Vietnam stock market: A soft recovery is underway

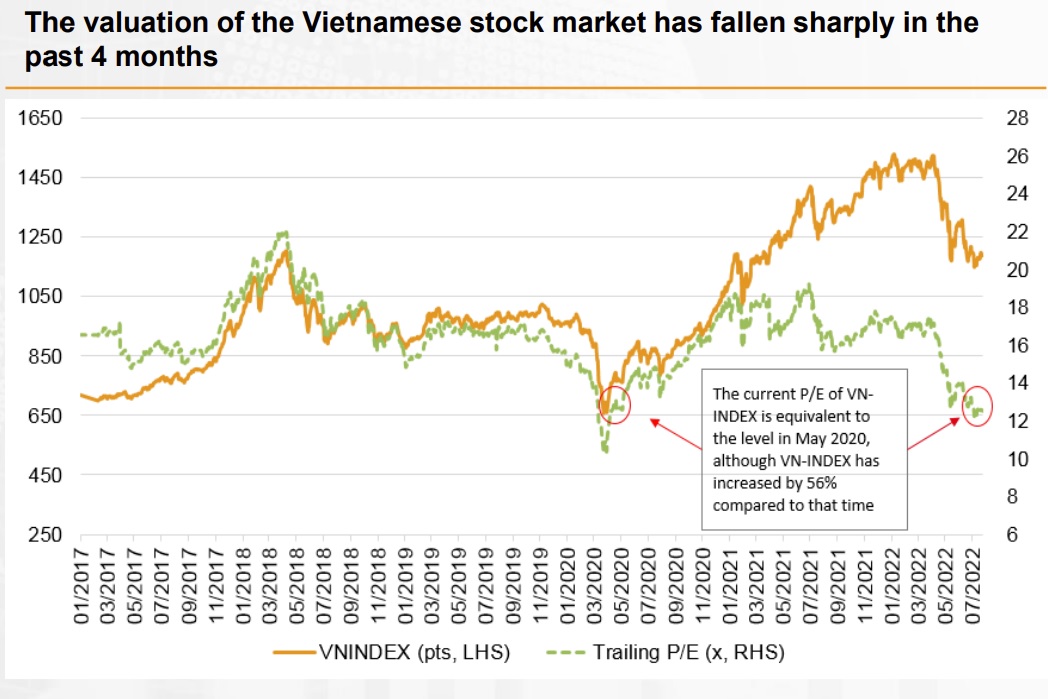

In early August, the VN-INDEX successfully broke the 1,200 level, reaching 1,256 points.

The VN-INDEX reached 1,256 points in early August 2022.

>> The VN-Index is under downward pressure

VN-INDEX started to bottom out from the lowest level of 1,149.6 since July 6 and then closed the month at 1,206.3pts (0.7% mtd, -19.5% ytd). Market sentiment has improved following the rally in the US stock market and the constructive economic growth of Vietnam.

The average trading value of three bourses decreased by 24.1% mom (-45.7% yoy) to VND13,444bn (HOSE: VND11,452bn/trading day, -22.0% mom; HNX: VND1,251bn/trading day, -30.4% mom; UPCOM: VND741bn/trading day, -39.5% mom). Notably, foreign investors changed their position from net buyers to net sellers, with an outflow of VND2,138bn in July.

VNDirect expects Vietnam’s GDP to increase 7.8% yoy in 2H22F (vs. -0.2% in 2H21), thus lifting the 2022 full-year growth rate to 7.1% yoy (/-0.3% pts). The main supports come from (1) the low base in 3Q21 when Vietnam's GDP dropped 6.0% yoy, (2) the reopening of non-essential services, including public transport, tourism, and entertainment, (3) new economic stimulus packages (2% VAT reduction, additional interest rate compensation package worth VND 40,000bn, disbursing investment package for infrastructure development worth VND 113,050bn,...), (4) the recovery of FDI inflows after the government allowing international commercial flights and (5) strong export activities.

However, in VNDirect’s view, Vietnam's economy could face potential risks in the second half of 2022, such as: (1) export slowdown due to lower external demand, higher inflationary pressure, (3) increasing interest rates.

Meanwhile, market earnings growth decelerated in 2Q22. As at July 29, 2022, 778 listed companies, representing 45.1% of the total listed stocks and 55.9% of market capitalisation, have released 2Q22 results. At this point of time, aggregate revenue and earnings of listed companies that have been reporting results grew positively by 9.4% yoy and 16.9% yoy in 2Q22, respectively. For 1H22, the net profit of listed companies on three bourses rose 26.0% yoy (1H22 NP growth was calculated on companies which had released 2Q22 business results).

>> 2022 stock market outlook: VN-Index could hit a new record

"We maintain our forecast of market earnings to grow 23% yoy and 19% for FY22F and FY23F, respectively," said VNDirect.

The best is yet to come, the worst seems to be over. As for the timing, the external situation has improved, with market expectations of Fed rate hikes having passed their peak. While global macro is not completely out of the woods, we may see incremental optimism for the Vietnam equity market, which will be supported by (1) global inflation likely to cool down, (2) the FED reducing the intensity of monetary tightening policy, (3) State Bank of Vietnam's signal its plan to increase commercial banks’ credit growth quota, (4) Decree 153/2020/ND-CP to be modified to loosen some requirements relating to corporate bond issuance than previous drafts.

VNDirect expects the VN-INDEX to fluctuate within the narrow range of 1,180-1,260 points in August 2022. Market liquidity would remain low. Therefore, investors should maintain a moderate proportion of stocks and limit the use of margin at the moment to minimize risks. Its high-conviction stocks for August include: BCG, DXG, KBC, PNJ, SZC and VTP.

However, a lot of observers predicted that if market liquidity continued to increase, the VN-Index would reach 1,300 points.

In VNDirect's view, downside risks to the market in the short term include: (1) higher-than-expected inflation due to increasing food prices, (2) the US dollar continues to strengthen, putting more pressure on Vietnam’s exchange rates, interest rates, and foreign investment.