Tailwinds for textiles and garment export

Vietnam's apparel and textile industry may benefit from China's reopenings and the EVFTA.

The price of input materials, such as cotton yarn and polyester yarn, could fall by 1% to 3% year over year in 2023F as a result of poor demand and the slowdown in the price of oil and cotton.

>> Textile-garment targets up to 48 billion USD in 2023 export turnover

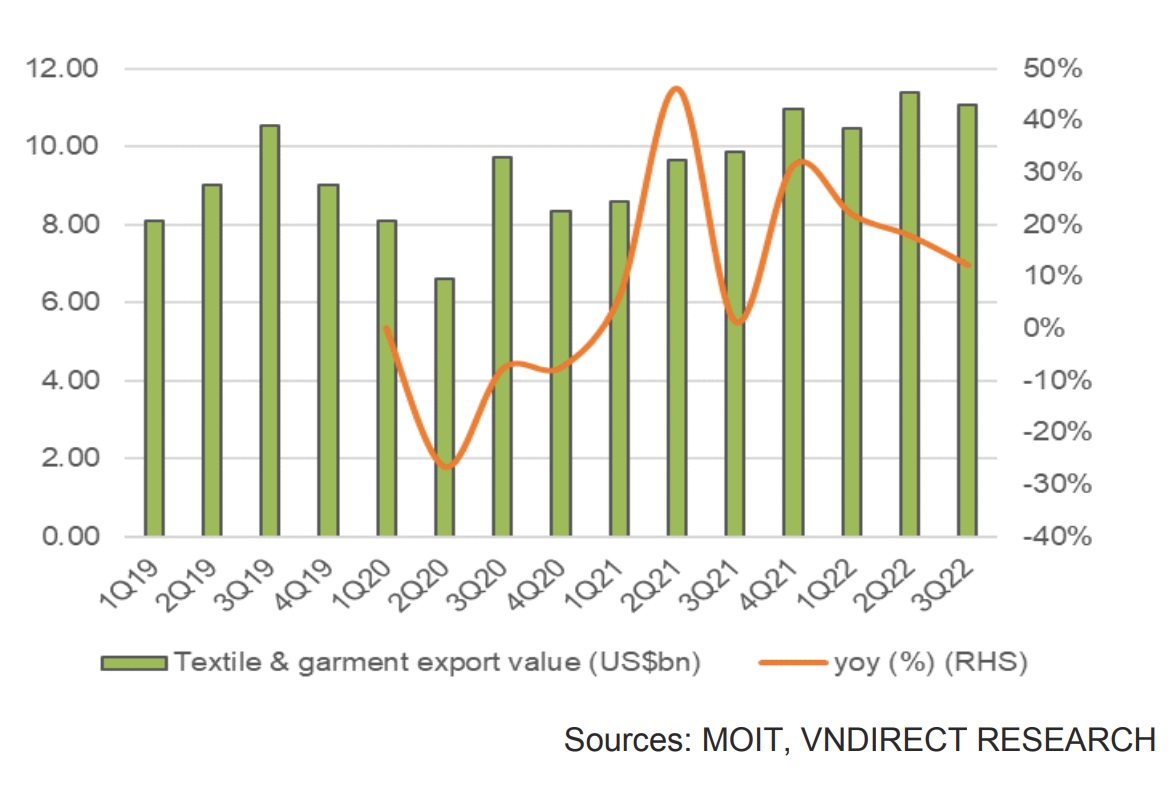

Thanks to a low starting point in 3Q21, the textile and apparel export turnover continued to increase in 3Q22. The value of textile and apparel exports rose 19.9% year over year to $8.8 billion in 3Q22. However, due to sluggish demand in the US and EU, the value of textiles and apparel exports fell by 28.2% mom in September 22. due to sluggish demand in a key market, the value of fiber and yarn exports fell by 32.3% year over year in the third quarter of 22 (caused by ongoing high inflationary expectation and, and potential economic recession in U.S., E.U). In all, the export value of textiles and apparel rose by 21.6% year over year in 9M22 to US$35.3 billion, exceeding 80% of the government's forecast for 2022.

Due to the low base in 3Q21, the combined sales of publicly traded textile and apparel companies climbed by 23.3% yoy for the third quarter of 2018. However, despite the high inflation and recession risk in the major export markets, 3Q22 net profit actually declined 32.2% qoq.

Due mostly to lower input material prices, the gross margin of textile and apparel businesses increased 0.3% points. In addition, the cost of doing business for textile and apparel industries increased by 126.9% year over year as a result of currency loss from importing raw materials and debt in USD.

The sector's overall sales and net profit increased by 23.6% and 41% yoy, respectively, in 9M22. Notably, a small number of textile and apparel industries reported a sizable FX loss as a result of the weak EUR. Strongest 9M22 earnings increase was reported by the following top companies: VGG (255.3% yoy), HTG (130.3% yoy), and TCM (86.4% yoy).

Vietnamese textile and apparel exports expanded robustly in 9M22 (17.3% yoy), but they began to decline in 3Q22 (-2.9% qoq). Analyst at VNDirect Mr. Nguyen Duc Hao predicts that through 2023, the discretionary demand of Vietnam's key exporting markets, including the U.S., EU, and even China, will decline even further. Due to heavy inventories at major U.S. stores like Adidas, Nike, and others, Vietnam exporters have seen a decline in orders since July 2022, according to market research conducted by VNDirect. According to the most recent quarterly report, lackluster domestic consumption led to significant increases in inventory for Adidas and Nike of 44% and 35% yoy, respectively.

>> Garment- textile sector hits export target

Overall, Mr. Nguyen Duc Hao predicts that the price of input materials, such as cotton yarn and polyester yarn, will fall by 1% to 3% year over year in 2023F as a result of poor demand and the slowdown in the price of oil and cotton. Though he believes that in the face of the impending challenge and high inflation, textile and apparel companies would switch to producing lower-value goods. As a result, in FY23F, the gross margin of textile and apparel companies will decrease by 0.8% to 1.0% points year over year.

“In 2023F, we anticipate China will quickly reopen its economy. Given that China accounts for 48% of Vietnam's total export value and is the country's top yarn importer, the yarn sector will consequently tend to recover. We think that yarn producers like Dam San JSC (ADS) will benefit from the significant share of exports to China”, said Mr. Nguyen Duc Hao.

Additionally, Mr. Nguyen Duc Hao anticipates that the outlook for textile and apparel exports to the EU will improve in 3Q23F as a result of the EVFTA, which will lower the import duty on textile and apparel items in the EU market in 2023F. According to EVFTA, the export tax on clothing categories B3, B5, and B7 will be reduced by 2% to 4% in 2023F. According to predictions made by the European Commission, inflation in the Eurozone would peak at 8.3% in 2022 before declining to 4.3% in 2023F. As a result, businesses like MSH, M10, VGG, and TNG that export suits, shirts, pants, and skirts to Europe will profit from the EVFTA.