Tailwinds for Vietnam’s thermal power

Due due to the weakening of hydropower in 2023, thermal power will see significant production mobilization.

VNDirect forecasts coal-fired power capacity to account for 34% of total weight in 2023

>> Coal shortages puts thermal power plants at risk

In terms of power capacity, VNDirect forecasts coal-fired power capacity to account for 34% of total weight in 2023F, due to an extra 2,632MW on board, followed by hydropower, which will account for 29% of total capacity with an additional 1,636MW on board. The capacity of other power sources will stay constant.

VNDirect forecasts a severe reduction in hydropower output owing to unfavorable weather conditions, followed by a slight return in 2024F. Coal-fired power continues to be underutilized, owing mostly to decreased mobilization among imported coal-fired power units. Because of decreased hydropower output and cheaper input prices, gas-fired electricity will see a 12% increase in total weight mobilization. The added capacity of roughly 2,000MW from transitional projects will boost RE electricity generation.

Higher mobilization for gas-fired power

Because of the plant's high efficiency, some gas-fired power plants recorded positive output mobilization in 2M23, including Nhon Trach 2 and Ca Mau 2, but overall, total gas-fired power output suffered a modest reduction due to weaker power demand, particularly among industrial zones in the South.

Notably, gas prices fell significantly, following the Singapore FO downtrend. Its price fell from a peak of at least US$700/tonne in 2022 to below US$400/tonne in March. As a result, while the price remains considerably above the 5-year average, we see this as a sign of confidence, boosting the competitiveness of the energy source.

“Given EVN's severe financial distress, we find some of the risk threatening lower output generation of gas-fired power plants in 2023F. Because the outcome of gas-fired power is heavily reliant on electricity consumption in the South, we anticipate that power demand will be hampered by the region's weak construction and industrial activities. However, we see gas-fired power having its own advantages as hydropower declines in 2023F”, said Mr. Nguyen Duc Tung, analyst at VNDirect.

Furthermore, due to the anchored high coal price, the price difference between gas-fired and coal-fired power has gradually shrunk. VNDirect expects the Brent oil price to fall to US$85-80/barrel in 2023-24F, supporting reduced gas prices. As a result, it expects gas-fired power ASP becoming more competitive and significantly less expensive than new imported coal-fired power plants. It believes that gas-fired electricity will continue to play an important role as a dependable background source, ensuring system safety, and will profit from the continued high CGM price. As a result, VNDirect expects gas-fired power production to climb 15% year on year and 9% year on year throughout the 2023-24F period. As a result, POW and NT2 will benefit from this tendency.

>> What is the outlook for coal-fired power?

Impitus for domestic coal-fired power

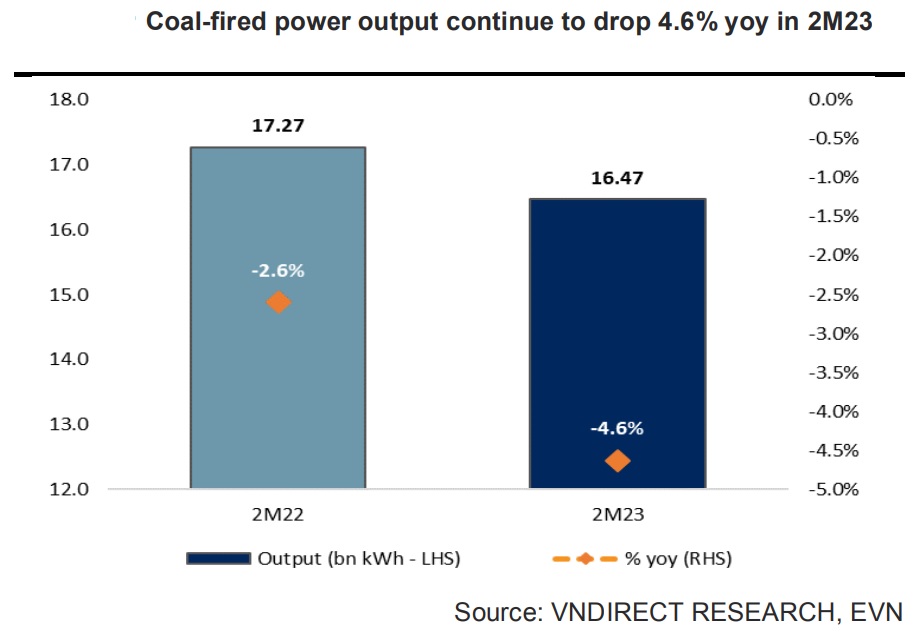

In 2M23, coal-fired power output fell 4.6% year on year to 16.47 billion kWh, extending the abysmal mobilization condition that began in 2022. The fundamental cause remained the increase in imported coal costs, especially considering that Vietnam's energy consumption climbed slowly beginning in 2H22, while hydropower - the cheapest power source - was having favorable weather.

Newcastle coal futures - the benchmark for Asia's top consuming region - surged to nearly US$450/tonne in 4Q22, lingered through the first month of 2023F, before falling to a 14-month low of US$173/tonne since mid-March due to China's permission for its three largest utility companies and steelmakers to continue importing coal from Australia, the first such action since Beijing imposed an unofficial ban on coal imports from this country by the end of 2020.

At the same time, milder weather than typical allows the United States and Europe to lessen heating pressure in the winter, alleviating some concerns about fuel shortages. However, Mr. Nguyen Duc Tung stated that the recent price would be far above its normal level before 2020, and that Vietnam coal-fired power plants may still face significant price competition.

Mr. Nguyen Duc Tung forecasts overall coal-fired power generation to increase 8-12% year on year from the 2022 low-base in 2023-24F. He believes that the future for power sources will vary based on geography and kind of input fuel. He expects high-anchored global coal prices to persist due to higher demand when China's economy fully reopens, while on the supply side, Australia's new legislation to cap greenhouse gas emissions required national coal mines to cut output by 5% per year, putting pressure on supply from the key exporter.

As a result, VNDirect believes that new coal-fired power plants that use entirely imported coal, such as Song Hau 1, Duyen Hai 2, Nghi Son 2, as well as the upcoming projects Thai Binh 2 and Van Phong II, will face significant mobilization challenges because the price of this power source is significantly higher than the price of other power sources.

In contrast, VNDirect believes that domestic coal-fired power plants, particularly those in the North, such as QTP, HND, and PPC, would have a brighter outlook in 2023F, owing to the North consistently recording the largest electric-load increase as the core of numerous big and quickly rising industrial areas. Furthermore, the Vietnam Meteorological and Hydrological Administration forecasted a surge in power demand during the upcoming hot weather due to 0.5°C higher temperatures in the North region than the multiple-year average, supporting higher power demand.

For starters, it sees the modest 2023F capacity increase as a chance for operating power plants to absorb increased output mobilization, particularly in probable power shortage areas such as the Northern region.

Second, it considers the consistent price level of domestic coal at VND1.054m/tonne to be one of the most significant advantages for domestic coal-fired power plants in the context of global input price increases. Furthermore, it observes that power sources in the North benefit from lower transportation costs as well as guaranteed input sources by being located near a coal mine.