Vietnam’s Exports to U.S.: Short-term Breakthroughs but Risks Ahead

Vietnam’s GDP grew 7.5% in the first half of 2025, up from 6.5% a year earlier, driven by strong exports, particularly to the U.S. However, rising global trade risks could weigh on future export performance.

According to the latest World Bank report, Vietnam’s economic growth in the first half of 2025 was fueled by a 14.2% rise in exports, with shipments to the U.S. jumping by 28.3% as businesses anticipated higher tariffs.

Vietnam is among the most trade-dependent economies in the world, with the U.S. as a key partner. The country’s trade-to-GDP ratio reached over 170% in 2024 (the highest in the East Asia-Pacific region after Singapore), with exports to the U.S. accounting for 30% of total exports, equivalent to 26% of GDP in 2024. The U.S. is Vietnam’s largest export market, with total shipments amounting to US$136.6 billion in 2024. In the first seven months of 2025, Vietnam’s exports to the U.S. hit US$106 billion, up 44% year-on-year. The Bilateral Trade Agreement (BTA) between Vietnam and the U.S., implemented since 2001, has significantly boosted trade relations between the two nations.

Vietnam-U.S. trade relations are also reflected in investment and employment figures, particularly in electronics, textiles, and footwear. Intel established its first office in Vietnam in 1997 and opened a US$1 billion assembly and testing facility in Ho Chi Minh City in 2010, employing thousands of Vietnamese workers. Other major U.S. corporations have also set up large-scale operations in Vietnam, especially in processing, manufacturing, textiles, and footwear, thereby helping the country integrate further into global value chains. Notably, as of January 2025, Nike had partnered with 98 contractors operating 162 factories in Vietnam, employing over 493,000 workers and producing about half of Nike’s global footwear output.

Since 2018, U.S. exports have more than tripled as firms adopted a “China 1” strategy, making Vietnam increasingly reliant on U.S. demand. The trend accelerated in 2025, with companies frontloading electronics, furniture, and machinery ahead of expected tariffs.

However, according to Viet Dragon Securities Corporation (VDSC), since the U.S. imposed a 20% tariff, Vietnam’s export growth to the U.S. has slowed, driven mostly by FDI firms and electronics rather than domestic producers. While exports equal about 26% of GDP, domestic value-added is only 10%, highlighting heavy dependence on U.S. demand and rising trade risks across key sectors.

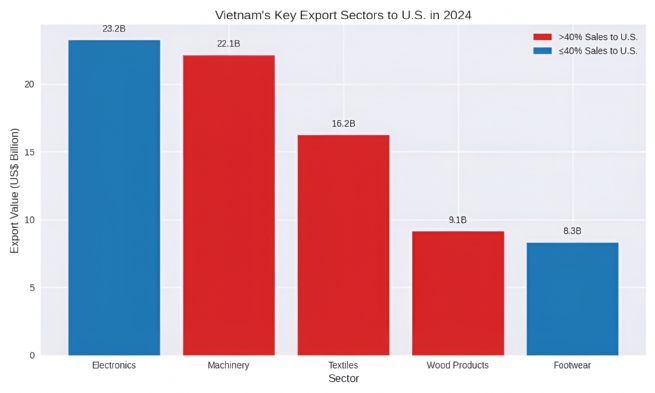

In 2024, Vietnam’s key exports to the U.S. were electronics (US$23.2 billion, 32% of total), machinery (US$22.1 billion, 42%), textiles (US$16.2 billion, 43%), wood products (US$9.1 billion, 56%), and footwear (US$8.3 billion, 36%). With several sectors deriving over 40% of sales from the U.S., textiles, footwear, and wood products are especially exposed to demand shocks and higher tariffs under new reciprocal measures.

Looking ahead, the World Bank projected that global growth will slow as trade decelerates. Global economic activity is forecast to ease from 2.8% in 2024 to 2.3% and 2.4% in 2025-2026 respectively. This is due to weaker global trade growth and prolonged geopolitical tensions. U.S. growth is expected to decline in the second half of 2025, further dampening external demand for Vietnam’s products. Consequently, Vietnam’s exports to the U.S. may fall short of expectations, especially if transshipment provisions lead to higher tariffs. With limited scope to offset losses in other markets, this could further weigh on Vietnam’s export growth.

To address this, according to representatives of some Vietnamese enterprises, firms need to meet green standards and international certifications. This requires investment in production lines and technology, which raises costs while output prices remain unchanged, thereby squeezing profit margins. However, this is a mandatory requirement for maintaining market share.

Moreover, Vietnamese companies must promptly implement ERP management systems to ensure accurate traceability. Without proof of origin, goods may face high tariffs, causing severe damage to businesses, particularly in textiles. Enterprises need to build an ecosystem aligned with global standards, from ESG documentation and traceability to efficient logistics corridors. The most crucial factor is that everything must be verifiable and transparent.