The VN-Index is headed for the bottom

Mr. Doan Minh Tuan, Head of Research & Investment at FIDT, argues that global forces and hazards that are currently unable to forecast when they will finish are having an unforeseen impact on market liquidity perception.

Investors are now unable to measure the degree of harm caused by U.S. policy concerns under the Trump administration to interest rate and DXY trends, which have a significant impact on short-term financial market movements.

The liquidity sentiment in the stock market is being unexpectedly affected by global factors. Illustration photo.

VN-Index Lost Support Levels

With dangers that are unpredictable in terms of their duration, this is the scenario that liquidity sentiment fears the most. Foreign investors have therefore aggressively resorted to net selling. Due to a huge supply of stocks being sold by overseas investors and cautious buying liquidity, the market is trading unbalancedly.

As a result of these factors, the VN-Index had a significant decrease last week, particularly on Thursday and Friday. The VN-Index returned to lower price levels at the end of the week, ending the week at 1,218 points after formally losing its short-term support zone of 1,240–1,250.

The market is quickly weakened by selling pressure, which is particularly strong at times of high institutional activity, such as after 2:00 PM. The majority of sectors break short- and mid-term bottoms, a sign of strong selling pressure. Given that several significant industries and equities lost their short- and mid-term support zones throughout the course of the week's final two sessions, we think market risks could soon result in additional adjustments.

Steel (HSG, NKG), Securities (VND, SHS, SSI, VIX), Oil & Gas (PVD, PVS, BSR, PLX), Retail (MWG, VNM, MSN DGW), Real Estate (DIG, CEO, NVL, NTL, TCH), and Electricity (GEX, POW) are among the sectors that momentarily lost their mid-term bottoms (6 months to 1 year).

The banking sector has also been in a distribution phase for the past four weeks, with very high distribution volumes at peak levels. Most bank stocks have also lost price levels since June, with a more negative adjustment trend seen in banks with rising Q3 bad debts and poor business results (BID, VPB, TCB, MBB, VIB, EIB, MSB, OCB).

Faint Bright Spots Only in Mid- and Small-Cap Groups

Mid- and small-cap sectors with low trading volumes, such as Viettel Group (VTP, VGI, CTR), Shipping (HAH, VOS), Textiles (MSH, TNG), and Fisheries (VHC, ANV), are the only faint bright spots. The positive trend of these sub-sectors with moderate market capitalizations is unlikely to have a significant impact on the overall market.

Most equities have undergone significant corrections since their Q3 peaks, and a sizable number of stocks have been dispersed over the 1,250–1,280 area. Therefore, a widespread situation of cross-margin selling is anticipated as the market continues to change. One important element is margin calls, which probably result in ongoing adjustment cycles until the last "washout" phase.

When conditions are favorable, the market is expected to start recovering alongside global financial markets if cross-margin calls do not take place and the approaching adjustment scenario proves to be more favorable. It is possible for the market to recover amid uncertainty, accelerate with an FTD (Follow-Through Day) session, and build an uptrend when global risks (DXY, U.S. 10-year Treasury yields) decline sharply.

Market Outlook

The overall market has undergone a deep adjustment over an extended period, strongly reflecting mid- and long-term risks. The adjustment since October can be compared to mid-term corrections such as in September 2023 and April 2024.

Source: FIDT

In particular, upon analyzing these corrections with a large number of stocks, most are nearing mid- to long-term support zones, which stimulate mid-term bottom-fishing as valuations become attractive.

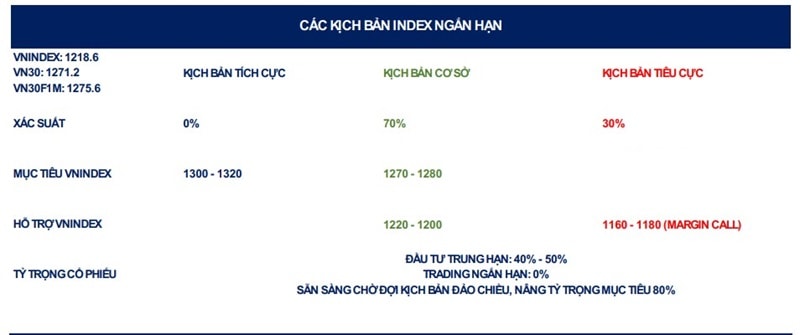

Mr. Tuan outlines two highly probable scenarios for the market in the short term (until the end of 2024):

Base Scenario

Mr. Tuan thinks that most "assumed risks" in the medium term have been reflected in the recent deep revisions in the base scenario. During recent severe drop sessions, FIDT's technology continuously logged bottom-fishing signals, demonstrating the allure of values in relation to mood and risk.

Opportunities for reversals and successful bottom formation would therefore arise from any notable reversal of global adjustment indicators, such as the DXY (dropping strongly below 105) and U.S. 10-year Treasury rates (falling decisively below 4.2%).

Mid-term bottom assumption: 1,200 – 1,220

Balanced trading zone: 1,220 – 1,250

Technical signals for an uptrend return:

- Convincing breakout above 1,250 with high volume and breadth;

- Breakout and maintenance above 1,270, advancing toward the old peak zone of 1,280 – 1,300.

Recommendation weightings: Maintain a weighting of 30%–50% during the VN-Index bottoming process (1,200 – 1,220). Actively increase the weighting to 70%–80% at times when the VN-Index sharply approaches 1,200. As global variables ease and the VN-Index significantly decreases, uptrend signals may return, allowing investors to actively raise weightings to a maximum of 100%.

Negative Scenario

Exchange rate pressures and selling pressures from foreign investors are anticipated to be very strong if global finance continues to reflect worsening "Donald Trump policy" variables, with the DXY rising to historical levels near 110 (currently 106.7) and U.S. 10-year Treasury yields exceeding 4.6% (almost simultaneously). It is anticipated that the market will be quite bearish at that time. There is a significant chance of cross-margin call pressure in addition to an already extensive correction phase.

The VN-Index's bottom range will be highly discounted and difficult to forecast when the "cross-margin call" phenomenon takes place. Until the margin call issue is fixed, portfolio safety should therefore be given top priority. One to three strong dropping sessions followed by a "washout" phase that totally destroys sentiment are typical outcomes of this procedure. Furthermore, indications of reducing DXY and domestic exchange rate risk are necessary.

Mid-term bottom assumption: 1,160 – 1,180

Balanced trading zone: 1,200 – 1,220

Technical signals for an uptrend return:

- Convincing breakout above 1,220 with high volume and breadth;

- Breakout and maintenance above 1,270, advancing toward 1,280 – 1,300.

FIDT weightings recommendation: When estimating the likelihood of margin calls, keep weightings below 30%. Investors should keep an eye on the market in the sessions that follow the occurrence of the margin call phenomena in order to profit from purchases at extremely low valuation zones. The market's mid-term bottom will surely be set once the margin phenomena is resolved if the margin call phenomenon materializes.

As soon as the VN-Index falls sharply below the 1,180 zone, investors may proactively raise their weightings to 70% to 80%. Uptrend indications may reappear if global variables subside and the VN-Index sharply declines, enabling investors to aggressively increase weightings up to 100%.