What is the outlook for coal-fired power?

Given the continued high import coal prices, it is difficult to forecast a sharp output recovery in this sector beginning in 2023.

Pha Lai coal-fired plant

>> Gas-fired output could improve in 2023-2024

Coal-fired power output fell 14% yoy to 86.5 billion kWh in 10M22 due to: (1) Power demand growing below forecasted levels following a cooler hot season and electricity-incentive sector such as steel cutting down capacity because of lower demand; and (2) a coal price hike regarding the supply disruption during the Ukraine – Russia conflict, thus, making it difficult for new imported and mixed coal power plants to compete with the other cheaper power source, especially in the context of favorable hydrology and additional RE capacity.

"We see a distinction between Northern and Southern power plants, with the Northern plants such as QTP, HND, and Mong Duong (PGV) recording positive output while the Southern plants, including Vung Ang and Vinh Tan, suffered from lower output due to the excess capacity situation," said Mr. Nguyen Duc Tung, analyst at VNDirect.

In the context of remained high imported coal prices, it is hard to expect a sharp output recovery of this sector from 2023F, especially for new operated coalfired power plants using imported coal such as Nghi Son II, Song Hau I thermal. However, Mr. Nguyen Duc Tung said there is a brighter prospect for coal-fired power plants using domestic and mixed coal for combustion in 2023-24F, as we see a lighter pressure in terms of price on these plants.

Besides, Mr. Nguyen Duc Tung expects coal-fired power plants in the North will record denser mobilization regarding the strong forecasted power consumption growth of this region in the following years, while the Southern power plants might be faced more intense competition due to the excess capacity situation in this region. Coal-fired power still plays an essential role as a reliable background source with cheap prices in short and medium term to ensure the adequacy of the power system and we see QTP and HND might be benefited from this trend.

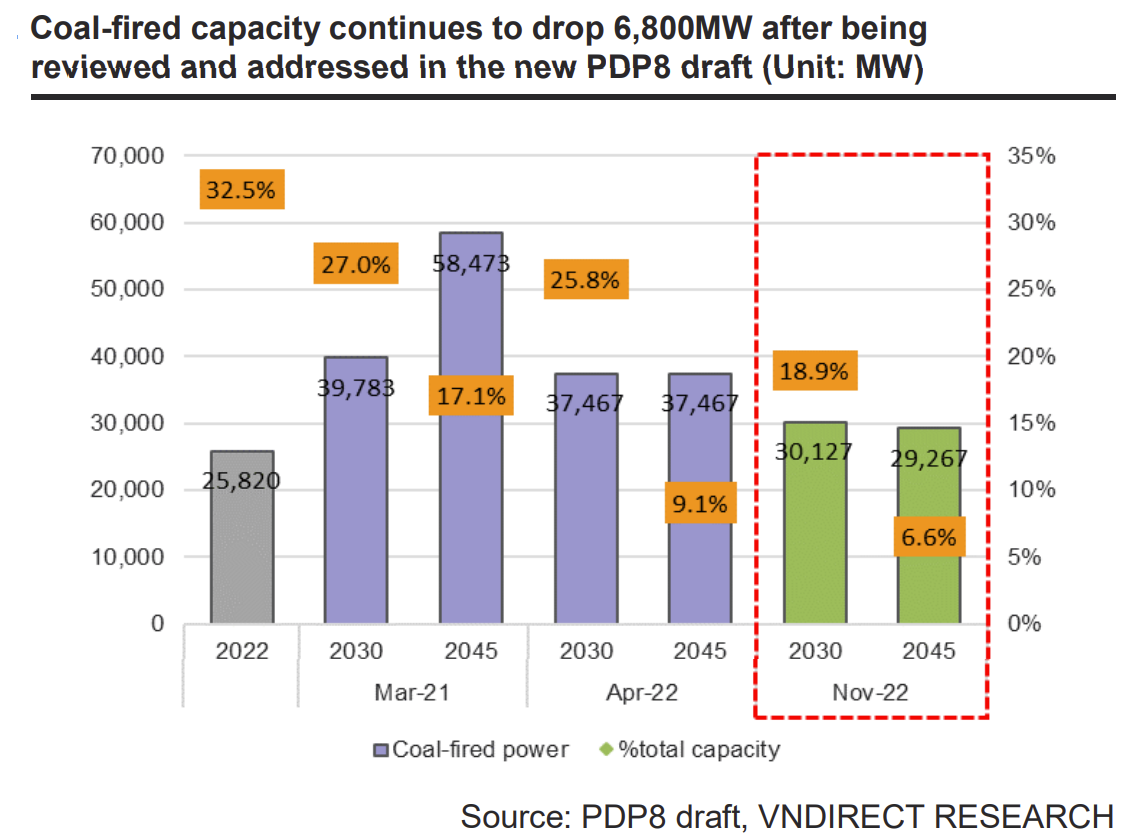

Following the firm government effort for clean energy transition, coal-fired power capacity is constantly reduced after several iterations.As a result, following the bold move to phase out coal-fired power after 2030F in the April-22 draft, the October 2022 version continued to delete five projects (6,800 MW) from the plan due to capital-arrangement difficulties.

>> Vietnam power snapshot: Leverage for gas-fired power

However, it is very difficult to eliminate these projects due to legal problems, compensation, and litigation. Therefore, even though these are projects with a high probability of not being able to arrange capital, they will still have to be considered for development. Therefore, in 2030F, coal-fired power capacity will only shift up to 30,127MW, accounting for 18.9% total capacity after narrowing down to only 6.6% in 2045F.

"We noted down some of the outstanding plants that are expected to keep developing in the 2022–30F period, and some of the domestic giants could benefit thanks to the capacity expansion, including TKV, PVN, and GENCO2. At the moment, several pending coal-fired projects on the remaining list still face funding issues, and the recent hike in coal prices has raised concerns about the "cheap" element of this energy. Along with global efforts to reduce emissions, we see the coal-fired power outlook fading, with tougher access to capital as a result of fund boycotts. However, we anticipate that the continuation of coal-fired power in the Central and the North to be a crucial action to meet the region’s fast power demand growth in the upcoming years, especially when the development potential of RE power in this area is modest", said Mr. Nguyen Duc Tung.