VET faces dual challenges

Risks from a vaccination incident, combined with high competitive pressure, are causing substantial difficulties and challenges for the Central Veterinary Medicine Joint Stock Company (Navetco, UPCoM: VET).

In the first six months of this year, VET only met 36% of its revenue goal and 20% of its pre-tax profit target for 2024.

Declining Business

In the first part of 2024, VET's decline persisted. Net income was little over VND 153 billion, down 13% from the same time last year. After-tax earnings fell 57% year on year, to barely VND 6.2 billion. Compared to the plan authorized at the 2024 Annual General Meeting of Shareholders, the firm has only met 36% of its sales objective and around 20% of its pre-tax profit target for 2024.

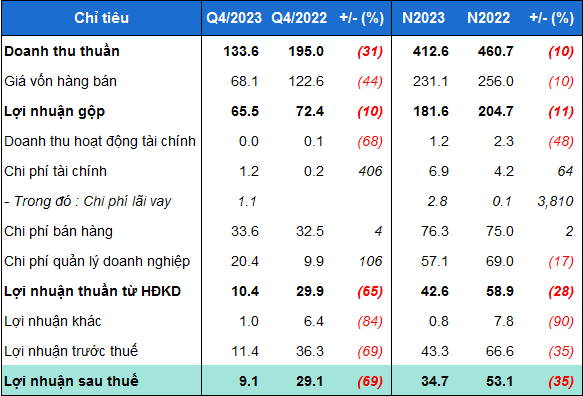

VET has seen business performance drop not just in the first half of this year, but also throughout the previous two years. In 2023, VET's revenue was just VND 413 billion, with after-tax profits of almost VND 29 billion. In 2022, VET generated VND 461 billion in revenue and a net profit of more than VND 53 billion, a 21% reduction year on year.

According to VET’s explanation, the total number of livestock and poultry is decreasing due to disease outbreaks. Moreover, production costs are higher than selling prices, meaning the more livestock is raised, the more losses are incurred, leading farmers in many areas to stop raising livestock or poultry and not replenish their herds. The decrease in livestock numbers has impacted VET's veterinary medicine business, with vaccine products not being consumed. This has caused a sharp decline in the company’s core business.

Vaccine Risks

Furthermore, VET has encountered a new issue as a result of an event using the NAVET-LPVAC vaccination for lumpy skin disease in Lam Dong. On May 17, 2024, VET inked an economic contract with Lam Dong's Livestock, Veterinary, and Fisheries Sub-department to offer vaccinations for lumpy skin disease in cattle, as well as avian influenza vaccines and disinfectants. VET began vaccination dairy cows in Lam Dong at the end of July 2024, where there had been incidents of disease and death (with a mortality rate of around 5%).

VET collaborated with local authorities, specialists in Lam Dong, and dairy cattle experts to develop a treatment regimen, provide personnel, materials, and medicines to treat and restore the cattle herd, while also proposing compensation and remediation plans to share the losses with livestock households. As of September 15, 2024, nearly 6,000 cows had recovered.

Business situation of VET in the Last Two Years

However, because VET is a company with 65% state ownership, overseen by the Ministry of Agriculture and Rural Development (MARD), the company stated that the process for providing support and compensation must comply with legal regulations. Previously, in 2022, in the provinces of Binh Dinh, Phu Yen, and Quang Ngai, after VET vaccinated pigs against African swine fever, mass pig deaths were reported, totaling 743 pigs.

VET provided compensation to farmers with dead pigs, offering VND 2 million per sow or breeding boar and VND 1 million per market pig.

High Competitive Pressure

According to the Ministry of Agriculture and Rural Development, the overall income of the veterinary drugs market is anticipated to be VND 1 trillion per year, with an average revenue per firm of VND 100 billion. Domestic enterprises account for just around 20% of the market, while global corporations control the remaining 80%. However, because to a shortage of finance and intense competition, VET and other industry participants find it extremely difficult to compete on this level.

It is known that MARD applies a regulation that if a manufacturer fails to meet Good Manufacturing Practice (GMP) standards, they will be shut down and their license revoked. This creates significant pressure on businesses in the industry, as each company must invest VND 30–50 billion to meet GMP standards. As a result, the current veterinary medicine market is now a competition among large companies.

The severe competitive pressure has placed VET into a tough situation, pushing it to decrease prices in order to remain competitive. The emphasis for aggressive sales practices has resulted in a steady reduction in VET profitability. The firm indicated that owing to declining revenue, the sales staff was forced to create promotion and discount programs, reduce earnings, and support transportation expenses.

Furthermore, geopolitical events such as the Russia-Ukraine war had an impact on fuel prices, USD exchange rate volatility, and raw material costs, all of which boosted manufacturing costs. However, because to severe competition, VET was unable to raise prices and, in some circumstances, was forced to lower them.