Vietnam’s bid to be upgraded to EM status

Vietnam is classified as a frontier market by FTSE and MSCI. It has been on the FTSE Russell watchlist for a potential upgrade to emerging market (EM) status since September 2018. FTSE is expected to reconsider Vietnam’s status at its review on 7 October 2025.

Vietnam already meets the quantitative criteria, such as the presence of large stocks, trading volumes, and the size of the market.

Despite US tariffs, Vietnam’s stock market is up 40% y-t-d, making it one of the best performers in the world. While we are also in the optimists’ camp, HSBC notes that FTSE also consults investors and brokers when arriving at a final decision. If FTSE were to confirm an upgrade, it would probably take at least another six months before the market classification is changed.

Progress of Vietnam

For a market to be upgraded to EM status, it must meet various criteria laid out in FTSE’s Quality of Markets framework. Vietnam already meets the quantitative criteria, such as the presence of large stocks, trading volumes, and the size of the market. Vietnam is still classified as a frontier market because of qualitative limitations.

For example, FTSE noted in the past that Vietnam failed to meet the “Settlement Cycle (DvP)” and “Settlement – costs associated with failed trades” criteria. At the time, FTSE rated them as ‘Restricted’, a partial failure. The issue is that Vietnam conducts a pre-trading check to ensure the availability of funds prior to the execution of a trade. This makes trading and settlement an onerous process.

In its latest update, FTSE acknowledged that Vietnam now meets seven out of the nine criteria required (see Table 1 on the next page). Notable progress has been made on the two pending requirements and, in our view, this strengthens Vietnam’s case for reclassification. For example:

The relaxation of pre-funding requirements to purchase stocks. This was changed in September 2024 when the Securities Law was amended; this included the need for market information disclosures to be available in English.

Vietnam launched the much-awaited KRX trading system in May this year. This was a pivotal moment for the exchange. The new system overcomes issues such as order congestion and has the capacity to handle high trading volumes.

More importantly, this system paves the way for the exchange to transition to a central counterparty clearing system in which trading and settlement is simultaneous and more efficient.

HSBC thinks this moves Vietnam closer to EM status. Note that FTSE also consults investors and brokers in arriving at a final decision. If it were to confirm an upgrade, it might take at least another six months before the classification is changed and for Vietnam to be included in FTSE indices. That is to ensure a smooth transition. Recent upgrades of other markets from frontier to EM status took one year.

Foreign ownership limits

One issue FTSE has highlighted is the complicated registration process for foreign investors. In addition, there are foreign ownership limits (FOLs) in certain industries such as banking, aviation, and telecoms. They are typically up to 50%, but the limit of foreign ownership in commercial banks stands at 30%.

This means that when foreigners have bought 50% of a company’s shares they can only trade with other foreigners. A foreign price will be established, which differs from prices for local investors. While this may not be a strict requirement for FTSE for re-classification, it might be an issue raised by investors.

At present, only 12 stocks in the VN Index have reached their FOL limits. Overall, the VN Index has a FOL of 42%, while current foreign holdings are less than half the limit at c17%.

Vietnam will be on MSCI’s watchlist?

Vietnam is not yet on MSCI’s watchlist for a potential upgrade to EM status. For this, it must meet MSCI’s assessment criteria, which are more stringent than FTSE’s. MSCI follows an 18-factor framework unlike FTSE’s nine criteria framework.

MSCI’s 2024 Global Market Accessibility Review highlighted nine areas where Vietnam’s market still falls short of expectations. Foreign ownership limits is one. Other issues are the absence of detailed disclosures in English, the lack of an offshore currency market, and limitations in the onshore currency markets, prefunding of trades, and restrictions in off-market transfers. Since the latest MSCI review, local regulators have worked on some of these restrictions. Resolving issues around FOL limits and FX hedging are still pending.

In a best-case scenario, even if MSCI puts Vietnam on a watchlist in its next classification review in June 2026, any upgrade to EM would not take place before 2028.

Prospects for material fund inflows

The short answer is yes. An upgrade means Vietnam would automatically be included in indices like FTSE All-World, FTSE EM, and FTSE Asia. Passive funds benchmarked to these indices will have to buy Vietnam equities or ETFs. Active funds have the discretion to do so.

Our analysis tells us that a large portion of Asian and EM active funds already hold Vietnamese equities (38% of Asia funds and 30% of GEM funds). The Asia funds already own on average 0.5% in Vietnam.

The number of funds dedicated solely to Vietnam has risen in recent years. There are now more than 100, with total AUM of USD11bn, vs 17 with AUM of USD3bn at the end of 2014.

It is important to highlight that a large portion of passive funds investing in EM and Asia are benchmarked to MSCI indices. Only a few track FTSE indices. As FTSE will determine whether to upgrade Vietnam in October, and a decision by MSCI’s might take a few more years, only FTSE benchmarked passive funds will have to buy Vietnam equities upon inclusion. With this in mind, we crunched a few numbers to get an idea of the size of potential inflows:

Assuming that Vietnam is upgraded to EM status at its current frontier market cap, it will account for c0.6% of the weight in the FTSE Asia and c0.5% in the FTSE EM. In this scenario, USD1.5bn of foreign capital is expected to flow into Vietnam’s stock market via passive funds, with the majority of inflows from the funds benchmarked to FTSE EM and FTSE Global ex US.

If the inclusion weight for Vietnam in EM Asia is 1.3% – similar to Indonesia’s weight in the index, an optimistic assumption – inflows could be as high as USD3bn.

For all active funds, as highlighted earlier, many already have exposure to Vietnam. Adjusting for that, we estimate the flows from active funds to be between USD1.9bn and USD7.4bn, depending on Vietnam’s weight in the index.

In short, based on HSBC’s most optimist scenario, reclassification by FTSE could bring a maximum of USD10.4bn into Vietnamese equities.

HSBC thinks the actual flows are likely to be much more moderate and staggered. FTSE gives at least six months’ notice before changing the classification of any country, and the inclusion takes place in tranches to minimise the impact on the market. For passive funds, approximately USD1.5bn would enter the market immediately once inclusion is completed.

Lessons from similar upgrades

A number of markets have been upgraded by MSCI and FTSE over the past 10 years. Vietnam can learn lessons from their experience.

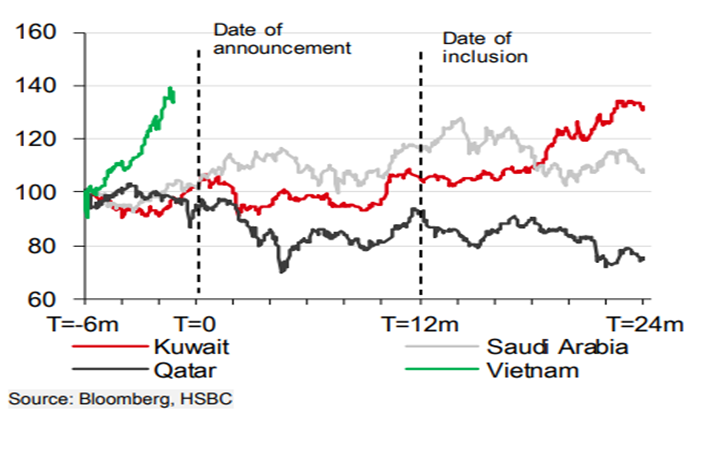

Saudi Arabia and Kuwait were the latest upgrades by FTSE, also from frontier to EM. These markets were broadly flat in the six months leading up to the announcement of their inclusion.

Saudi equities rallied by 15% between the announcement of inclusion and first tranche following inclusion. Saudi is a much bigger market and hence FTSE completed the inclusion in six different tranches. Qatar on the other hand underperformed. Vietnam, on the contrary, has enjoyed an outsized rally, up 37% over the past six months.

“Vietnam’s performance is also quite remarkable compared to markets that were upgraded by MSCI. The best comparisons are with UAE and Qatar, which were upgraded in 2014. The UAE rose 33% in the six months up to the announcement and another 43% between confirmation and inclusion. Qatar was up 46% between the announcement and inclusion. But we have to be careful about assuming all these gains were the results of the MSCI upgrade as the timing coincided with a period of a rally in oil prices (Brent went as high as over USD110 per barrel)”, said HSBC.