Upbeat about Vietnam’s steel sector

Rising steel prices improve the profit margins of steel businesses, as most businesses have large inventories by the end of 2021.

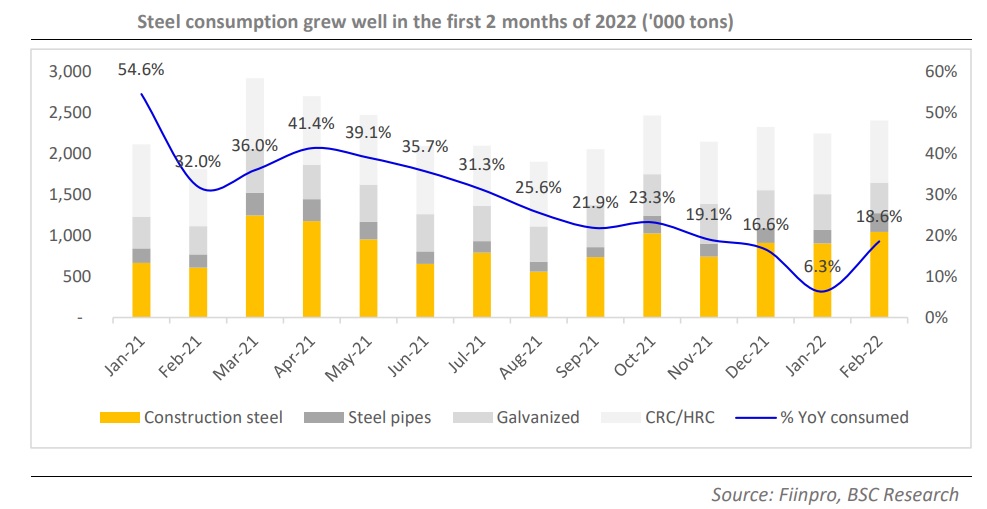

In the first 2 months of 2022, Vietnam's steel market continued to have high growth (18.6%YoY)

>> Policies needed to support steel industry

Vietnam's domestic steel consumption and exports increased significantly (16.8% year on year) in 2021, with hot rolled and cold rolled coil steel (50.6 percent year on year) and galvanized steel (38 percent year on year) offsetting a drop in construction steel (-3.6 percent year on year).The domestic market grew by 5% year on year (with steel construction down 10%), but the export market grew by 66% year on year (with galvanized steel growing by 110 percent year on year).

In the first 2 months of 2022, Vietnam's steel market continued to have high growth (18.6%YoY), especially in construction steel products, due to the recovery in domestic construction demand (domestic market 49%YoY despite the Tet holiday). The export market grew 11% YoY, a somewhat modest increase due to transport to Europe being affected by the Russia-Ukraine conflict.

The market share of domestic consumption has not changed much, but competitive pressure in the export market is increasing. HPG continues to lead the market share of industry-wide steel consumption in general (35%) and construction steel and steel pipes in particular. The leading position in the plating industry continues to belong to HSG (29%).

In the export market, HSG's market share of galvanized steel continues to shrink, while Ton Dong A's market share (TDA) has grown strongly. BSC thinks that the market share of galvanized steel in the coming years is likely to change as some manufacturers plan to increase capacity in 2022.

The increase in steel prices in the first quarter of 2022 will help the gross profit margin of steel enterprises recover. Steel prices have had seven upward corrections since the start of the year, with increases of about 10% for galvanized steel and 20% for construction steel. Rising steel prices improve the profit margins of steel businesses, as most businesses have large inventories by the end of 2021.

In the future quarters, fluctuations in input material costs will have an impact on manufacturers' gross profit margins. Because of the impact of the Russian-Ukrainian conflict, raw material costs (ore, coal, and scrap steel) have risen dramatically since the beginning of the year, particularly coal prices. Steelmaking businesses typically have a two-to-three-month inventory turnover, so if raw material prices continue to climb, they will be severely impacted. Nevertheless, we believe that strong demand will assist the manufacturer move the majority of the price increase to the price of steel.

BSC maintains its outperform recommendation for the steel sector in 2022 because (1) forecast consumption output remains high; (2) gross profit margins only slightly decrease due to material price fluctuations; and (3) cheap valuation with P/E for some large enterprises ranging from 3.5x to 5.1x.