Vietnam’s consumer–retail giants open doors to foreign capital

Vietnam is moving closer to a long-awaited market upgrade, opening the way for deeper inflows of global capital.

Among the industries expected to benefit from reclassification, shares of Masan Group (HoSE: MSN)—with a market capitalization of nearly USD 4.8 billion, ample liquidity, open foreign ownership room, and a solid business foundation—stand out as a prime candidate for foreign investors.

Market Upgrade and the Potential Capital Wave

Under the government’s stock market development strategy through 2030, Vietnam is accelerating reforms to secure an upgrade from frontier to emerging market status. Such a shift would not only raise the country’s profile but also unlock billions of dollars in potential inflows from ETFs, passive funds, and active global investors.

In September 2025, Vietnam’s equity market enters a critical phase of global scrutiny as FTSE Russell prepares its periodic review. After years on the watchlist, the chance of an upgrade has never been higher. According to SSI Research’s latest strategy report, Vietnam is likely to be reclassified by FTSE Russell in October 2025. The event could draw in roughly USD 1 billion from index-tracking ETFs. History from other markets shows that stocks often rally even ahead of an upgrade, fueled by expectations of increased foreign capital and improved investor sentiment.

With a market capitalization of around VND 90 trillion (USD 3.4 billion), a 30-day average liquidity of USD 15.1 million, and nearly 24% foreign room remaining, MSN emerges as a strong candidate to be included in global indices. Beyond technical criteria, however, its appeal rests on robust fundamentals.

A Resilient Consumer–Retail Ecosystem

What sets MSN apart for long-term investors is its business model rooted in essential consumer demand—the most sustainable growth driver in Vietnam. With a population of nearly 100 million, the country’s total retail sales and consumer services revenue in 2024 reached VND 6.39 quadrillion, up 9% year-on-year, creating vast room for market leaders.

Masan today operates an integrated consumer–retail ecosystem spanning production to distribution. Its portfolio includes Masan Consumer (MCH), WinCommerce (WCM), Masan MEATLife (MML), and Phuc Long Heritage (PLH). Among them, WCM leads the modern retail market with nearly 4,200 stores, providing a powerful distribution channel for MCH and MML products.

According to company data, second-quarter 2025 results highlight not just headline growth but also the synergies of its integrated ecosystem—from FMCG and retail to food and high-tech materials. Quarterly net revenue hit VND 18.3 trillion, with pre-minority profit after tax of VND 1.6 trillion, bringing six-month earnings to VND 2.6 trillion—nearly double year-on-year and over 50% of the full-year target.

Within this, WinCommerce reaffirmed its role as the engine of modern retail, posting four consecutive profitable quarters. Q2 revenue rose 16.4%, driven by expansion of the WinMart format into rural areas—an increasingly fast-growing market. Masan MEATLife accelerated with VND 2.34 trillion in revenue, up 30.7%, as it sharpened its focus on processed meat products in line with consumers’ shift toward higher-value items. Meanwhile, Masan High-Tech Materials capitalized on recovering prices of strategic minerals to improve margins, adding further momentum.

Attractive Valuation in the Upgrade Scenario

These strong results not only cement MSN’s role as Vietnam’s consumer–retail leader but also strengthen its case as an attractive stock for both domestic and foreign investors ahead of a market upgrade.

On the HoSE, MSN remains among the largest-cap stocks with stable liquidity in the VN30 basket, well positioned to absorb billion-dollar flows. Recent shareholder restructuring has significantly improved its free-float ratio, aligning it more closely with global index criteria. SSI Research highlights this as a key reason MSN is well placed to benefit directly from foreign inflows post-upgrade.

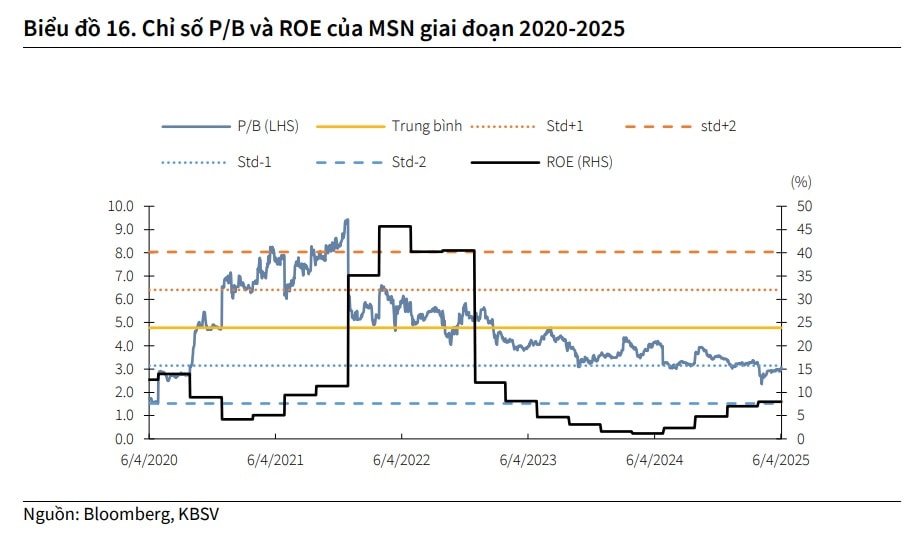

Brokerage valuations also reinforce investor confidence. KBSV estimates MSN’s fair value at VND 100,000 per share under a sum-of-the-parts model. VCBS recommends a BUY with a target of VND 93,208—around 14% above the current price. VCI sets a higher target at VND 101,000, citing advantages from network expansion and portfolio optimization.As Vietnam edges nearer to its reclassification milestone, international institutions will prioritize stocks that meet both technical requirements and growth potential. With its essential consumer base, improving financial performance, and wide foreign ownership room, MSN is emerging as a strategic “gateway” for global capital seeking deeper exposure to Vietnam’s market.