Vietnam banks’ asset quality: Shaken but definitely not broken

Banks’ asset quality has been relatively affected as a consequence of the COVID-19 pandemic, in which 1Q22 average NPL ratio rose while LLR slightly reduced compared with the levels at end-4Q21, said VNDirect.

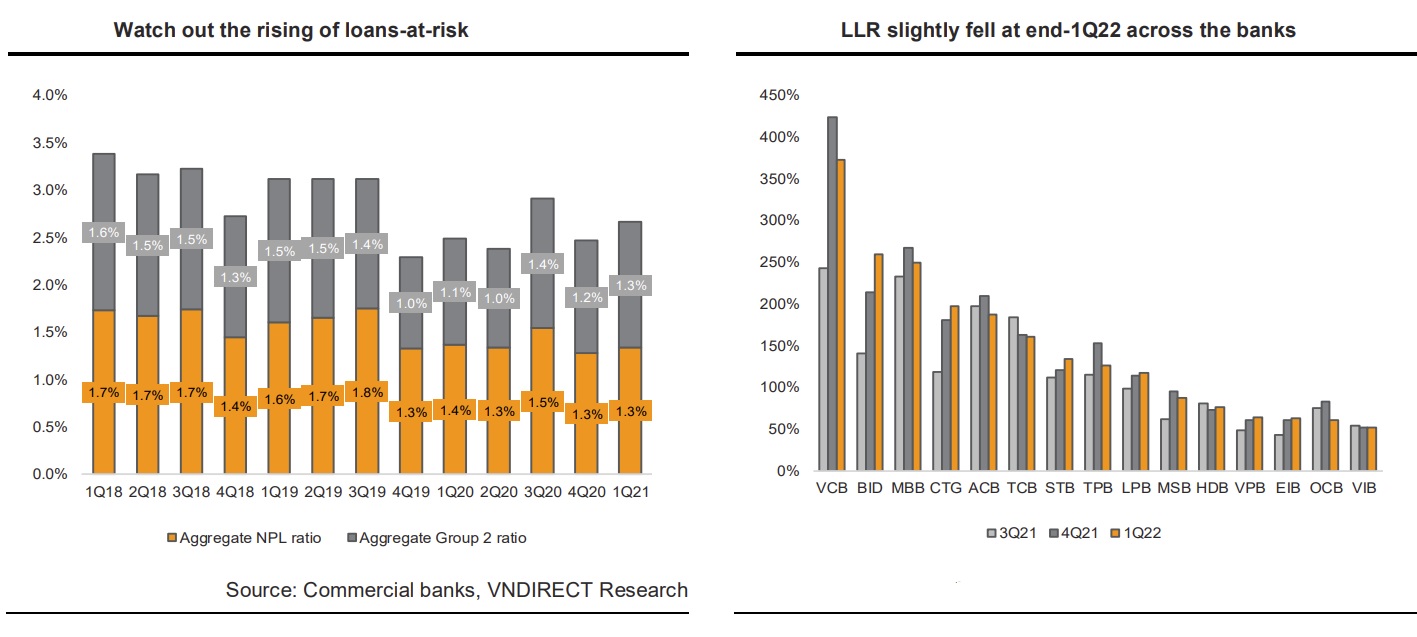

Vietnam banks's average NPL ratio increased to 1.5% at end-1Q22 from the levels of 1.39% at end-2021.

The average NPL ratio in Vietnam banks grew to 1.5 percent at the end of 1Q22, up from 1.39 percent at the end of 2021. The bad debt ratio for Group 5 increased to 0.58 percent at the end of 1Q22, up from 0.51 percent at the end of 4Q21. The entire loan book of 15 publicly traded banks increased by 6.7 percent year over year, while total non-performing loans increased by 11.4 percent. TCB (0.67 percent), VCB (0.81 percent), ACB (0.82 percent), and MBB are the top five banks with the lowest NPL ratios (0.99 percent ).

The average annualized credit cost of 15 listed banks gone down to 1.48% in 1Q22 from the level of 1.84% in 2021 and 1.51% in 1Q21. However, their average provision expense/pre-provision operating profit slightly fell to 28.9% in 1Q22 from 31.4% in 1Q21, thanks to banks’ stronger topline growth and lower CIR. Top banks that posted heavy provisioning include BID (62.1%), CTG (43.2%), TPB (31.8%). Meanwhile, average loan loss reserve (LLR) dropped to 147.2% at end-1Q22 from 151.4% at end-2021, but still higher than that of 108.6% at end-2020. Top 5 highest LLR banks were VCB (372.6%), BID (259.2%), MBB (250.1%), ACB (197.7%) and CTG (197.3%).

The State Bank of Vietnam (SBV)’s permission to keep the debt group constant, according to Mr. Nguyen Quoc Hung, General Secretary of the Vietnam Banking Association, distorts the picture of bad debt. The potential bad debt from the restructured debt balance has not yet manifested itself clearly, but it is expected to rise significantly, especially given the impact of the fourth epidemic.

"The Vietnamese banking system has restructured approximately VND 600,000 billion in outstanding debts to date. However, because there are VND 3 million billion in outstanding loans affected by the virus, this figure is still in its early stages and will continue to rise quickly. On the basis of structured debt, which is effectively bad debt, banks must continue to evaluate new loans. In the environment of businesses still experiencing numerous challenges, when they must combat the pandemic while producing, it will put the banking industry in jeopardy, and bad debts may rise in the near future”, said Mr. Nguyen Quoc Hung.

The expected increase in bad debts in the next months will be visible when Circular N.14/2021/TT-NHNN expires on June 22, 2022. According to the State Bank of Vietnam, the NPL ratio might rise to 7.3 percent if all restructured loans and bad debts sold to VAMC are included, which is comparable to the NPL ratio in 2016-17.

However, according to VNDirect, asset quality in Vietnam banks has significantly improved since 2016-17. They have increased their provisions to prepare for the possibility of escalating bad debt, and LLR has reached all-time high levels in most Vietnam banks by the end of FY21. Aside from that, most Vietnamese banks indicated that all restructured loans were properly supplied.

“Thanks to solid asset quality and strong provisioning buffer, Vietnam banks will be able to mitigate the bad debt spike risk”, VNDirect said.

Furthermore, Vietnam banks are attempting to strengthen their capital adequacy ratio (CAR), reflecting in the CAR improvement at end-FY21 and 1Q22 as well. Raising capital is always a top priority for banks in 2022, especially for State- ownered commercial banks, in order to strengthen their CARs in the direction of Base III application.