Textile and garment sector: Gross margin is expected to recover in 4Q22

Although the gross margin of textile and garment businesses fell 0.3% in the second quarter of this year, it is predicted to grow in the fourth quarter.

.jpg)

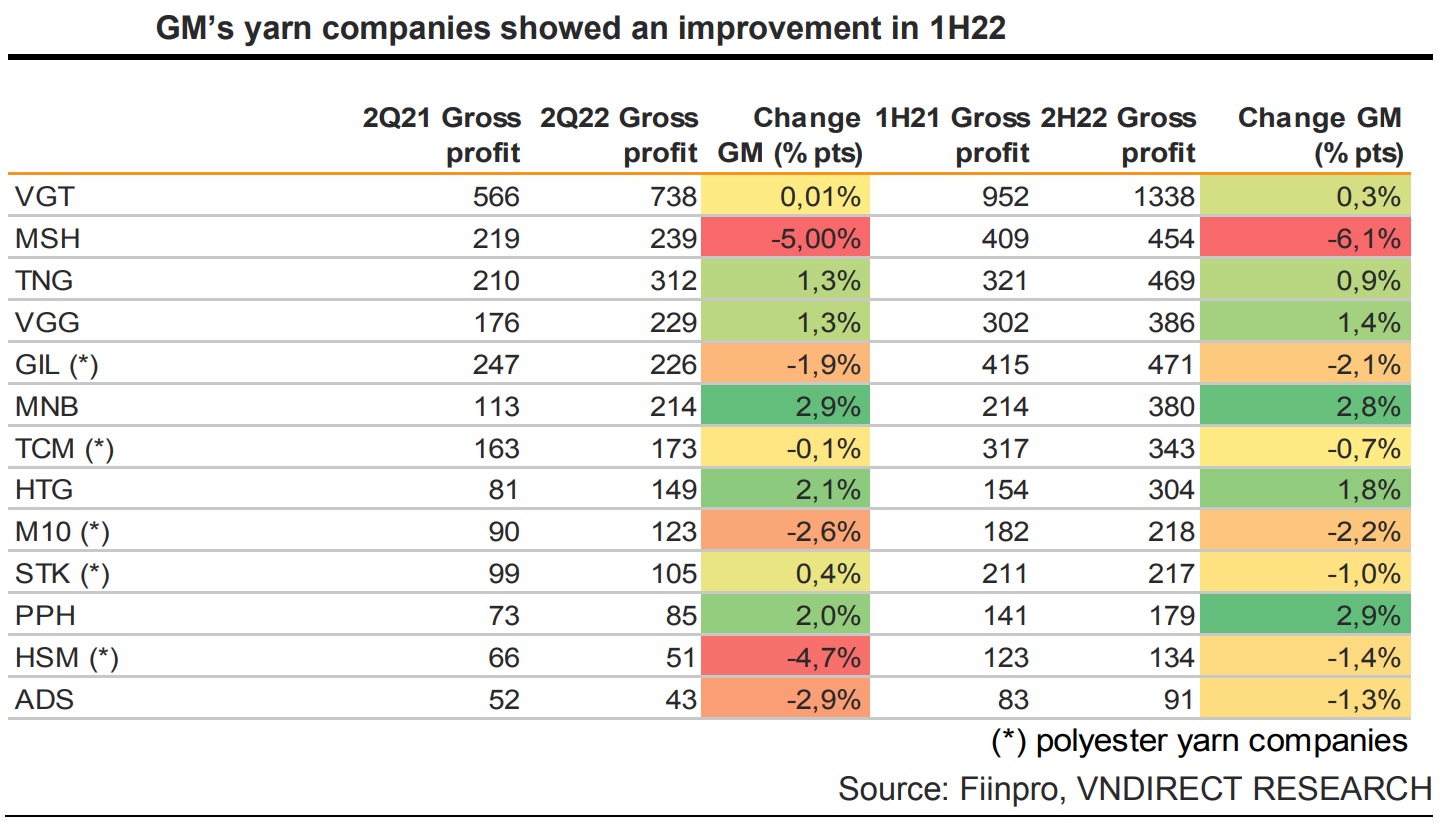

Due to high raw material prices, the gross margin of textile and apparel businesses decreased by 0.3% points in 2Q22

>> Textiles and garments face many challenges in major import markets

Strong demand from the US and EU markets as well as shifting garment orders from China and Sri Lanka as a result of China's "zero-Covid" policy and Sri Lanka's financial problems helped keep the garment and textile export turnover growing in 2Q22. The value of textile and apparel exports rose 20.6% year over year to $8.8 billion in 1H22. The entire export textile and garment value climbed by 21.6% year over year to US$18.53 billion in 6M22, exceeding 44% of the Vietnam government's recommendation for 2022.

In 1Q22, the value of yarn exports remained positive. Due to a lack of cotton and an increase in oil prices, the prices of cotton and polyester yarn have increased by 6% and 10% since January 22, respectively. However, because of supply chain disruption, the value of fiber and yarn exports in 2Q22 fell 6.7% year over year. The total value of yarn and fiber exports rose 10.9% year over year to US$2.8 billion. In the first half of 2012, Vietnam remained the sixth-largest exporter of fiber and yarn globally.

According to VNDirect's estimation, robust demand from the main export markets, including the US and EU, helped listed texile and garment businesses' combined revenue for the second quarter of 2018 grow by 22.4% year over year. Following lockdown, the US has demonstrated a strong pent-up demand. Due to Americans going back to work, demand for office supplies like shirts and vests is increasing.

However, due to high raw material prices, the gross margin of textile and apparel businesses decreased by 0.3% points, with the exception of those that use cotton yarn. In addition, the cost of doing business for textile and apparel industries increased by 109.3% year over year as a result of raw material import exchange rate losses and debt in USD. As a result, this industry's net profit increased 19.5% yoy in 2Q22.

>> Many textile and garment enterprises have orders until the third quarter of 2022

The combined revenue of publicly traded textile and apparel companies climbed by 28.3% yoy in the first half of 2012, while net profit increased by 38.7% yoy. The top three firms with the fastest growth in 1H22 earnings are HTG (224.3% yoy), VGT (43.1% yoy), and TNG (50.0% yoy).

Meanwhile, 1H22 saw outstanding improvements from cotton yarn producers. Due to 1) low-priced cotton inventory in 1Q22 and 2) high demand for cotton products, VGT and HTG's net profits increased by 43.1% yoy and 224.3% yoy, respectively.

TNG was one of the few apparel businesses with exceptional financial performance in 2Q22 and 1H22. TNG's revenue and net profit (NP) increased 36.7% yoy and 50% yoy in the first half of 22 due to, respectively, thanks to (1) increased demand from core clients including Decathlon and Haddad and (2) bettering sales and manufacturing technology.

The only two companies with negative net profit growth were MSH and ADS. Due to high input material and logistic costs and a labor shortage in the SH10 factory, MSH's net profit reached VND187bn (-13.4% yoy). While the main export market (China), which was closed down in 2Q22, caused a minor 4.4% yoy fall in ADS's net profit in 1H22.

Mr. Nguyen Duc Hao, an analyst at VNDirect, said the 1H22 high input material costs severely impacted the gross margin of polyester yarn producers. Due to rising pricing for PET chips and polyester yarn, significant companies including GIL, STK, and M10 saw their gross margins decline by 2.1/1.0/2.2% points year over year, respectively. While MSH's gross margin decreased 6.1% points year over year in 1H22, the depreciation expense at the SH10 production was the main cause.

While PPH, HTG, and MNB saw their gross margins increase by 2.9%, 1.8%, and 2.8% points, respectively as a result of keeping low-cost inputs on hand, Mr. Nguyen Duc Hao predicted that the gross margin of clothing manufacturers would rise in the fourth quarter of this year as the cost of inputs will come down in the third quarter due to lower prices for cotton and oil.