Unlocking the capital puzzle for businesses

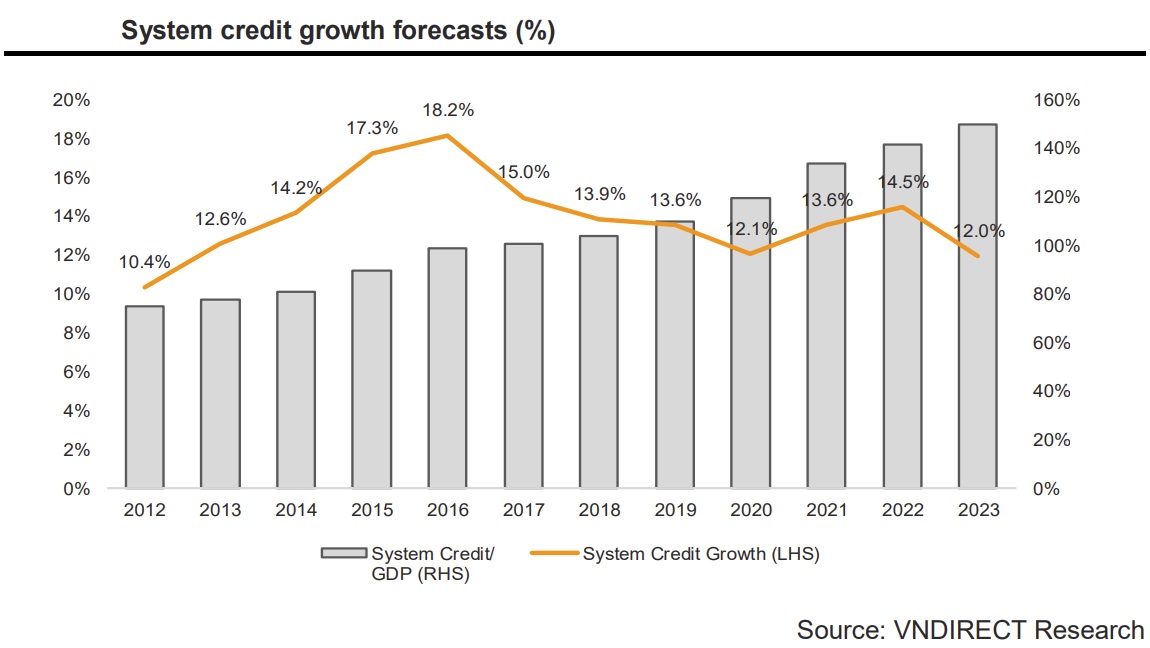

Experts predict that Vietnam's interest rate will remain high in 2023, raising concerns about the availability of financing for enterprises in the absence of aggressive support from the government, banks.

SMEs would have trouble obtaining bank loans in 2023 due to the continued high interest rates.

>> Capital flow needs to be unblocked to support businesses

Barriers to business recovery

In 2022, Vietnam's economy, which includes finance, banking, real estate, and securities sectors, faced several challenges as a result of both internal and international causes, including the FED's protracted tightening policy. With no indication that FED’s current policy would change, Vietnam must immediately put in place targeted measures to maintain economic development and successfully control interest rates.

Vietnam is one of many emerging economies that have been significantly impacted by the FED's monetary tightening stance. As a result, the USD appreciates against the majority of other currencies, including the VND, puting pressure on the USD/VND exchange rate. The State Bank of Vietnam raised policy rates to stabilize the economy as a result of this and rising inflation.

Small and medium-sized businesses (SMEs) would have trouble obtaining bank loans in 2023 due to the continued high interest rates, according to Mr. Dao Gia Hung, Deputy Director of VPBank's SME Banking Division. With little chance of an interest rate fall, the market will continue to be driven by interest rates, inflation, and credit. To boost enterprises, the State Bank of Vietnam is urging commercial banks to lower loan rates.

SMEs’s access to bank loans is hampered not just by high interest rates but also by internal business issues including insufficient collateral and poor governance.

>> Unlocking capital channels for enterprises

Businesses must exert effort

Businesses must focus on their core markets, exhibit transparency in their operations, and make precise predictions of future cash flows after raising capital in order to overcome these challenges. Additionally, the financial industry needs to be proactive in putting together funds, with a focus on global funding and digital goods. Furthermore, companies need to cut operation costs, create a reserve fund, improve their financial capacity, and maintain honest and long-lasting relationships with banks.

Dr. Mac Quoc Anh, Vice Chairman of the Hanoi Small and Medium Enterprises Association, emphasizes that companies can obtain bank loans with affordable interest rates as long as they also comply with the standards established by banks. By assembling industries that are having trouble, the association will support enterprises by urging state and commercial banks, security firms, and consultants to help with the required steps to increase financial capacity of businesses.

Financial expert Dr. Vu Dinh Anh advised businesses to address certain difficulties. First, regardless of whether they are in good or bad conditions, they must always be proactive in their business and production goals. Second, they must make every effort to increase their initiative and lessen their reliance on government assistance. Third, determining whether a problem has subjective or objective causes is necessary. If the issue has an objective cause, they can recommend the relevant authorities to address it; but, if the issue has a subjective source, the businesses themselves must find a solution.