how IoT can be applied through the supply chain to help businesses build more resilient, efficient, and transparent value chains going forward. Our equity analysts also detail how IoT can be used in key sectors now and in the future to improve operations. For a summary of sectoral supply chain applications of IoT tech", HSBC said.

How does IoT work?

IoT devices essentially function as mini computers that are connected to the internet. IoT devices typically have sensors that monitor a range of environmental factors, ranging from temperature, status of components, use of water and more. The data collected by these sensors is transmitted through the internet to the cloud to be processed and analysed, with instructions based on the analysis being returned to the devices.

There are five key components in the IoT ecosystem: (1) Hardware (e.g., IoT devices); (2) Networks that connect the IoT solution to the user (e.g., WiFi, cellular); (3) Remotes that provide the user with an interface to connect to the IoT solution (e.g., smartphones, tablets, smart watches); (4) Platforms that provide analytics (e.g., Amazon, Microsoft, and Google offer managed IoT platform options); and (5) Security protocols that ensure the IoT solution is secure.

Where are we with the IoT?

We place IoT between the real application and the new normal stages of HSBC’s disruption framework, based on the sector applications today and the development of supportive connectivity networks going forward.

HSBC highlights how the aviation sector has been deploying IoT in the form of so called "loggers" to track vaccine temperature during transportation. Thus, it can be said that the rollout of this type of IoT supply-chain solution has been accelerated by the pandemic, and is in the early part of the "new normal" phase of its connectivity disruptive framework.

On the other hand, HSBC also highlights the chemicals sector, which is in the process of digitising the onsite communication at large chemical plants for automated guided vehicles and intelligent inspection robots facilitated through IoT. The current bottleneck is signal weakness between plants. But as 5G connectivity technology is deployed, IoT for this sector will move from the "real application" to the "new normal" stage.

According to a recent survey by Microsoft, IoT adoption remains strong across industries, with over 91% of manufacturing businesses and 85% of energy companies having adopted IoT. Around 90% of businesses surveyed regard IoT technology as critical to their overall success. The key drivers for IoT within industry are to maintain quality, secure technology, optimise operations, enhance employee productivity, and improve workplace safety. Managing supply chains, optimising energy use, and improving sustainability are also notable reasons for businesses to use IoT.

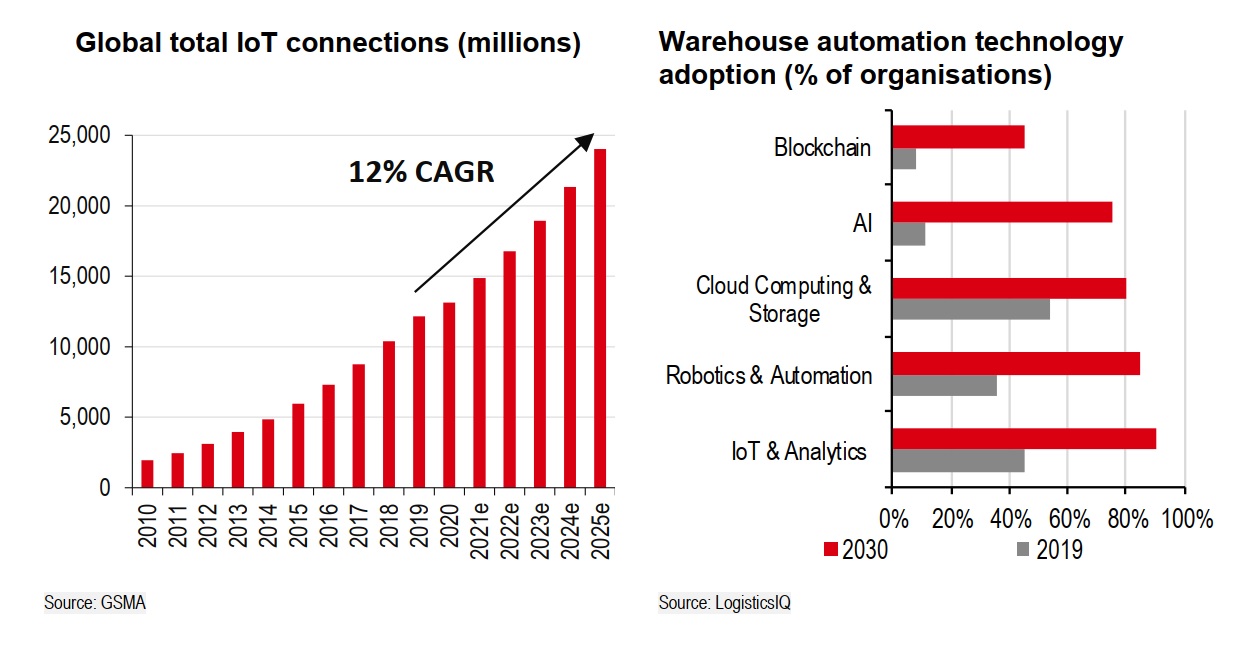

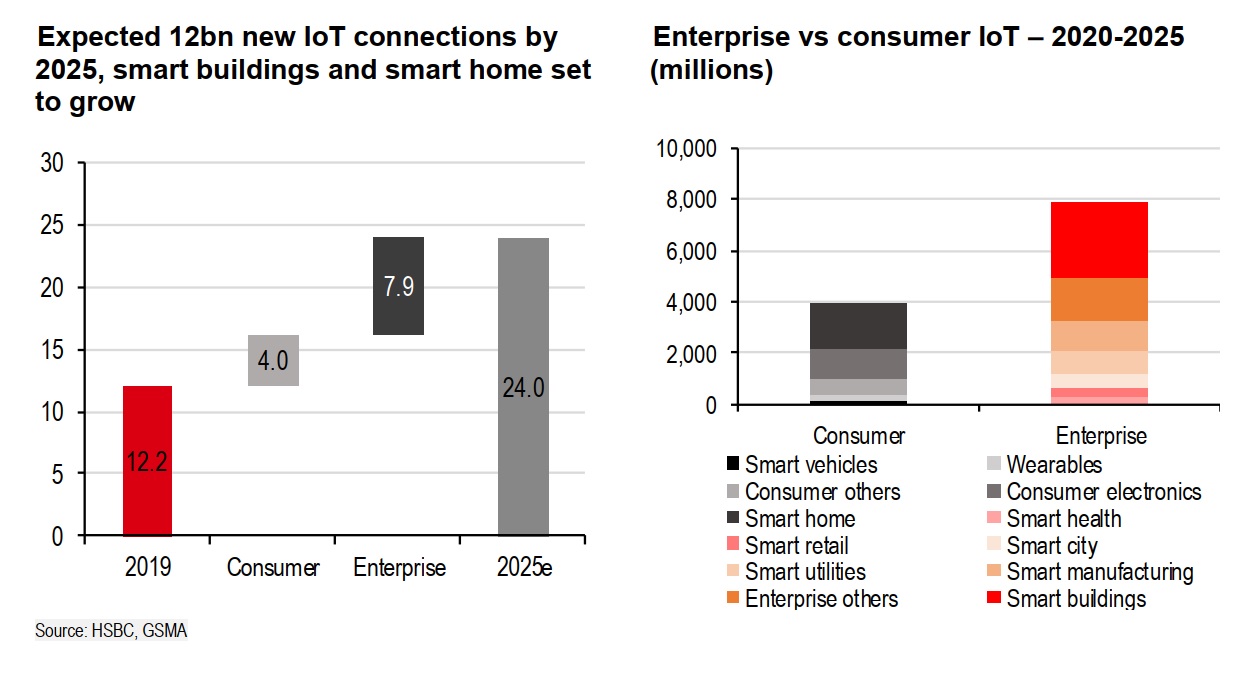

According to the GSMA, the number of IoT devices globally is forecast to grow at a CAGR of 12% between 2019 and 2025. Although the number of IoT connections is expected to double over this period (reaching 24 billion connections in 2025), the GSMA recently revised down their pre-pandemic forecast for 2025 by 2% due to COVID-19. Nevertheless, they say that enterprise IoT is set to recover faster than consumer IoT, which bodes well for the development of smart supply chains going forward.

Considering that 91% of manufacturing companies are users of IoT devices, one would assume warehouses have similar levels of automation. However, it is estimated that only 5% of warehouses were automated in 2016, with only 15% mechanised and 80% manually operated. But this is expected to change as robotic technology develops and becomes highly complex with its logistics capabilities, such as picking and packing.

According to the GSMA, enterprises rather than consumers are set to be the largest users of IoT technologies by 2025. The enterprise for smart buildings (e.g., lighting, HVAC systems, security, and automation) accounts for the lion's share of growth, with 2.9 billion more IoT devices, followed by smarter enterprises (1.8 billion) – including fleet management, asset tracking, agriculture, oil & gas, mining, and transportation. Smart manufacturing (1.2 billion – inventory tracking, monitoring, and diagnostics, warehouse management)On the consumer end, IoT is likely to be driven by the smart home (1.9bn), for example, home network infrastructure and home-security devices.

HSBC believes that increasing IoT uptake within the industrial sector, along with steps to embrace automation and improve connectivity, could fuel data centre growth going forward. Moreover, according to McKinsey, the majority of IoT-related investments will be directed towards improving operational efficiency and asset utilisation of plants, which are expected to generate 70-75% of total future value for connected factory set-ups.