USD in global foreign-exchange reserves and expectations for exchange rates

The U.S. dollar is the settlement core of the world, where virtually every financial thread converges into the central hub of the Federal Reserve.

Most reserves of central banks around the world remain held in USD. The dollar’s share is currently around 58% (IMF COFER), far ahead of the euro (20%), yen (6%), pound (5%) and RMB (2%).

Central banks around the world continue to peg their domestic currencies to the dollar. This explains why policy moves in the U.S. – such as interest-rate adjustments by the Fed – and fluctuations in the dollar carry profound implications for the monetary policy of many central banks and the value of numerous national currencies.

“The settlement core” of the world

“In today’s financial order, the U.S. dollar is akin to a silent bloodstream to which all economic flows must return. It is not only a medium of exchange, but a symbol of trust and power. That privilege is an ‘exorbitant privilege’ – a favour that history has never granted another nation,” says Mr Nguyễn Minh Hạnh, Director of Securities Analysis at SHS.

According to SHS, over half of global foreign-exchange reserves remain denominated in USD, about 58% in 2024. Other currencies — the euro, yen, pound and China’s renminbi — comprise only small fractions, like stars orbiting the bright moon. Despite periodic criticism or challenge of the U.S., its role has remained largely unchanged since the early 21st century. Even when the U.S. froze Russia’s reserves in 2022 — a move that startled many countries — the global financial flows still lacked a credible alternative. “Even the BRICS bank primarily trades in dollars — so ‘de-dollarisation’ remains a long, hard road,” the SHS “Global Order in Flux” report states.

Not only in central-bank reserves is the dollar dominant—it also controls key global payment and settlement flows. On the Society for Worldwide Interbank Financial Telecommunication (SWIFT) system, about 50% of transactions still use the green-back; in the FX market, the dollar appears in 88% of all trades, dominating for decades.

“The dollar is the settlement core of the world, where every financial thread converges into the central hub of the Federal Reserve. Central banks everywhere continue to anchor their domestic currencies to the U.S. dollar, and when needed the Fed simply opens a ‘swap line’ and USD floods allied nations like a life-saving stream.” As a result, the U.S. can borrow in its own currency, benefit from low interest rates and wield immense sanctions power.

USD and the U.S. Treasury market

Alongside the dollar’s strength, U.S. Treasuries constitute the backbone of the global financial system. As of Q1 2025, foreign investors held roughly USD 9 trillion in U.S. Treasuries, about 32% of total issuance. This proportion had been near 50% in 2014, before the U.S. public-debt surge and sales by some nations. Even at 32%, the absolute size remains enormous—roughly 12% of global GDP.

The U.S. Treasury market is the largest and most liquid debt market worldwide, with daily volumes exceeding USD 1 trillion, across maturities from 1-month to 30-years.

China’s ambition to internationalise the RMB

These data and viewpoints matter especially as China pursues “de-dollarisation” — seeking to reduce dependence on the U.S. dollar and American assets. While Japan has become a major creditor holding more than USD 1 trillion in UST (as of May 2025), China has restructured its massive USD 3.1 trillion FX reserves over the past decade, reducing U.S. debt exposure and diversifying.

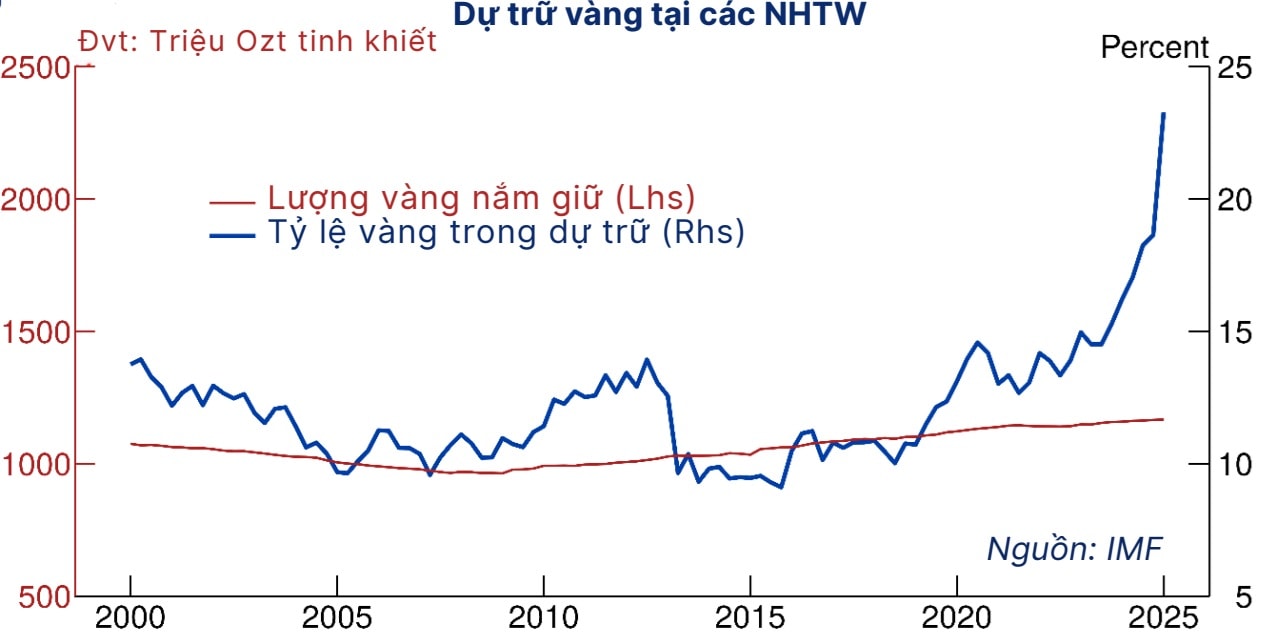

Global gold prices rose about 26% in 2024 and approximately 54% from the start of 2025 to October 8, reflecting consistent buying by central banks including China. U.S. Treasury data show China’s holdings of UST fell continuously from over USD 1.3 trillion in 2011 to around USD 765 billion by March 2025. Conversely, China’s gold reserves rose from 1,054 tonnes in 2015 to over 2,298 tonnes by Q2 2025—now among the largest globally. Valued at market rates, gold accounts for about 5% of China’s FX reserves, though the bulk remains dollar-denominated.

“This trend is not unique to China. The world is witnessing the return of gold as the ‘ultimately final currency’. In 2024, the gold share in global FX reserves reached 18%—highest in three decades—and for the first time, central-bank gold holdings exceeded the total value of U.S. Treasuries they hold. Russia, Turkey and China are major buyers, sharing a common concern: geopolitical risk and the dominance of the dollar—and, more critically, gold stands outside SWIFT sanctions,” Mr Nguyễn Minh Hạnh observes.

Yet despite China’s ambition to internationalise the renminbi (RMB; CNY), the results remain limited: the RMB accounts for about 2% of global FX reserves, 23% of international payments and 7% of FX transactions — far below China’s trade volume and economic scale.

The dollar enters the digital era?

While the foundation, power and status of the dollar remain intact, signals are emerging that its value and credibility may face risks. In the digital age, a new “pipeline” mechanism is forming—fueling commerce and spreading influence much like the USD did—namely stablecoins: the digital version of the dollar, or rather tokenised T-bills. U.S. debt is now being transformed into globally circulating tokens via blockchain.

According to Mr Hạnh, stablecoins such as USDT (Tether) or USDC (Circle) are fully backed by safe-asset reserves, mostly short-term U.S. Treasuries and cash. When users deposit USD on an exchange or wallet, the issuer mints equivalent tokens and uses the received USD to buy T-bills or similarly secure money-market instruments. Thus, each USDT or USDC in circulation is backed by a fraction of U.S. Treasuries in their reserves—a T-bill turned token. Currently, the two largest stablecoins—USDT and USDC—are major purchasers of T-bills. U.S. policy is being shaped to regulate them, with the goal of “reinforcing the global standing of the dollar in its digital form”.

In practice, the rise of stablecoins does not weaken the dollar’s role, but rather reinforces its spread. Crypto users ultimately still hold USDT or USDC, meaning they hold assets denominated in USD. The digital world, which seemed poised to escape the traditional financial system, becomes in fact a new belt for the USD. A U.S. Treasury official in 2025 estimated that the market capitalisation of U.S.-dollar-pegged stablecoins could reach USD 2 trillion by 2028, or even more.

America wants to usher the dollar into the digital era, extending its power into the blockchain realm. In the age of digitalisation, stablecoins are taking the dollar to places that traditional banks cannot reach—new markets, fragile economies, people seeking to preserve value in the strongest currency. This is the test to maintain the central status of the dollar.

Implications for exchange rates

Therefore, as long as the global financial order remains largely unchanged—with most central banks anchoring their domestic currencies to the dollar—then many countries’ independent monetary policies will continue to be “tethered” to the dollar, which remains the core reserve unit of the global system.

The interest-rate policy announced by the Fed today (30/10, Vietnam time) may not fulfil all global investors’ expectations. Although the Fed’s journey to bring inflation down to 2% still lies ahead, at least one further rate cut of 0.25%—bringing the federal-funds rate into the target range of 3.75-4%—would reduce reserve-holdings risk. Alongside this, numerous currencies would face less depreciation pressure.

For the USD/VND exchange rate, the pressure is clearly reduced. At the same time, from now until year-end, the policymaker will have more room to support growth rather than focus solely on exchange-rate defence.

Importantly, many firms with USD-denominated debt are expecting borrowing costs to decline. At the same time, many large private Vietnamese companies have been planning international fundraising. This is the time when major investment decisions need the backing of a favourable macro-environment, stable inflation and exchange rate.

When interest rates in developed markets decline, the interest-rate differential between emerging markets such as Vietnam and the U.S. may narrow, prompting foreign capital to search for more attractive alternatives beyond the U.S. Accordingly, Vietnam is expected to become a destination to receive renewed or even accelerated foreign-capital flows in the future—following the Fed’s ultimate objective of keeping inflation low to uphold the dollar’s status.