Technology stocks make waves in the market

Technology equities continue to lead the way in garnering investor funds. What features define this group, and is there still opportunity for expansion?

As of the May 20 trading session, numerous technology stocks have maintained their gains from the beginning of the year, even reaching new highs. First, Viettel Global Investment Company (VGI) shares increased by 7.6% to 92,600 VND per share, the highest price in the stock's history. Calculations suggest that VGI's market price has risen by 200% since the start of the year.

FPT stock leading the technology stock group

With this pricing, VGI's market value has risen to 300 trillion VND (about 12 billion USD), a huge increase since the beginning of the year. This valuation drove the business to third place on the Vietnam Stock Exchange.

Next, FPT Corporation (FPT) stock finished at 133,000 VND per share. This stock's price increase has piqued investors' interest, particularly since SCIC unloaded its holdings. FPT, Vietnam's hottest technology stock, has surged over 40% since the start of the year. As a result, FPT's market value has risen to 170 trillion VND (about 6.5 billion USD), up 48 trillion VND since the start of the year. FPT has overtook Techcombank (TCB) to become the ninth most valued business in the Vietnamese stock market. As a result, two technological businesses, VGI and FPT, are presently ranked among the top ten by market value.

These firms' stock prices have skyrocketed due to their remarkable business performance in recent years. FPT's financial report for Q1 2024 showed a net profit of 1,798 billion VND attributable to the parent company's shareholders, up 20.4% over the same time previous year. This is also the greatest profit that FPT has made in some years.

In 2024, FPT expects sales of 61,850 billion VND (almost 2.5 billion USD) and pre-tax profit of 10,875 billion VND, up approximately 18% from 2023 figures. If these aims are accomplished, this technological behemoth will continue to break previous year's records. Following the first quarter, FPT had accomplished around 23% of its anticipated goals.

CMG Group shares have also surged dramatically to 59,000 VND per share, the highest price in the last year. CMG, Vietnam's second largest IT and telecoms service provider with over 25 years of expertise, attracted investor interest after working with Nvidia in the AI industry. According to the collaboration agreement, CMC and Nvidia agree to form a long-term strategic relationship to establish Vietnam as a regional AI hub.

At a recent meeting with Nvidia's working group, Mr. Nguyen Trung Chinh, Chairman of CMC, announced plans to expand the AI DC in Ho Chi Minh City's Hi-Tech Park with a large-scale 40MW project, ensuring AI Cloud infrastructure and private cloud infrastructure for individual customers, assisting the AI community in developing application infrastructure and environment.

CMC previously announced intentions to invest $250 million USD in 1,000 Nvidia GH 200 GPUs between 2024 and 2025, with a focus on an ecosystem of interactive technology products across six major areas: chip design, AI, big data, social data, IoT and smart devices, and blockchain/information security.

In terms of business performance, CMG saw consistent growth, if not remarkable. The corporation has completed fiscal year 2023 (April 1, 2023 to March 31, 2024) with net sales of 7,323 billion VND, a little reduction of more than 4% from 2022. However, owing to a higher gross profit margin, the company's after-tax profit increased by 10% to 391 billion VND, the greatest profit CMC has recorded since founding.

According to the Ministry of Planning and Investment, there are now 14 FDI projects in areas such as semiconductor manufacturing, future technologies, and high-quality human resource training support. These projects are being discussed, with some scheduled for execution in 2024.

According to KBSV Securities, citing Gartner's prediction, worldwide IT expenditure in 2024 would increase consistently by 8%, reaching 5.1 trillion USD, driven by investment expectations in Cloud, information security, AI, and automation. The software and IT services industries are predicted to increase at 13.8% and 10.4%, respectively.

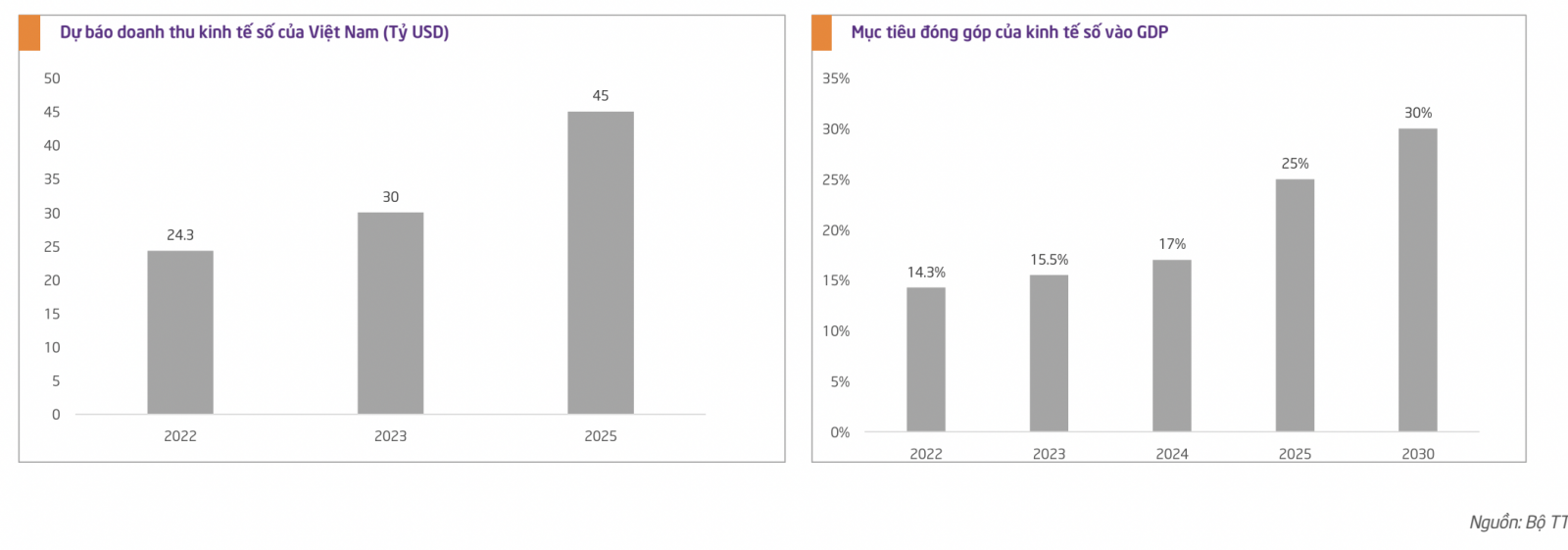

Thus, the growth potential of data centers and Cloud in Vietnam is enormous, with lots of area for expansion. According to the Savills Asia Pacific research, Indonesia, Malaysia, Thailand, and Vietnam have fewer data centers than Hong Kong and Singapore, while having populations that are more than 30 times greater. The government also intends to make Vietnam a major digital center.

In the long run, KBSV believes that IT spending will continue to rise due to the rapid advancement of technology, which requires businesses and organizations to invest heavily in order to compete and adapt to inevitable trends; consumers' habits are gradually changing, becoming more reliant on IT products; and governments prioritizing technology development to keep up with global change.

With a strong demand outlook, KBSV's analytical team expects technology businesses to continue growing at a double-digit rate. Thus, technology stocks still have plenty of space to expand in 2024 and 2025.