Two factors to impact US dollar in 2024

The US dollar has started 2024 in pretty stable fashion and this stability may continue until two key questions are answered: will the Fed ease policy as the market expects, and will former US president Trump win November’s election.

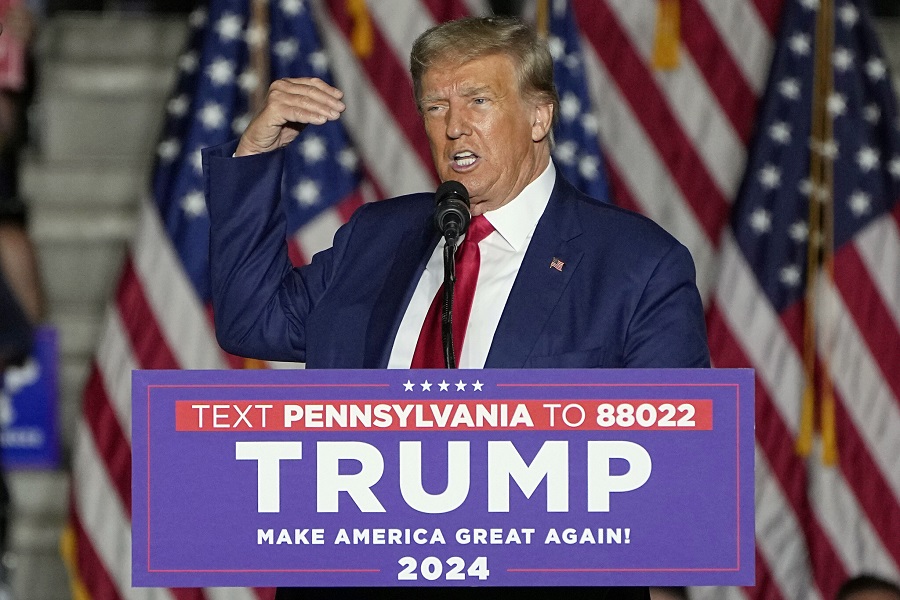

Trump leads rivals Nikki Haley and Ron DeSantis by more than 30 points in Iowa, which stages its Republican nominating contest known as a "caucus" on January 15, kicking off the 2024 primary season.

>> Reason for the USD's deflection from the US economy

The eyes of the FX markets will be on both policy and politics in 2024. That’s likely to be the case in many countries as policy easing and elections loom. Sterling, for instance, could be impacted by the speed and extent of any Bank of England easing this year and the outcome of an election that seems likely in the autumn, and is expected to bring a change in government.

But it is in the US where policy and politics threaten to have the biggest global impact, not just on currencies, but on asset prices in general. A widely expected easing cycle from the Fed could weigh on the US dollar if it produces narrower interest rate spreads, particularly against Japan, and strength in riskier assets like stocks and corporate credit.

The extent of any such dollar weakness will clearly be shaped by just how soon the Fed starts its easing cycle and the degree of rate cuts undertaken. But even if the Fed starts to cut later than consensus expectations, and does not cut as much, Mr. Steve Barrow, Head of Standard Bank G10 Strategy still believes that monetary policy will lower the US dollar this year. However, the influence from monetary policy may not begin for some time yet unless, that is, the economy starts to fold and the Fed cuts quickly; neither of which he expects.

Mr. Steve Barrow believes that the Fed will start to cut rates from Q3, which is later than the consensus, but will trim rates more aggressively than generally anticipated once it starts. This profile suggests to us that, if the US dollar does weaken this year, the bulk of the slide could come from mid-year as expectations for Fed easing start to rise. But the second half of the year will be heavily influenced by politics as well.

And while it might seem pretty straightforward that Fed easing will weigh on the US dollar, the political influence on the greenback from November’s election is far harder to determine. For a start, there is the issue of whether former president Trump will win the Republican nomination and whether some legal block is possible that prevents Trump running again even if he does win the nomination. Things are not much clearer on the Democrat side with rumours swirling that current President Biden will not run for a second term after all. And then, of course, there’s the question of who will win the election given they have proved very close in the past, and whether any loss will be generously accepted by the defeated candidate.

The final uncertainty surrounds both the domestic and geopolitical ramifications of any change in government. Our working assumption at the moment is that Trump will win the Republican nomination and the presidency. Could all of this uncertainty usurp the impact of monetary policy when it comes to the dollar? In other words, might the political noise be so great this year that it drowns out any monetary policy changes?

Mr. Steve Barrow doesn’t think that it will. Easier Fed policy should produce a lower dollar, at least against the yen as rate differentials narrow. The big issue is whether easier Fed policy can generate strength in global risk assets – and hence weakness in the dollar – if politics is so noisy. For if politics provokes significant weakness in asset prices via rising risk aversion, then US rate cuts probably won’t weaken the dollar.

>> Will the US dollar fall as rates are cut?

There is also a question mark over whether another Trump presidency would be good or bad for the dollar based on the policies that are pursued. For instance, the protectionism that Trump started with respect to China during his first term endures today. But while many decried such policies as a dose of massive self-harm to the US, it is hard to say that this has been the case. The blossoming trends of deglobalisation, re-shoring and general inward focus arguably aid the US – and the dollar – given that it is quite a closed economy in global terms.

“If Trump wins and turbodrives these trends it could produce more so-called US ‘exceptionalism’ and so counter any pressure on the dollar from easier Fed policy. But, at the same time, we have to bear in mind that the US is the world’s big debtor nation and this could turn on the dollar at any stage in the future. As things stand right now, we lean to the view that the dollar will give some ground in the second half of the year towards 1.15 against the euro and 125 against the yen, but we’re under no illusion that it's a tough one to call this year”, said Mr. Steve Barrow.