Vietnam moves towards green industrial parks to attract capital

Developing “green” industrial parks involves engaging in cleaner production activities, minimising negative environmental impacts, with the goal of achieving zero carbon emissions by 2050.

Traditional industrial parks (IPs) are gradually losing their competitive edge and being replaced by IPs that prioritise green and sustainable elements, making them more attractive to investors, said insiders.

Developing “green” industrial parks involves engaging in cleaner production activities, minimising negative environmental impacts, with the goal of achieving zero carbon emissions by 2050.

Investing in high-tech projects that use clean materials and reduce carbon emissions into the environment is a global trend.

According to Deputy Minister of Planning and Investment Nguyen Thi Bich Ngoc, the transition towards a green and circular economy in industrial parks (IPs) and economic zones (EZs) is a key factor in increasing competitiveness and ensuring sustainable development for each IP, EZ, locality and the overall economy.

With 403 operational industrial zones, promoting the development of eco-industrial zones will mobilise significant resources from the private sector to implement green industrial solutions, ensure energy security, and make a substantial contribution to Vietnam’s climate change response.

This is expected to promote green growth and circular economy practices, reflecting the Vietnamese Government’s strong political determination to implement sustainable development commitment.

A report reviewing the 30-year development of IPs and EZs in Vietnam by the Ministry of Planning and Investment (MPI) showed that by 2030, 40-50% of localities will have plans to convert existing IPs into ecological IPs, while 8-10% of localities will establish new eco-IPs.

Attention has been paid to simultaneously constructing new eco-IPs and transforming traditional IPs into eco-IPs.

According to MB Securities JSC (MBS), investment capital flows into industrial property tend to shift towards secondary markets located away from major cities due to their large supply and lower rental prices.

Quality control technicians at Hana Micron Vina Co., Ltd., a company with 100% investment capital of the Republic of Korea, in Bac Giang province. (Photo: VNA)

There are new challenges in the development of industrial real estate, with India and Indonesia being the biggest competitors with Vietnam in drawing foreign direct investment (FDI) in the hi-tech sector.

Nevertheless, the country holds competitive advantages thanks to signed trade agreements and attractive labour and electricity costs. The upgrade of the Vietnam – US relations to a comprehensive strategic partnership also contributes to attracting investment in hi-tech development.

As of the end of 2023, the total industrial land area in Vietnam reached 89,200 ha, up 1.5% from the end of 2022, mainly thanks to the growth in the northern region.

The total leased industrial land area reached nearly 51,800ha, a 5.7% increase over the end of 2022, with an occupancy rate of around 57.7%.

As of the end of 2023, the total industrial land area in Vietnam reached 89,200 ha, up 1.5% from the end of 2022. (Photo: VNA)

Notably, the occupancy rate of operational industrial parks stands at approximately 72.4%. Rental prices in the southern region remained stable at 168 USD/sq.m, while rental prices in the northern region rose by 10% from the end of 2022 to 123 USD/sq.m.

MBS said that the prospects for the industrial real estate sector in the coming time stem from stable macroeconomic conditions along with efforts to upgrade relationships with major powers help maintain the momentum of rising FDI.

However, new challenges will come from increasing competition from other countries or the risk of electricity shortages impacting production, MBS noted, adding that enterprises with large clean land funds and healthy finances will have long-term growth potential.

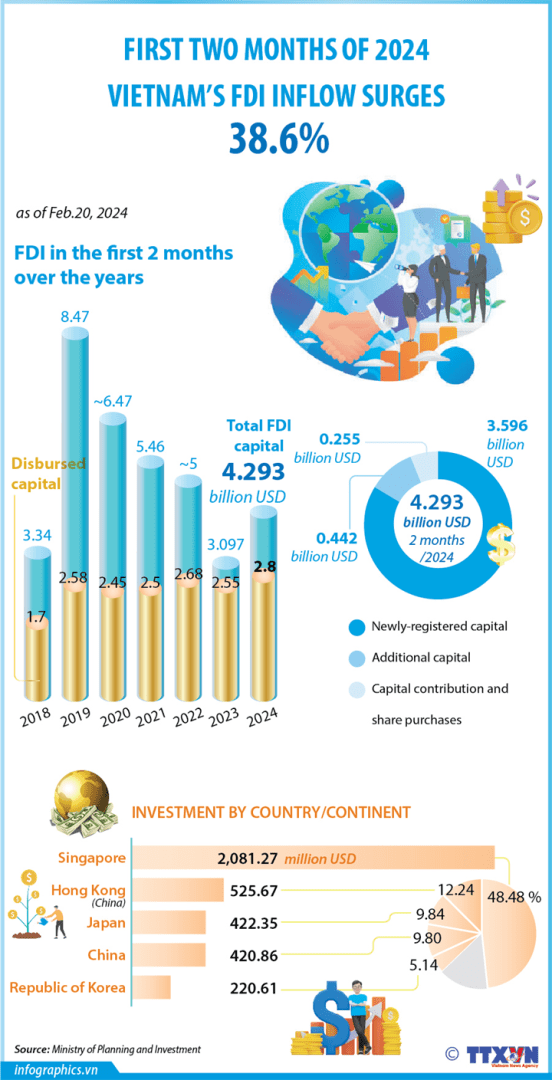

SSI Securities Corporation reported that disbursed FDI capital into Vietnam reached 23.2 billion USD last year, an increase of 3.5% year-on-year, mostly focusing on the manufacturing industry.

Meanwhile, the total committed FDI capital in 2023 rose 24.4% year-on-year to 28.1 billion USD.

SSI expects FDI capital to continue to maintain growth in 2024, focusing on the manufacturing sector (manufacturing and semiconductor enterprises) and renewable energy.

The securities firm said that many listed IP investors have signed Memoranda of Understanding (MOUs) on leasing industrial land to new tenants in the second half of 2023. These MOUs are likely to be converted into official contracts and recorded as revenue in 2024.

The industrial land rental demand in northern IPs is expected to be high in 2024, driven by the trend of shifting production facilities to Vietnam, primarily in the electronics and semiconductor industries.

Southern IPs are projected to record a technical recovery from a low base in 2023. Businesses leasing industrial land are typically businesses operating in textiles, wood, footwear production, logistics and food and beverages.

Thanks to the favourable business environment, many industrial real estate companies reported huge profits in 2023./.