Vietnam’s path to emerging market status

For Vietnam to be upgraded to EM status by MSCI and FTSE, it must meet various criteria.

Vietnam is doing its best to reform the securities market and bring it closer to international standards. Photo: Quoc Tuan

Toward international standards

Key issues outstanding are the presence of foreign ownership limit s, a lack of some disclosures in English, the lack of an offshore currency market and limit ations in the onshore currency markets, mandatory registration of accounts, prefunding of trades and restrictions in off-market transfers.

With new securities, investment and enterprise laws being passed, some of these issues should be addressed, albeit gradually. In 2019, Vietnam adopted the Law on Securities 2019, which seeks to restructure the market. This law came into force in 2021, introducing, among other things, a new settlement and clearing system under the Central Counter Party (CCP) model and Non-Voting Depositary Receipt (NVDR). NVDRs allow foreign investors to gain exposure to the share price performances of stocks that have reached their FOL, without the right to be involved in the companies’ decision making.

The new KRX trading system (a new IT system provided by the Korea exchange) is expected to come into operation later this year. This should improve trading, access to information, launch of new instruments such as intra-day trading and NVDRs and allow for more efficient clearing and settlement. The key point is that investors will no longer have to prefund their purchases.

In short, Vietnam is doing its best to reform the securities market and bring it closer to international standards.

Attraction of capital from ETFs

According to Mr. Do Bao Ngoc, Deputy General Director of Vietnam Construction Securities JSC, the Vietnamese stock market is not eligible to be upgraded from a frontier to emerging market because it is still lacking in many areas.

"If the missing criteria are quickly addressed, the Vietnamese stock market will be recognized as an emerging market, drawing more foreign investments. For example, global ETFs will boost their allocation of money to emerging markets", Mr. Do Bao Ngoc expressed his thoughts.

Mr. Do Bao Ngoc believes that in emerging markets, the capital allocation ratio of ETFs will be significantly higher than in frontier markets. As a result, if Vietnam's stock market is recognized as an emerging one, ETFs’ capital will flow into the Vietnam’s stock market in substantial amounts. ETFs will also invest in large-cap equities from the VN30 group.

"It is projected that tens of billions of dollars will be invested in the Vietnamese stock market through ETFs and actively-managed funds if it is recognized as an emerging market," he said. Ngoc explained.

Potential EM index inclusion

Consequently, with all these changes, which could address most of the concerns of the index providers, the FTSE added Vietnam to a watch list in September 2018 for possible reclassification to secondary EM status, due in September 2022. The market is yet to make it onto MSCI’s watch list, but if required reforms are implemented, it might meet the necessary criteria ahead of May 2023 (before the next review).

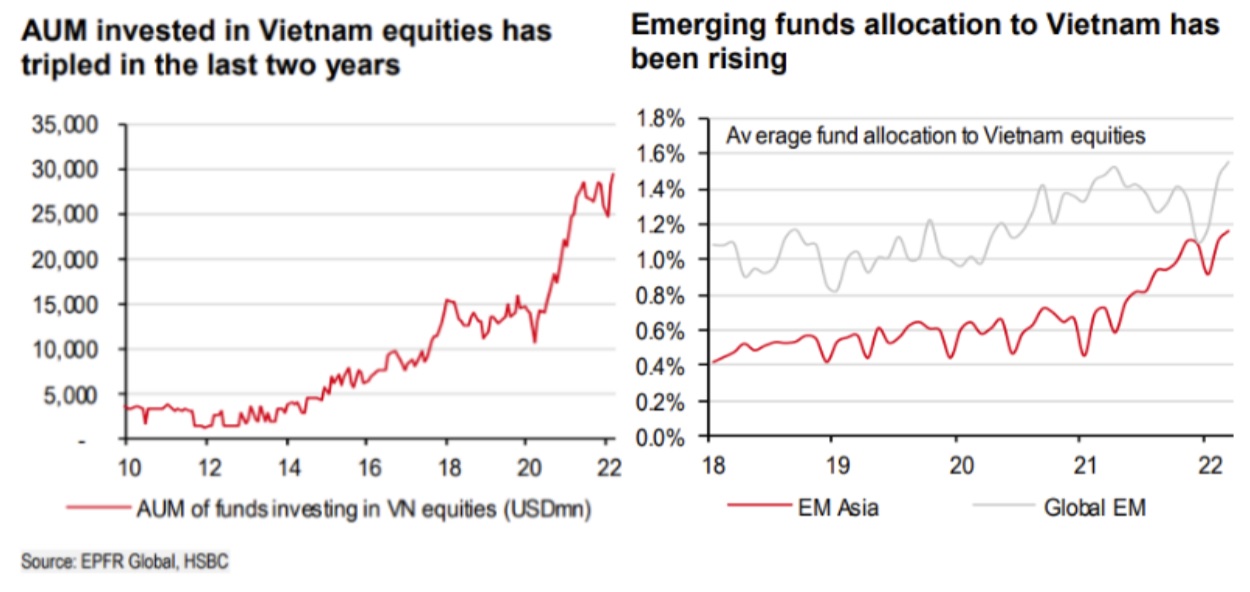

Being added to MSCI’s watch list could see increased fund flows into the market. But global funds already have built decent exposure to Vietnam equities.