Unveiling ambitions of real estate giants

Following the 2025 annual general meeting (AGM) season, many real estate companies have unveiled their growth strategies with ambitious business plans, while others have opted for more cautious approaches.

The Race Among Giants

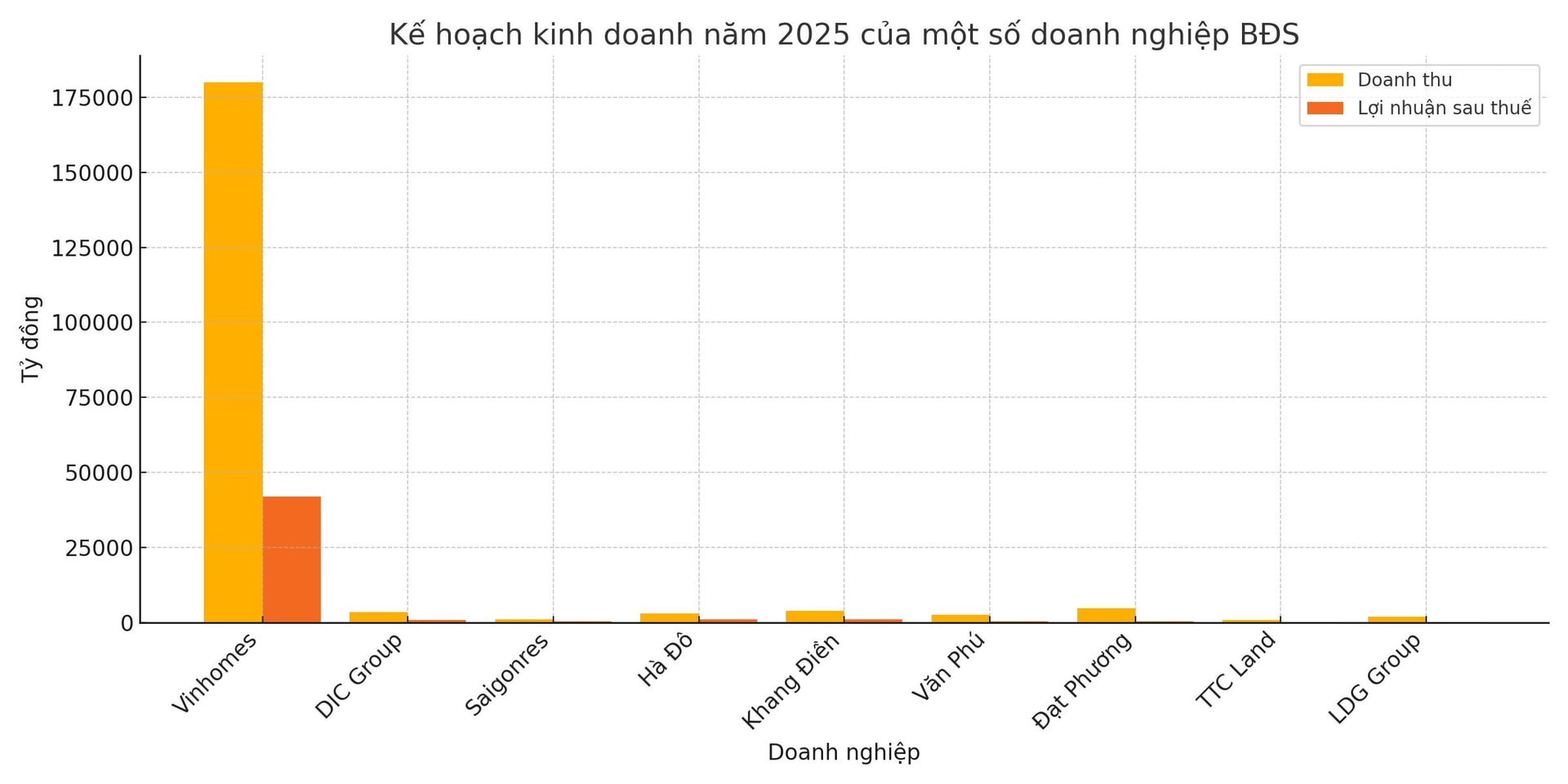

Vinhomes continues to be the center of attention this AGM season, setting a target of VND 180 trillion in net revenue and VND 42 trillion in post-tax profit—up 76% and 20%, respectively, compared to 2024. If achieved, this would mark the third consecutive year that Vinhomes has surpassed VND 100 trillion in revenue and would set an unprecedented milestone in Vietnam’s real estate industry. To realize this ambitious plan, Vinhomes is accelerating the development of several mega-projects such as Vinhomes Global Gate (Dong Anh, Hanoi), Vinhomes Wonder City (Dan Phuong, Hanoi), Vinhomes Green City (Long An), and Vinhomes Green Paradise (Can Gio). The continuous launch of large-scale urban areas signals a robust expansion strategy, capitalizing on a recovering housing demand. By the end of 2024, Vinhomes reported consolidated net revenue exceeding VND 141 trillion, laying a solid foundation for this year’s acceleration.

Also pursuing expansion, DIC Group is not lagging behind, targeting a record-high revenue of VND 3.5 trillion and a post-tax profit of VND 718 billion—more than 4.5 times that of last year. Although still far from the goal after Q1, the company has demonstrated strong determination to re-enter the race after a challenging 2024.

Other notable players are equally ambitious. Saigonres Group aims for VND 1.025 trillion in revenue and VND 320 billion in post-tax profit—many times higher than last year’s figures. Ha Do Group targets VND 1.057 trillion in post-tax profit, up 146%, while TTC Land plans to increase pre-tax profit by nearly 50%.

Notably, LDG Group—after two consecutive years of losses—has surprisingly set a target of nearly VND 1.823 trillion in net revenue and VND 92 billion in post-tax profit. Analysts see this as a potentially dramatic comeback.

Additionally, several mid-sized companies, such as Khang Dien, Van Phu Invest, and Dat Phuong have also outlined stable growth plans, with projected revenue and profit increases ranging from 15–33%.

Despite new market opportunities, many firms are taking a cautious approach—or even shifting into reverse.

When Caution Becomes a Survival Strategy

Despite new market opportunities, many firms are taking a cautious approach—or even shifting into reverse. Among the most notable is Novaland. At its 2025 AGM, Novaland presented two business scenarios: one optimistic, with VND 13.411 trillion in revenue but still a VND 12 billion loss, and one more pessimistic, forecasting a loss of up to VND 688 billion despite VND 10.453 trillion in revenue.

A similar situation is seen at Sunshine Homes, where revenue slightly increases but pre-tax profit drops by more than half. Nam Long Group, despite expecting a 35% profit rise, is accepting a 6% revenue decline.

A particularly concerning case is Lideco, which has set a revenue target of just VND 70 billion and a profit of VND 24 billion—a record low compared to last year’s VND 1.489 trillion in revenue and VND 620 billion in profit. The company admitted it has no products qualified for sale this year, indicating exhausted development resources.

According to Mr. Tran Quang Trung, Business Development Director at OneHousing, 2025 will see a wave of large-scale projects from north to south, particularly in Long An and Can Gio. Major developers are seizing the moment to capture market share, while those unable to adapt will have to restructure—or seek mergers and acquisitions (M&A) to survive.

Mr. Trung also believes 2025 marks a pivotal year for a shift in product strategy. “Not every investor will remain standing. Outdated business models and mindsets will be eliminated if they fail to adapt,” he said.

As the market trends upward but remains uncertain, the business outlook for real estate companies in 2025 reveals a clear divide. The giants continue to push forward, while many smaller firms opt for a slower pace—or even a retreat—to conserve resources.

This year’s “battle” in the real estate market is not just a race for revenue but a test of adaptability and strategic planning for a new, volatile cycle.