Upbeat about VN-Index's medium-term outlook

The VN-Index closed on May 17 at 1,273.11 points, up 28.41 points (2.28%), approaching the previous high of 1,280-1,290 points.

Mirae Asset Securities (MASVN) reviewed the stock market (TTCK) over the last week and identified a notable indicator of a four-session consecutive climb, accompanied by capital flow shifting to stocks that had not grown considerably. Notably, the banking industry saw a rebound, with four representatives in the top ten: LPB, VPB, TCB and MBB. LPB and VPB were the leading contributors, boosting the VN-Index by 1.95 and 1.76 points, respectively. Conversely, VCB was the most important detractor, lowering the index by 0.27 points.

The easing trend of the US CPI in April and the positive performance of US stock indices such as DJI, NYSE Composite, and S&P 500 are expected to positively influence the VN-Index this week

Foreign investors continued to net sell VND 2,143 billion last week, with VHM being the most heavily sold stock at more than VND 756 billion, followed by CTG at VND 410 billion and VPB at VND 273. On the purchasing side, MWG led with roughly VND 770 billion, followed by NLG with VND 152 billion.

"The four-session straight gain suggests a dominating rising trend, which is expected to continue for the following one to two sessions, with the goal of reaching 1,280." However, investors should keep an eye out for significant resistance around the 1,275-1,280 zone in the next sessions, according to MASVN's research and analysis department.

In the medium run, MASVN is positive about the prospects of the VN-Index based on many variables.

First, the April downturn has lowered the value of important indexes such as the VN-Index, VN30, and VN70 (Midcap), returning valuations to a more balanced condition when compared to 10-year historical P/E ratios.

Second, Q1 2024 earnings: The first quarter of 2024 business results were quite favorable. According to MASVN statistics, with 395 companies listed on HOSE (accounting for approximately 99% of the VN-Index market capitalization) having announced their Q1 2024 earnings, the overall picture shows a number of positive signals, particularly when compared to the profit growth targets set by listed companies for 2024. In Q1 2024, net profit after tax for parent company shareholders (NPATMI) increased by 11.2% year on year and 17% quarter on quarter.

Notably, the study team identified the profit explosion in the Materials, Retail, and Transportation sectors as key drivers of VN-Index profit growth, along with the Banking sector. Analysts were particularly intrigued in HPG, MWG, and HVN's large profit rises, which not only led their sectors but also saw profits climb by several times to tens of times over the same period last year. Specifically, HVN declared a profit of more over VND 4,300 billion in Q1 2024, following 16 straight quarters of cumulative deficits. However, it is worth noting that the majority of HVN's unusual profit came from VND 3,630 billion in extraordinary profits from debt cancellation in a transaction with its subsidiary, Pacific Airlines.

"In other news, the annual shareholder meeting season is winding down, with over 280 businesses announcing their business objectives for 2024 (representing more than 90% of the VN-Index's total market value)." With more favorable company views, the VN-Index's profit growth projection in 2024 might reach 16.7% year on year," MASVN estimated.

Finally, selling pressure has steadily diminished since the end of April, with demand strengthening around the 1,160 to 1,180 point area, setting the framework for a possible upward trend in the near future.

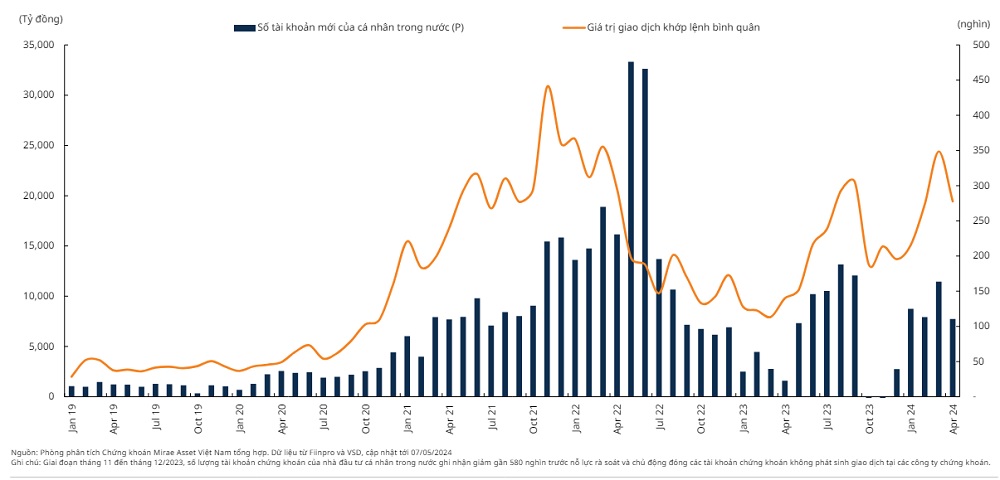

Individual domestic investors also created over 110,000 new securities accounts in April, adding to the additional capital flow that is expected to join the stock market. In recent weeks, private investors have been the primary purchasers in the market.

Domestic individual investors opened 110,622 new accounts in April, bringing the total number of new accounts since the beginning of the year to approximately 513,500. By the end of April 2024, Vietnam had over 7.7 million individual securities accounts, equivalent to about 7.7% of the population.

According to FIDT Research, individual investors were the primary net purchases between April 13 and 17, opposing foreign selling pressure. However, liquidity has not yet increased much, implying possible future capital inflows.

Nguyen Tuan Anh, the founder of FinPeace, argues that because capital inflows have not increased and investors are still waiting on the sidelines, the stock market still has opportunity to climb as buying power increases when foreign cash enters.

FIDT Research reports that international investors continued their net selling trend despite rising currency rates. Foreign investors net sold in three of the last five sessions, for a total of approximately VND 900 billion.

"With the exchange rate trend projected to improve, the State Bank of Vietnam (SBV) is not under pressure to raise interest rates, and liquidity in the banking sector is increasing again. This gives a far better macroeconomic picture than current exchange rate and gold pressures. FIDT Research believes that foreign investment inflows will resume in the near future. Individual investors are currently offsetting the heavy foreign selling pressure, and we expect this capital flow to continue as macroeconomic conditions improve considerably," said Pham Hoang Quang Kiet, Deputy Head of FIDT Research.

In the medium term, several factors are also supporting the stock market, including the potential operation of the KRX system (which has been delayed several times) and information about the stock market's upgrade from frontier to emerging market status, with the next review scheduled for September.