Vietnam to control inflation at 3.2% in 2021: KB Securities

The CPI inflation in the second quarter of 2021 remained low despite a slight acceleration in the last 4 months.

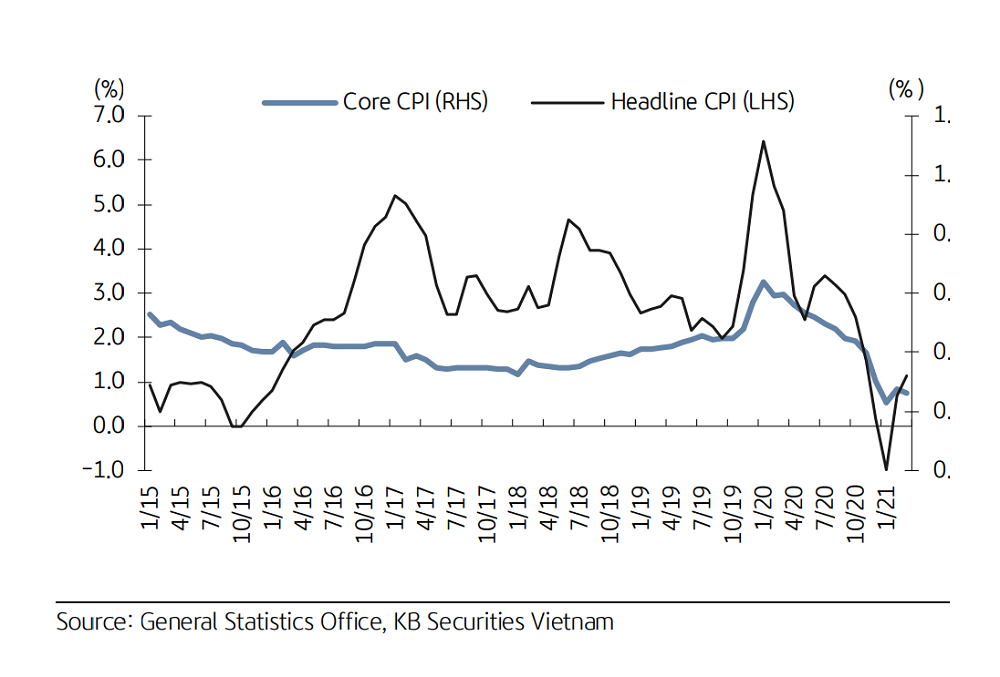

Vietnam - Headline and core inflation (% YoY)

The average CPI in 2Q increased by 0.45% QoQ and 2.67% YoY. The H1- 2021 average CPI rose 1.46% YoY, which is safe compared to the limit of less than 4% mentioned in the Government’s Resolution 01/NQ-CP earlier this year. However, the MoM CPI inflation tends to increase gradually in the past four months, corresponding to the period when the price of raw materials (steel, oil, and copper) surged from rebounding demand, while the broken supply chain had not yet recovered. The core inflation tends to be similar to headline inflation, the average core CPI rose 0.9% YoY. In the first six months of this year, the main factors affecting CPI include:

First, food prices decreased by 0.39% YoY, causing the overall CPI to decrease by 0.08 percentage points.

Second, the Government implemented bailouts packages for Coronavirus-hit people and producers. For example, the aid package launched by Electricity of Vietnam (EVN) made the average price of electricity in H1- 2021 go down 3.06% YoY, causing the headline CPI to decrease by 0.1 percentage points.

Third, the domestic pump prices increased by 17.01% YoY, causing the headline CPI to increase by 0.61 percentage points.

Fourth, the gas prices increased by 16.51%, making the headline CPI increase by 0.24 percentage points.

Fifth, the prices of educational services increased by 4.47% YoY under the impact of tuition fee increase according to the Decree No. 86 /2015/ND-CP, causing the headline CPI to increase by 0.24 percentage points.

The Bloomberg Commodity Index, which tracks price movements of commodities around the world, has slowed down since the strong rise in the beginning of the year and moved sideways from 2Q. KB Securities believed that the period of the strongest increase in world commodity prices would be over and the general trend will be flat or correct until the end of the year when the supply starts to recover, the supply chain is restored, while the consumer demand stabilizes and the positive impacts from fiscal support packages in major countries gradually fade away. More specifically, the domestic steel prices- the main input construction material cooled down thanks to the adjustment of the world billet prices, while the petrol prices should remain unchanged in the next few adjustment periods, similar to the stable movements of world oil prices after the previous surge.

Meanwhile, the prices of liveweight hog prices at the moment reached two-year lows of around VND65,000 - 67,000/kg in the North, falling from the peak of VND94,000/kg more than one year ago. This is partly caused by weakening demand when the pandemic hinders gathering activities, catering services, and tourism, while domestic supply is steady and imported goods increase. China's pork prices also slumped after Chinese farmers massively increased their herds after a supply shortage last year caused by the African swine fever.

With the above situation, KB Securities lowered its CPI inflation forecast for 2021 to 3.2% (from 3.8% in the 1Q report), reflecting weak domestic demand amid the COVID-19 pandemic and the decline in commodity prices after a strong uptrend from the beginning of the year to the middle of 2Q, while liveweight hog prices continued a downward trend.