Vietnam’s Inflation remains contained?

According to Mr. Yun Liu, HSBC economist, Vietnam’s inflation should be well contained this year.

HSBC: Energy inflation rose, but inflation should remain contained in 2021

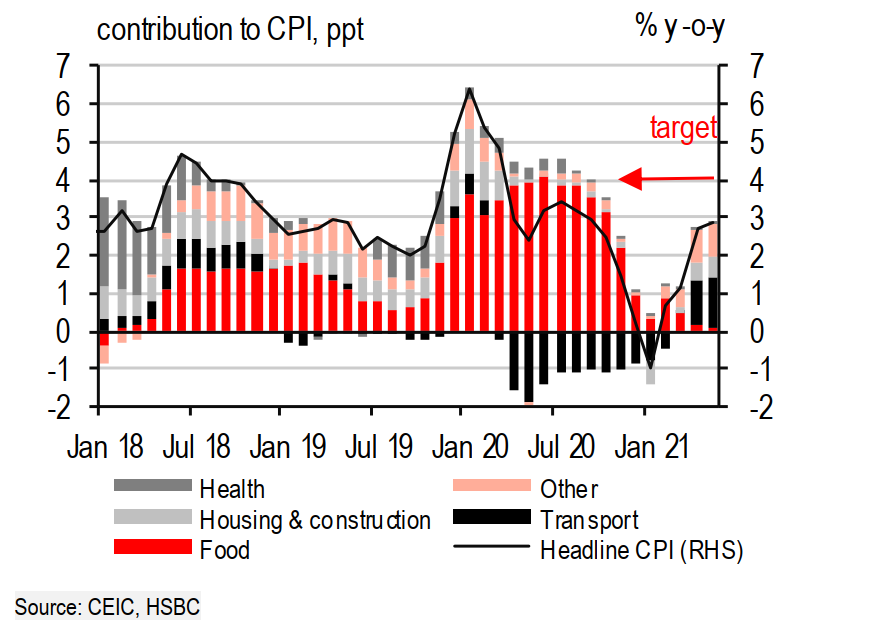

The inflation in Vietnam remained stable, rising 0.2% month on month, equivalent to 2.9% year on year in May. Similar to April, transport costs rose 0.8% month on month (21.2% year on year), the biggest driver of inflation. This was widely expected as energy inflation has started kicking in, and we expect the base effects to peak by 2Q21.

Mr. Yun Liu, HSBC economist, shared: On a positive note, momentum in food prices remained flat, thanks partly to the ongoing normalizing of pork prices (-1.6% month on month). In addition, the recent impact of COVID-19 has shown up in the May’s print. Entertainment prices fell 0.2% month on month, reflecting falling demand in local tourism. Overall, Vietnam’s inflation should be well contained this year, in our forecast: 3%.

Dr. Can Van Luc, BIDV’s Chief economist said the risk of inflation in Vietnam is still hidden and complicated by two main reasons.

First, the money supply increases moderately, but if capital efficiency is low, it will create long-term pressure on inflation, especially in the context that Vietnam’s M2/GDP ratio compared to other countries is relatively large (at 138% of GDP, higher than the average in the ASEAN region). While Vietnam's credit scale at the end of 2019 is equivalent to 138% of GDP (compared to the ASEAN-9 average of 86% of GDP, according to the WB). Meanwhile, Vietnam's ICOR coefficient for the period 2016-2020 is at 6.13 times, much higher than ASEAN’s other countries and World Bank standards for developing countries (ICOR is only 3-4 times).

Second , the money cycle slows down, but the flow of money is more complicated. Money rotation slows down in the real economy, but "cheap money" has the opportunity to flow into real estate, securities, cryptocurrencies..., resulting in hot growth of these markets. This is also a common phenomenon of many countries around the world, the money cycle is slowing down in the real economy, but money is in quick circulation in risky investment channels.

However, Dr. Can Van Luc said there many factors that would help Vietnam's inflation remains contained. Therefore, Vietnam's average CPI in the first 6 months of this year will rise by 1.85-2% compared to the same period in 2020, and the average CPI in 2021 will increase by about 3.4-3.6% compared to the same period last year (lower than the forecast of the World Bank, IMF...), but higher than 3% as forecasted by Citi Research.

In Mr. Yun Liu’s opinion, despite relatively resilient data in May, the fourth wave of COVID-19 is proving to be the biggest challenge facing Vietnam so far. Not only does it bring significant risks to the nascent recovery in the labor market and private consumption, it also weighs on Vietnam’s external sector and manufacturing, two key pillars of the industry that have helped support growth.

Although there are many moving parts, the recent resurgence of COVID-19 may place the government’s 2021 growth target of 6.5% at risk. The key to putting growth back on track is thus a swift virus containment program through increased testing and rigorous contact tracing, in conjunction with an accelerated vaccination program, said Mr. Yun Liu.