Unlocking new financing solutions

Reforms to tackle key structural challenges are critical to unlock the immense growth potential for Vietnam’s corporate bond market.

Reforms to tackle key structural challenges

Investor Base Constraints Remain a Key Bottleneck. Regulatory restrictions continue to prevent banks and insurers from investing in refinancing bonds—those issued to repay maturing debt—narrowing the investor pool and driving up issuance costs. Coupon rates for refinancing bonds surged to 11–13% in 2024–2025, well above prevailing bank lending rates. With bond maturities peaking in recent years, issuers faced mounting challenges in rolling over debt amid subdued demand.

In response, the Ministry of Finance (MoF) released a new development roadmap for the securities investment fund industry in September 2025. Covering the 2026–2030 period, the plan includes a pivotal regulatory shift: lifting the investment ban on refinancing bonds for insurers and commercial banks. Once enacted, this reform is expected to materially broaden the investor base and enhance market access for refinancing issuances.

For long-term projects, developers often favor bank loans due to their flexibility—loan disbursements can be tailored to match construction schedules, minimizing idle capital and optimizing financing costs. In contrast, issuing multiple bonds aligned with project phases requires separate documentation and regulatory approvals, adding execution complexity. While tranchebased bond issuance could offer a solution, current regulations restrict the offering period of new tranches to no more than six months from the first tranche, rendering it impractical for multi-year infrastructure projects.

Since July 2024, credit institutions have been restricted from managing collateral assets for corporate bonds, with some limited exceptions. As a result, many have exited the trustee business, reducing market capacity at a time when bond issuance volumes are rising. To sustain growth and investor confidence, Vietnam will need to expand the pool of qualified institutions capable of providing trustee services and supporting collateralbacked corporate bond issuance.

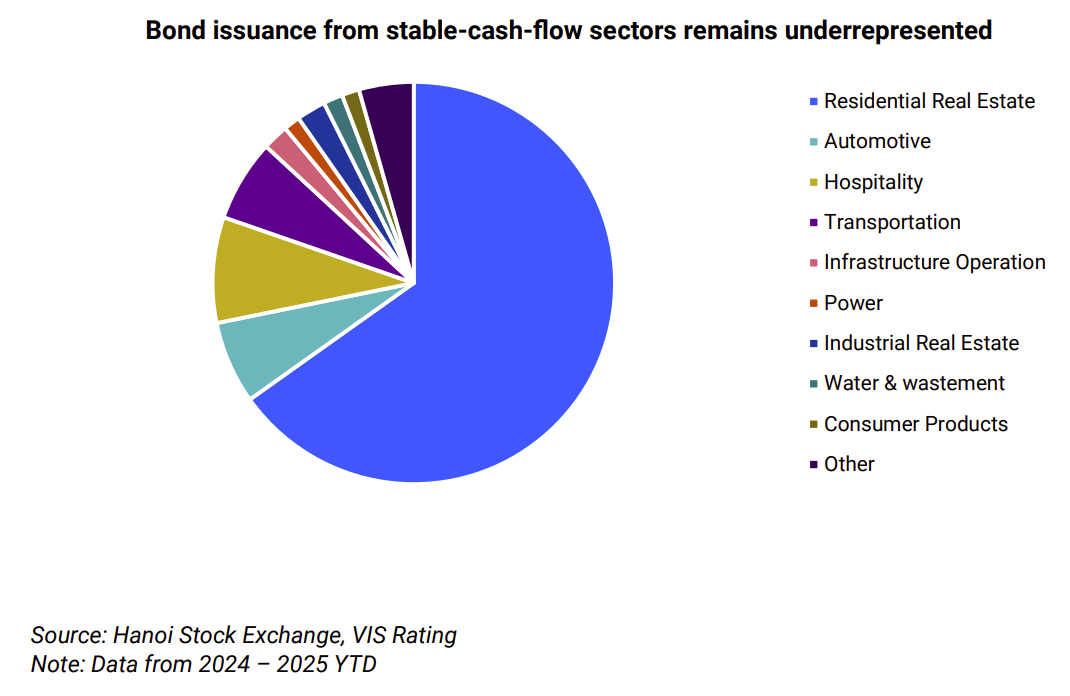

Lack of supply to meet institutional demand: Even as the AUMs of fixed-income funds quadrupled since 2023, many institutional investors struggle to diversify their investment holdings due to the limited supply of eligible bonds. Demand is particularly strong for bonds in stable cash-flow sectors such as infrastructure and utilities—yet these sectors remain underrepresented in historical bond issuance, constraining diversification and dampening market depth.

Strong collaboration among multi-stakeholders

Vietnam’s infrastructure development hinges on policy consistency, innovative credit solutions, and strong collaboration among multi-stakeholders. Duong Duc Hieu, CFA Director – Senior Analyst, said there would be some factors to consider:

First, policy consistency: A sound and stable regulatory environment is essential to attracting long-term investors. Infrastructure projects typically have high leverage, rely on single revenue streams, and span long tenors—often 15 to 20 years—making them vulnerable to construction and liquidity risks. Clear issuance frameworks and robust post-issuance controls—such as trustee oversight, escrow mechanisms, and regulated disbursements— combined with macroeconomic stability, are key to strengthening investor confidence.

Second, issuer governance & ESG alignment: Strong governance and integration of environmental, social, and governance (ESG) principles in market practices are increasingly non-negotiable for accessing global capital. Domestic issuers must align with international standards through enforceable covenants and transparent ESG practices. While local investors may tolerate looser terms, foreign investors typically demand rigorous financial discipline and sustained ESG compliance throughout the bond lifecycle—raising the bar for issuance quality and lowering funding costs.

Third, credit enhancements: Guarantees play a pivotal role in de-risking infrastructure project bonds, especially during the project construction phase. Global experience shows that partial or full credit guarantees—offered by institutions like CGIF—can significantly improve bond investability. Notable examples include Gelex and Phenikaa, which successfully issued guaranteed bonds in 2019 and 2023 to global insurers for energy and healthcare projects, respectively.

Fourth, role of credit rating agencies (CRAs): CRAs provide analytical clarity on complex structures and ESG alignment, helping investors assess risk and build trust in innovative instruments like green and sustainable bonds. In regional markets, credit ratings support the assessment of relative credit risks and guide the pricing of bond investments. As the sustainable debt market grows, second party opinions from CRAs will enhance transparency and facilitate issuers’ pursuit of green financing, while providing investors with additional tools for risk evaluation and investment analysis.

Fifth, institutional & development bank participation: Deepening the corporate bond market requires active participation from pension funds, insurers, and development banks. In regional markets, robust institutional investor bases have enabled PPP toll road projects to secure bond financing with tenors of up to 50 years. Development banks such as ADB and IFC further enhance project viability through mezzanine and subordinated financing.

In Vietnam, however, institutional participation remains constrained. The Vietnam Social Security Fund and private pension funds are currently barred from investing in corporate bonds, while life insurers hold less than 10% of their assets in such instruments. If the legal restrictions are lifted – aligned with the MoF’s roadmap for 2026-2027, Vietnam could unlock significant long-term capital to finance its infrastructure ambitions.