The price war in the auto market is set to continue

Vietnam’s automobile market in 2025 witnessed fierce competition among carmakers. A “price war” played out intensely across all segments, stretching from the beginning to the end of the year, and is expected to continue into 2026.

From the very start of 2025, automakers continuously rolled out deep promotional policies to boost competitiveness and attract customers. Discount programs, financial incentives, support for registration fees, and gifts for car buyers were implemented on a monthly basis.

An Intensifying Price War

Promotions and price cuts were widespread across all segments—from small to mid-size and large vehicles, from conventional gasoline and diesel cars to fully electric vehicles and various types of hybrids. Many brands and dealerships were still holding inventory from 2024, 2023, and even 2022 that had yet to be sold. High inventory levels forced automakers and dealers to launch steep discount programs. Numerous models from 2024, 2023, and 2022 saw price cuts of hundreds of millions to as much as one billion Vietnamese dong to clear stock.

Not only inventory vehicles were discounted; newly manufactured 2025 models were also subject to price reductions. A series of newly launched models quickly introduced promotions shortly after going on sale. For example, some mid-size MPV models priced between VND 560–699 million (depending on the version), launched in mid-September 2025, had already rolled out major promotions by early October 2025, including support for 100% of registration fees and complimentary body insurance, with a total value of nearly VND 100 million.

Many models recorded actual transaction prices significantly lower than their list prices, gradually blurring the boundaries between market segments. While this directly benefits consumers, it has also led to increasingly thinner profit margins for automakers and dealers.

Rising supply alongside substantial inventory, coupled with the launch of numerous new models, has resulted in market oversupply. Even as demand and sales increased, supply continued to far exceed demand, driving sharp price reductions. Competition intensified further toward year-end, as many models offered massive promotions to reduce inventory.

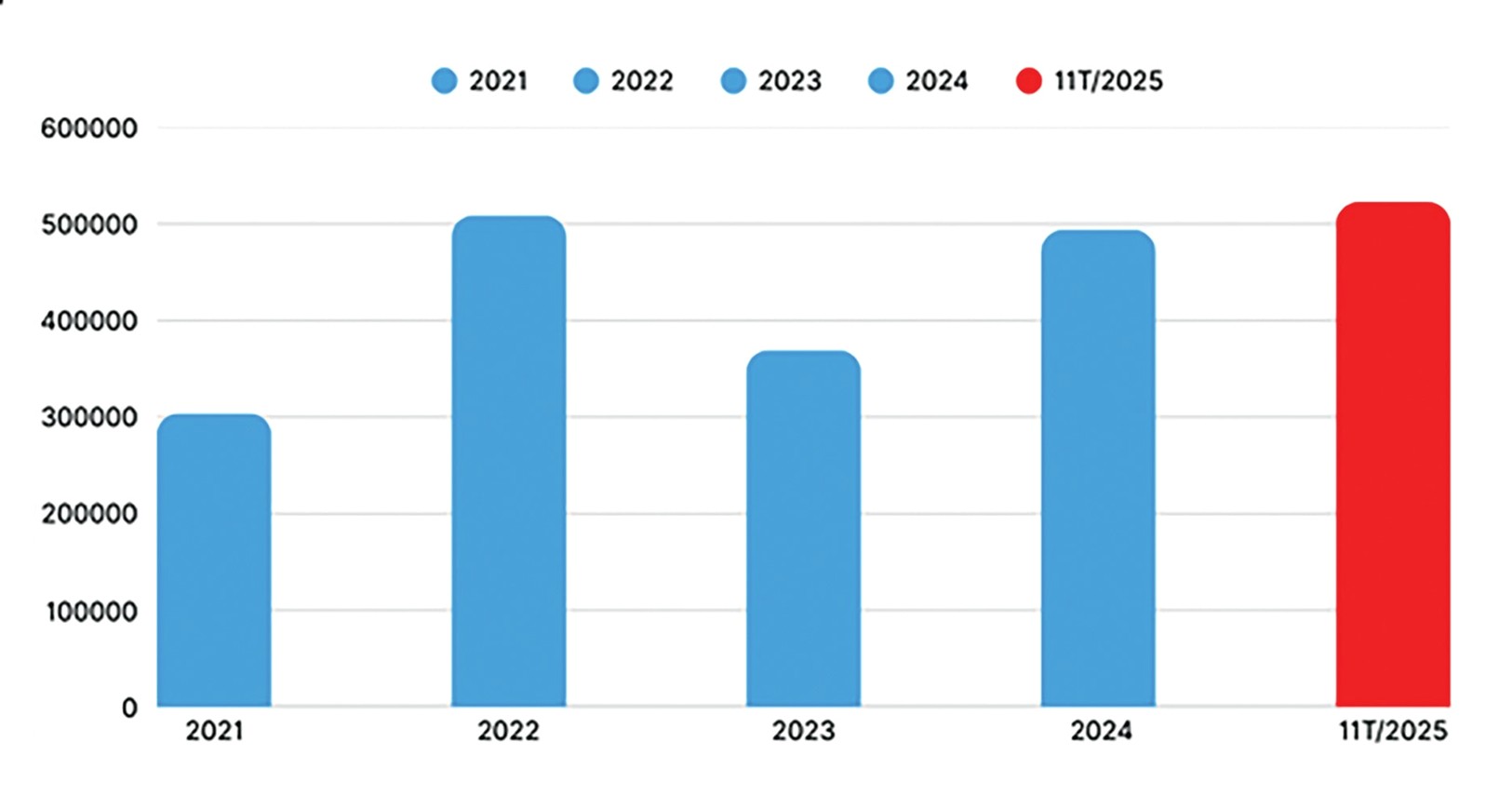

According to consolidated data from the Vietnam Automobile Manufacturers’ Association (VAMA) and other enterprises, total vehicle sales in the first 11 months of 2025 reached approximately 550,000 units, up 10% compared to the same period in 2024. However, new vehicle supply, based on data from the General Statistics Office (Ministry of Finance), amounted to 630,000 units, in addition to more than 100,000 units of inventory carried over from 2024, 2023, and 2022. This brought total supply to over 730,000 vehicles—nearly 200,000 units higher than demand. Full-year vehicle consumption in 2025 is forecast to exceed 600,000 units, while total supply is expected to rise to nearly 800,000 units. As a result, intense competition is set to persist.

Total market sales in the first 11 months of 2025 rose by 10% year-on-year. Source: VAMA

Electric and Hybrid Vehicles on the Rise

Industry insiders believe that sales of electric and hybrid vehicles will surge in 2026, while traditional gasoline and diesel vehicles will decline.

Data compiled from automakers show that total passenger car sales (up to nine seats) in the first 11 months of 2025 reached 415,636 units, of which as many as 159,972 were electric and hybrid vehicles, accounting for approximately 38.5% of market share. This figure does not include hybrid sales from Chinese automakers or premium brands such as Mercedes-Benz and Volvo.

Pressure to transition toward greener transportation is expected to influence consumers’ vehicle choices. At the same time, electric and hybrid vehicles benefit from significant tax and fee incentives, along with lower operating costs—key advantages driving growth.

Mr. Dai Yong Lin, Director of Bestune Vietnam (under China’s FAW Group), said that Vietnam’s electric vehicle market will grow strongly in 2026, supported by incentive policies and the government’s development orientation. More foreign EV brands are expected to enter the market, creating vibrant competition. Small electric cars in the A00 segment and electric SUVs are likely to be favored due to their affordability, ease of maneuvering in narrow streets and alleys, and convenient maintenance and servicing.

Mr. Keita Nakano, President of Toyota Motor Vietnam, noted that growing demand for hybrid vehicles and a strategic focus on prioritizing their development will change consumer habits. Hybrid vehicles will become an inevitable and widespread trend in Vietnam.

Automakers such as Toyota, Honda, Ford, Kia, and Hyundai have planned to ramp up the assembly and distribution of hybrid models in Vietnam from 2026 onward. Prices are expected to continue declining, while fuel-intensive gasoline and diesel vehicles will inevitably be affected.

According to an analytical report by Vietcap Securities, the compound annual growth rate (CAGR) of sales for traditional internal combustion engine passenger cars in Vietnam is expected to slow, reaching only around 2% during the 2025–2029 period, due to strong competitive pressure from electric and hybrid vehicles.